Micro Focus Fixed Income Presentation Deck

Transaction Overview

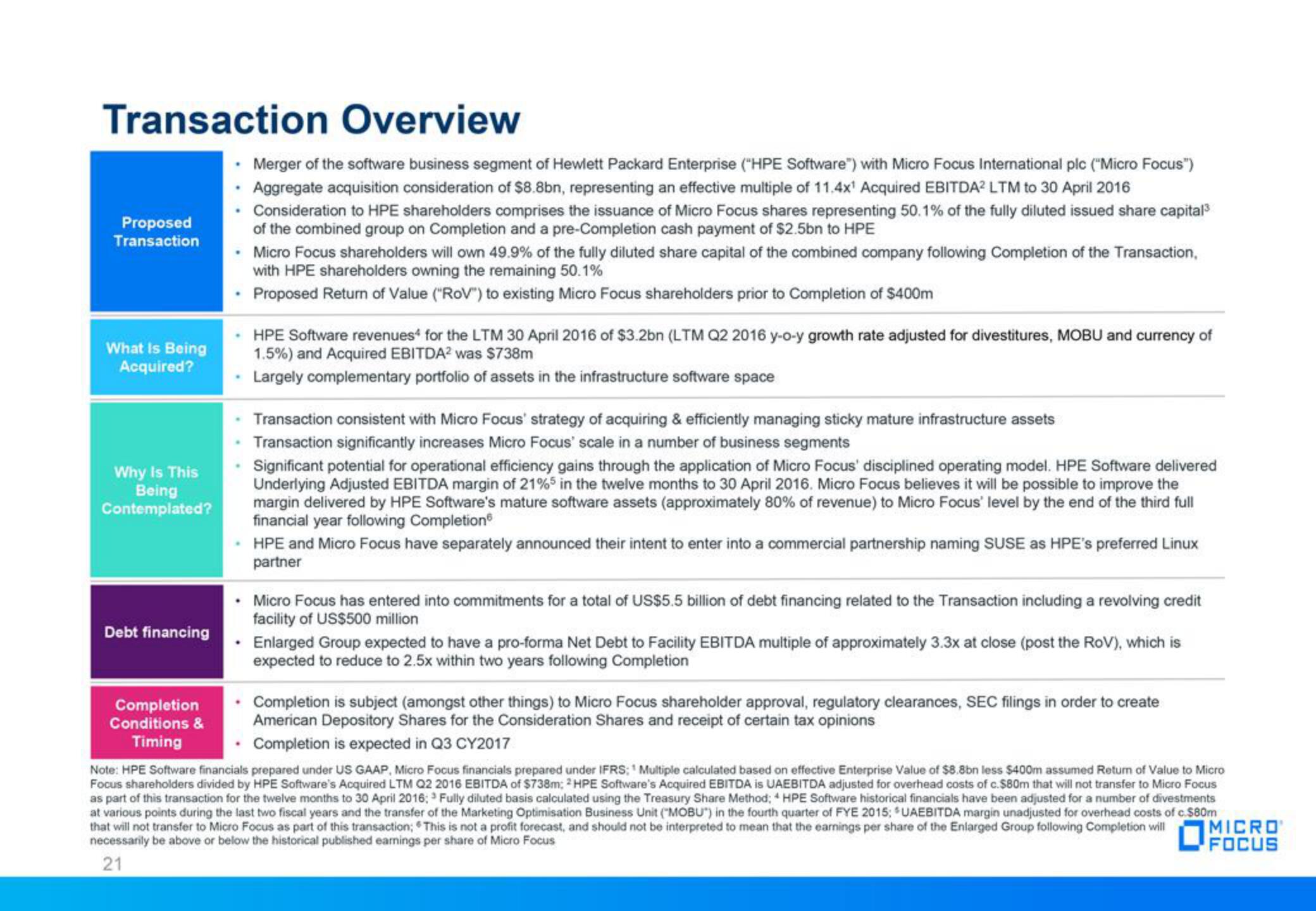

Proposed

Transaction

What Is Being

Acquired?

Why Is This

Being

Contemplated?

Debt financing

Completion

Conditions &

Timing

• Merger of the software business segment of Hewlett Packard Enterprise ("HPE Software") with Micro Focus International plc ("Micro Focus")

• Aggregate acquisition consideration of $8.8bn, representing an effective multiple of 11.4x¹ Acquired EBITDA² LTM to 30 April 2016

. Consideration to HPE shareholders comprises the issuance of Micro Focus shares representing 50.1% of the fully diluted issued share capital³

of the combined group on Completion and a pre-Completion cash payment of $2.5bn to HPE

Micro Focus shareholders will own 49.9% of the fully diluted share capital of the combined company following Completion of the Transaction,

with HPE shareholders owning the remaining 50.1%

• Proposed Return of Value ("RoV") to existing Micro Focus shareholders prior to Completion of $400m

HPE Software revenues for the LTM 30 April 2016 of $3.2bn (LTM Q2 2016 y-o-y growth rate adjusted for divestitures, MOBU and currency of

1.5%) and Acquired EBITDA² was $738m

Largely complementary portfolio of assets in the infrastructure software space

Transaction consistent with Micro Focus strategy of acquiring & efficiently managing sticky mature infrastructure assets

Transaction significantly increases Micro Focus' scale in a number of business segments

Significant potential for operational efficiency gains through the application of Micro Focus' disciplined operating model. HPE Software delivered

Underlying Adjusted EBITDA margin of 21% 5 in the twelve months to 30 April 2016. Micro Focus believes it will be possible to improve the

margin delivered by HPE Software's mature software assets (approximately 80% of revenue) to Micro Focus' level by the end of the third full

financial year following Completion

HPE and Micro Focus have separately announced their intent to enter into a commercial partnership naming SUSE as HPE's preferred Linux

partner

• Micro Focus has entered into commitments for a total of US$5.5 billion of debt financing related to the Transaction including a revolving credit

facility of US$500 million

• Enlarged Group expected to have a pro-forma Net Debt to Facility EBITDA multiple of approximately 3.3x at close (post the RoV), which is

expected to reduce to 2.5x within two years following Completion

• Completion is subject (amongst other things) to Micro Focus shareholder approval, regulatory clearances, SEC filings in order to create

American Depository Shares for the Consideration Shares and receipt of certain tax opinions

Completion is expected in Q3 CY2017

Note: HPE Software financials prepared under US GAAP, Micro Focus financials prepared under IFRS; ¹ Multiple calculated based on effective Enterprise Value of $8.8bn less $400m assumed Return of Value to Micro

Focus shareholders divided by HPE Software's Acquired LTM Q2 2016 EBITDA of $738m; 2 HPE Software's Acquired EBITDA is UAEBITDA adjusted for overhead costs of c.$80m that will not transfer to Micro Focus

as part of this transaction for the twelve months to 30 April 2016; ³ Fully diluted basis calculated using the Treasury Share Method; HPE Software historical financials have been adjusted for a number of divestments

at various points during the last two fiscal years and the transfer of the Marketing Optimisation Business Unit ("MOBU") in the fourth quarter of FYE 2015; $UAEBITDA margin unadjusted for overhead costs of c.$80m

that will not transfer to Micro Focus as part of this transaction; This is not a profit forecast, and should not be interpreted to mean that the earnings per share of the Enlarged Group following Completion will

necessarily be above or below the historical published earnings per share of Micro Focus

21

MICRO

FOCUSView entire presentation