Apollo Global Management Investor Day Presentation Deck

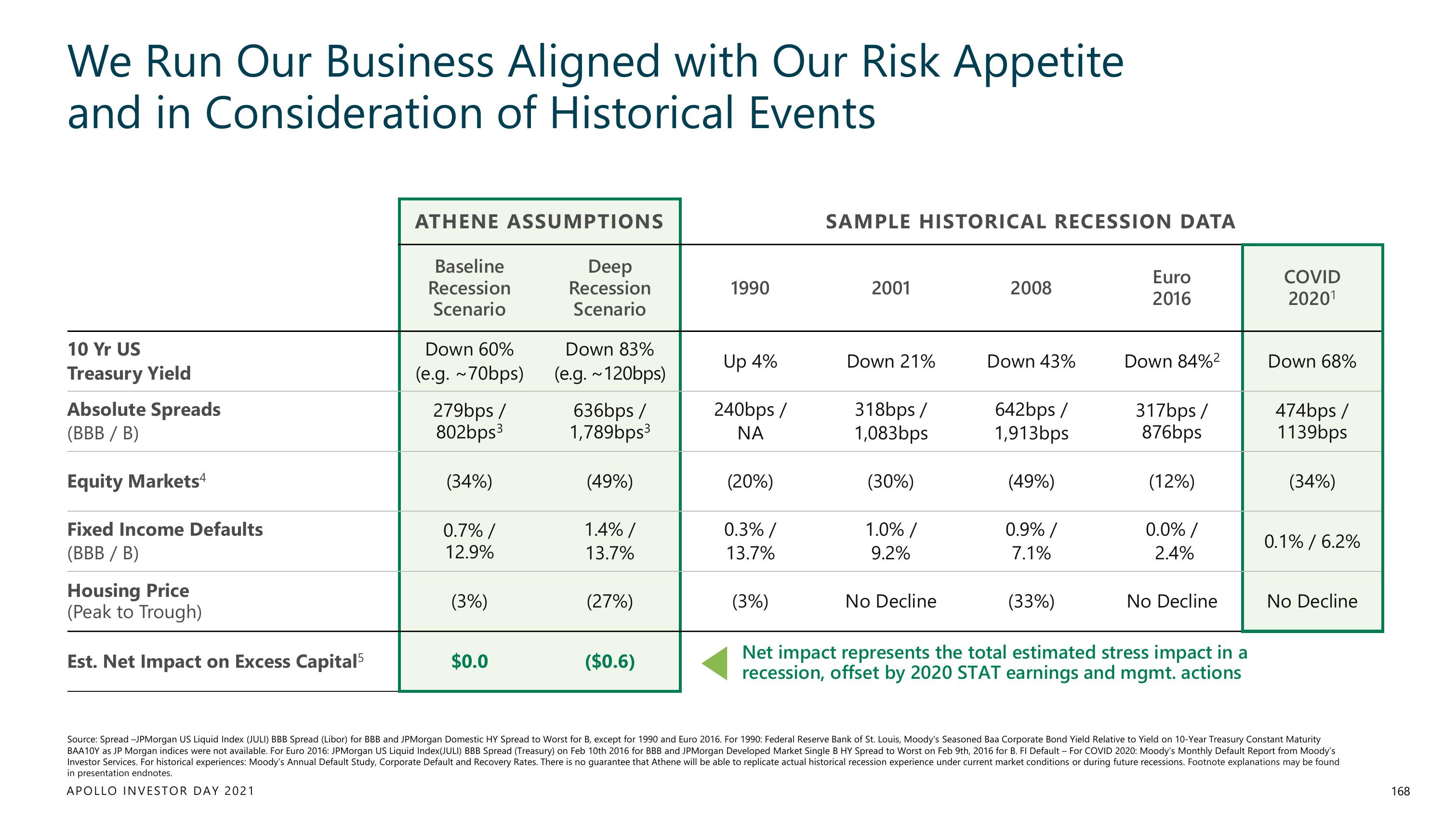

We Run Our Business Aligned with Our Risk Appetite

and in Consideration of Historical Events

10 Yr US

Treasury Yield

Absolute Spreads

(BBB / B)

Equity Markets4

Fixed Income Defaults

(BBB / B)

Housing Price

(Peak to Trough)

Est. Net Impact on Excess Capital5

ATHENE ASSUMPTIONS

Baseline

Recession

Scenario

Down 60%

(e.g. ~70bps)

279bps /

802bps³

(34%)

0.7% /

12.9%

(3%)

$0.0

Deep

Recession

Scenario

Down 83%

(e.g. ~120bps)

636bps /

1,789bps³

(49%)

1.4% /

13.7%

(27%)

($0.6)

1990

Up 4%

240bps /

ΝΑ

(20%)

0.3% /

13.7%

(3%)

SAMPLE HISTORICAL RECESSION DATA

2001

Down 21%

318bps /

1,083bps

(30%)

1.0% /

9.2%

No Decline

2008

Down 43%

642bps /

1,913bps

(49%)

0.9% /

7.1%

(33%)

Euro

2016

Down 84%²

317bps/

876bps

(12%)

0.0% /

2.4%

No Decline

Net impact represents the total estimated stress impact in a

recession, offset by 2020 STAT earnings and mgmt. actions

COVID

2020¹

Down 68%

474bps /

1139bps

(34%)

0.1% / 6.2%

No Decline

Source: Spread -JPMorgan US Liquid Index (JULI) BBB Spread (Libor) for BBB and JPMorgan Domestic HY Spread to Worst for B, except for 1990 and Euro 2016. For 1990: Federal Reserve Bank of St. Louis, Moody's Seasoned Baa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity

BAA10Y as JP Morgan indices were not available. For Euro 2016: JPMorgan US Liquid Index(JULI) BBB Spread (Treasury) on Feb 10th 2016 for BBB and JPMorgan Developed Market Single B HY Spread to Worst on Feb 9th, 2016 for B. FI Default - For COVID 2020: Moody's Monthly Default Report from Moody's

Investor Services. For historical experiences: Moody's Annual Default Study, Corporate Default and Recovery Rates. There is no guarantee that Athene will be able to replicate actual historical recession experience under current market conditions or during future recessions. Footnote explanations may be found

in presentation endnotes.

APOLLO INVESTOR DAY 2021

168View entire presentation