Micro Focus Fixed Income Presentation Deck

Made public by

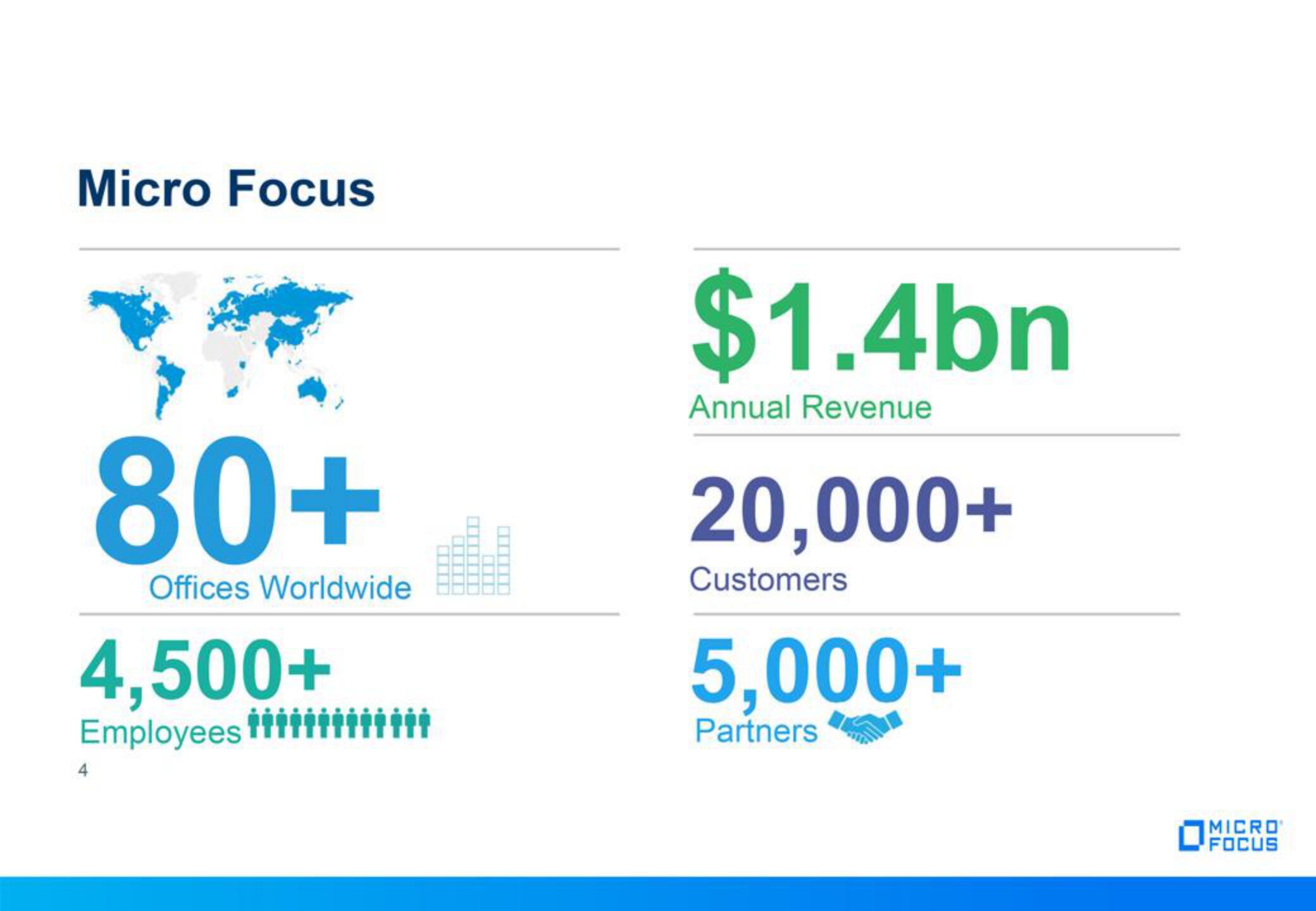

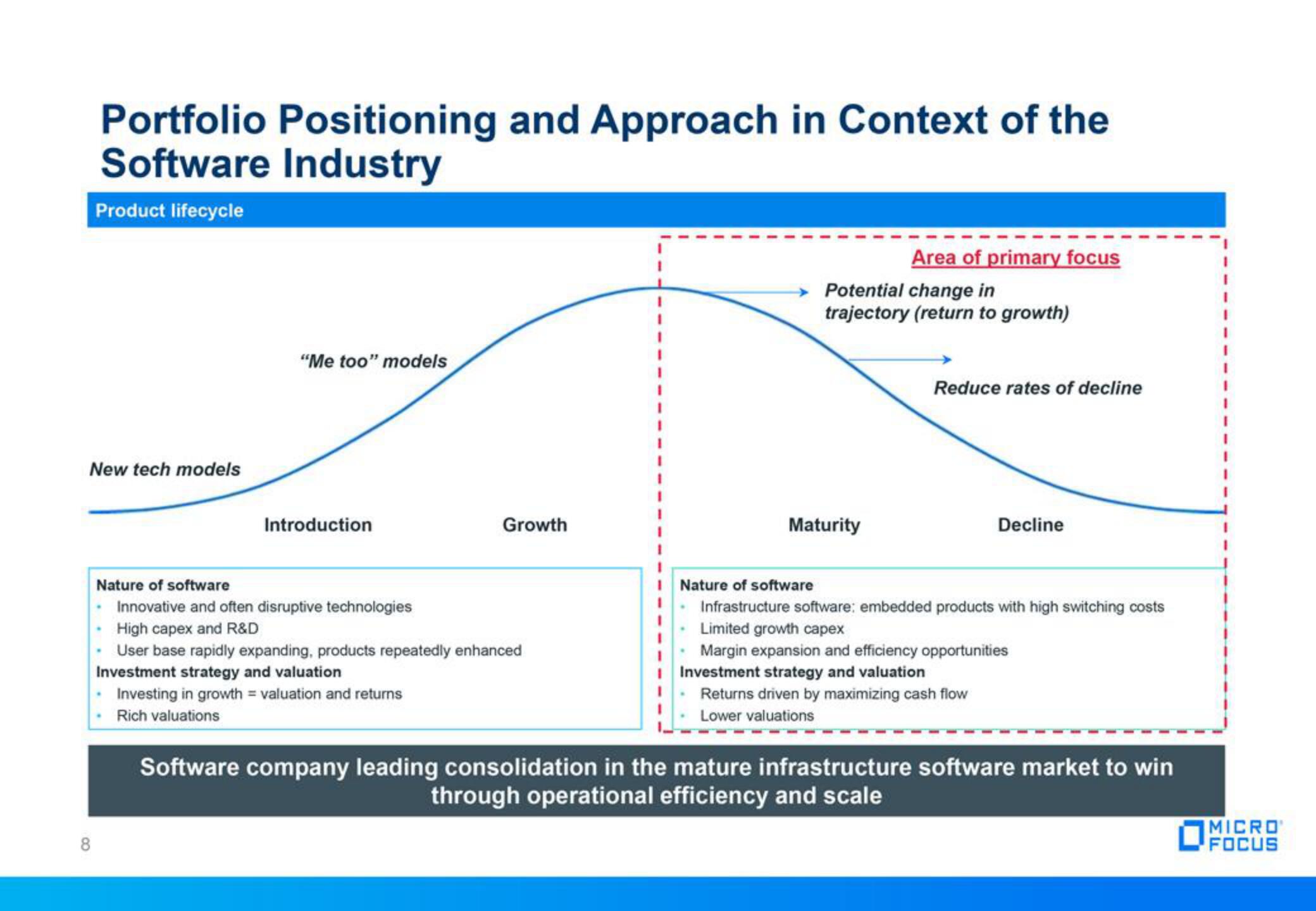

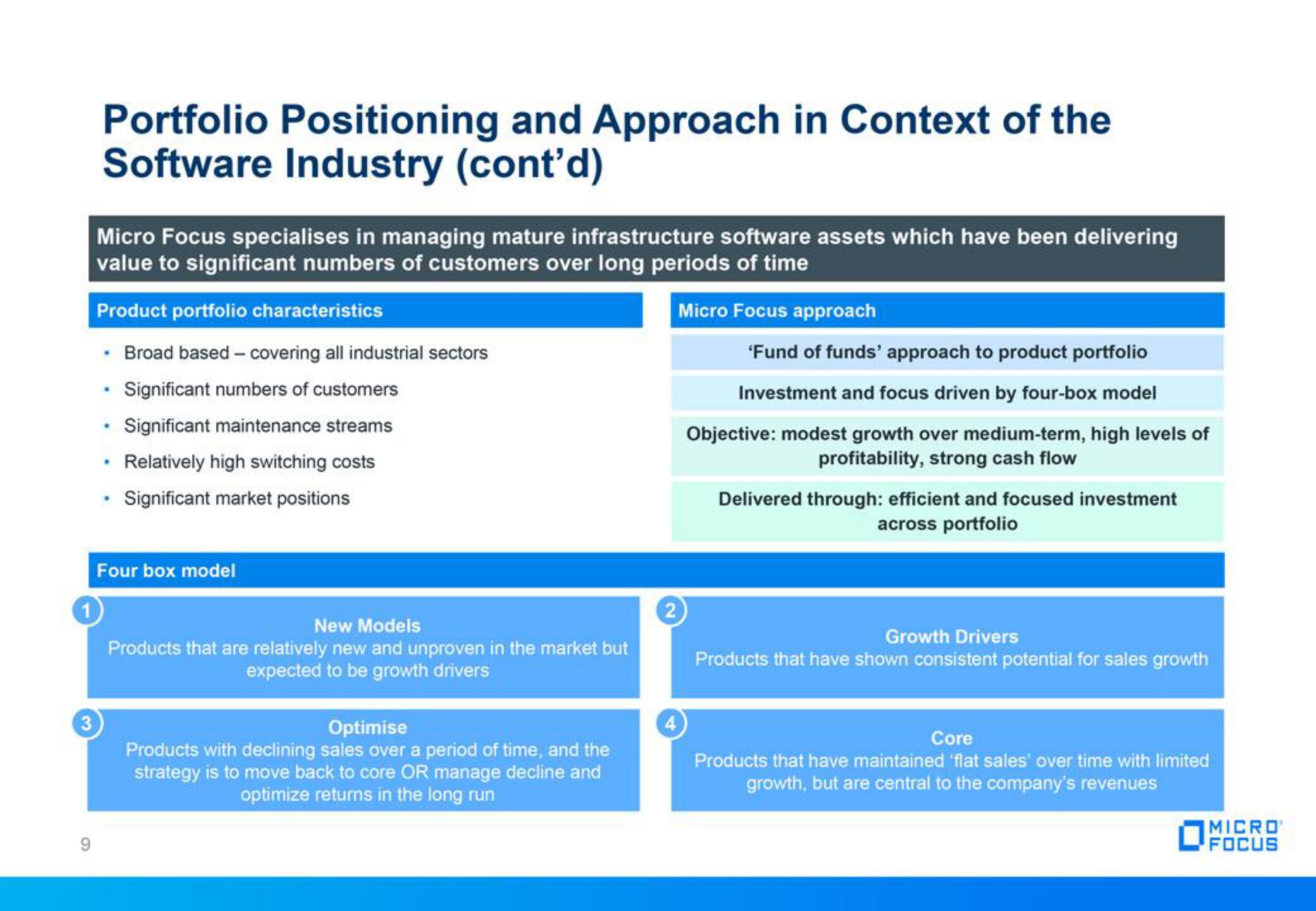

Micro Focus

sourced by PitchSend

Creator

micro-focus

Category

Technology

Published

November 2016

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related