Apollo Global Management Investor Day Presentation Deck

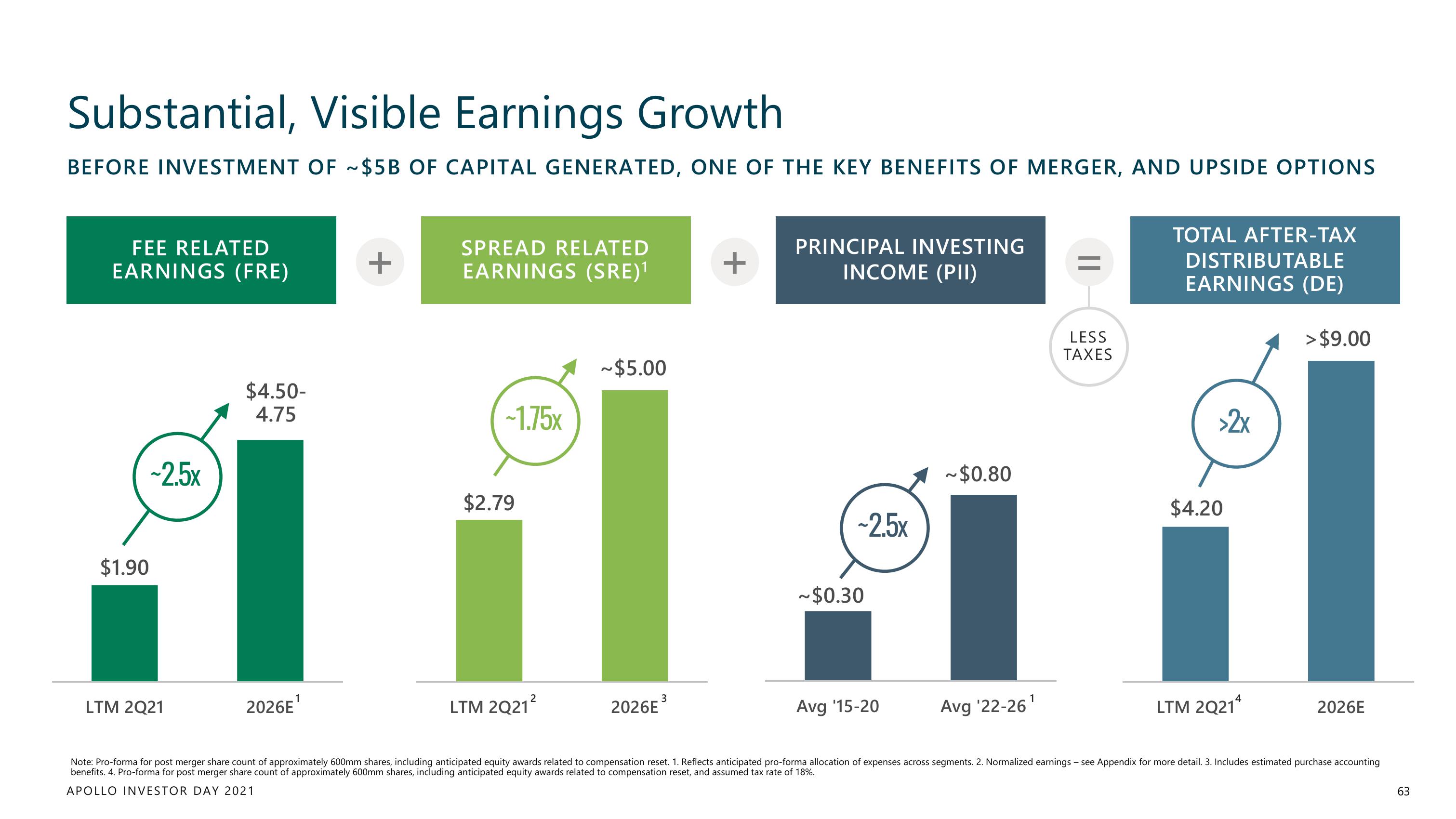

Substantial, Visible Earnings Growth

BEFORE INVESTMENT OF ~$5B OF CAPITAL GENERATED, ONE OF THE KEY BENEFITS OF MERGER, AND UPSIDE OPTIONS

FEE RELATED

EARNINGS (FRE)

$1.90

~2.5x

LTM 2Q21

$4.50-

4.75

2026E¹

+

SPREAD RELATED

EARNINGS (SRE)¹

-1.75x

$2.79

LTM 2Q21²

~$5.00

2026E

3

+

PRINCIPAL INVESTING

INCOME (PII)

~25x

~$0.30

Avg '15-20

~$0.80

Avg '22-26¹

LESS

TAXES

TOTAL AFTER-TAX

DISTRIBUTABLE

EARNINGS (DE)

>2x

$4.20

LTM 2Q214

> $9.00

2026E

Note: Pro-forma for post merger share count of approximately 600mm shares, including anticipated equity awards related to compensation reset. 1. Reflects anticipated pro-forma allocation of expenses across segments. 2. Normalized earnings - see Appendix for more detail. 3. Includes estimated purchase accounting

benefits. 4. Pro-forma for post merger share count of approximately 600mm shares, including anticipated equity awards related to compensation reset, and assumed tax rate of 18%.

APOLLO INVESTOR DAY 2021

63View entire presentation