Micro Focus Fixed Income Presentation Deck

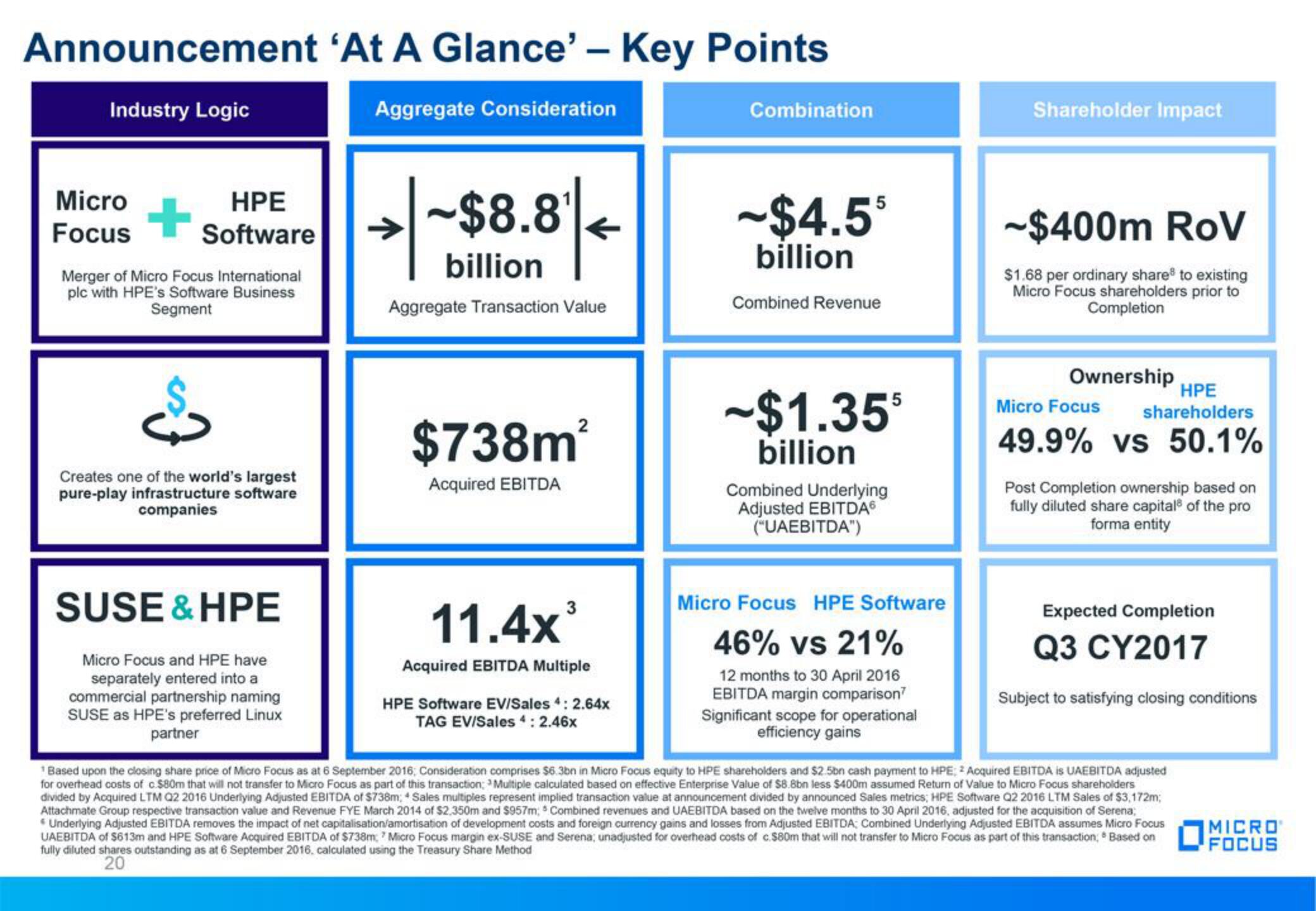

Announcement 'At A Glance' - Key Points

Industry Logic

Aggregate Consideration

Micro

Focus

HPE

Software

Merger of Micro Focus International

plc HPE's Software Business

Segment

$.

Creates one of the world's largest

pure-play infrastructure software

companies

SUSE & HPE

Micro Focus and HPE have

separately entered into a

commercial partnership naming

SUSE as HPE's preferred Linux

partner

~$8.8¹

billion

Aggregate Transaction Value

$738m²

Acquired EBITDA

3

11.4x¹

Acquired EBITDA Multiple

HPE Software EV/Sales 4: 2.64x

TAG EV/Sales 4: 2.46x

Combination

-$4.5

billion

5

Combined Revenue

-$1.355

billion

Combined Underlying

Adjusted EBITDA6

("UAEBITDA")

Micro Focus HPE Software

46% vs 21%

12 months to 30 April 2016

EBITDA margin comparison

Significant scope for operational

efficiency gains

Shareholder Impact

-$400m RoV

$1.68 per ordinary share to existing

Micro Focus shareholders prior to

Completion

Ownership

Micro Focus

HPE

shareholders

49.9% vs 50.1%

Post Completion ownership based on

fully diluted share capital of the pro

forma entity

Expected Completion

Q3 CY2017

Subject to satisfying closing conditions

¹ Based upon the closing share price of Micro Focus as at 6 September 2016; Consideration comprises $6.3bn in Micro Focus equity to HPE shareholders and $2.5bn cash payment to HPE 2 Acquired EBITDA is UAEBITDA adjusted

for overhead costs of c.$80m that will not transfer to Micro Focus as part of this transaction; Multiple calculated based on effective Enterprise Value of $8.8bn less $400m assumed Return of Value to Micro Focus shareholders

divided by Acquired LTM Q2 2016 Underlying Adjusted EBITDA of $738m; + Sales multiples represent implied transaction value at announcement divided by announced Sales metrics; HPE Software Q2 2016 LTM Sales of $3,172m;

Attachmate Group respective transaction value and Revenue FYE March 2014 of $2.350m and $957m; Combined revenues and UAEBITDA based on the twelve months to 30 April 2016, adjusted for the acquisition of Serena;

Underlying Adjusted EBITDA removes the impact of net capitalisation/amortisation of development costs and foreign currency gains and losses from Adjusted EBITDA; Combined Underlying Adjusted EBITDA assumes Micro Focus

UAEBITDA of $613m and HPE Software Acquired EBITDA of $738m 7 Micro Focus margin ex-SUSE and Serena; unadjusted for overhead costs of c.$80m that will not transfer to Micro Focus as part of this transaction; * Based on

fully diluted shares outstanding as at 6 September 2016, calculated using the Treasury Share Method

20

MICRO

FOCUSView entire presentation