Micro Focus Fixed Income Presentation Deck

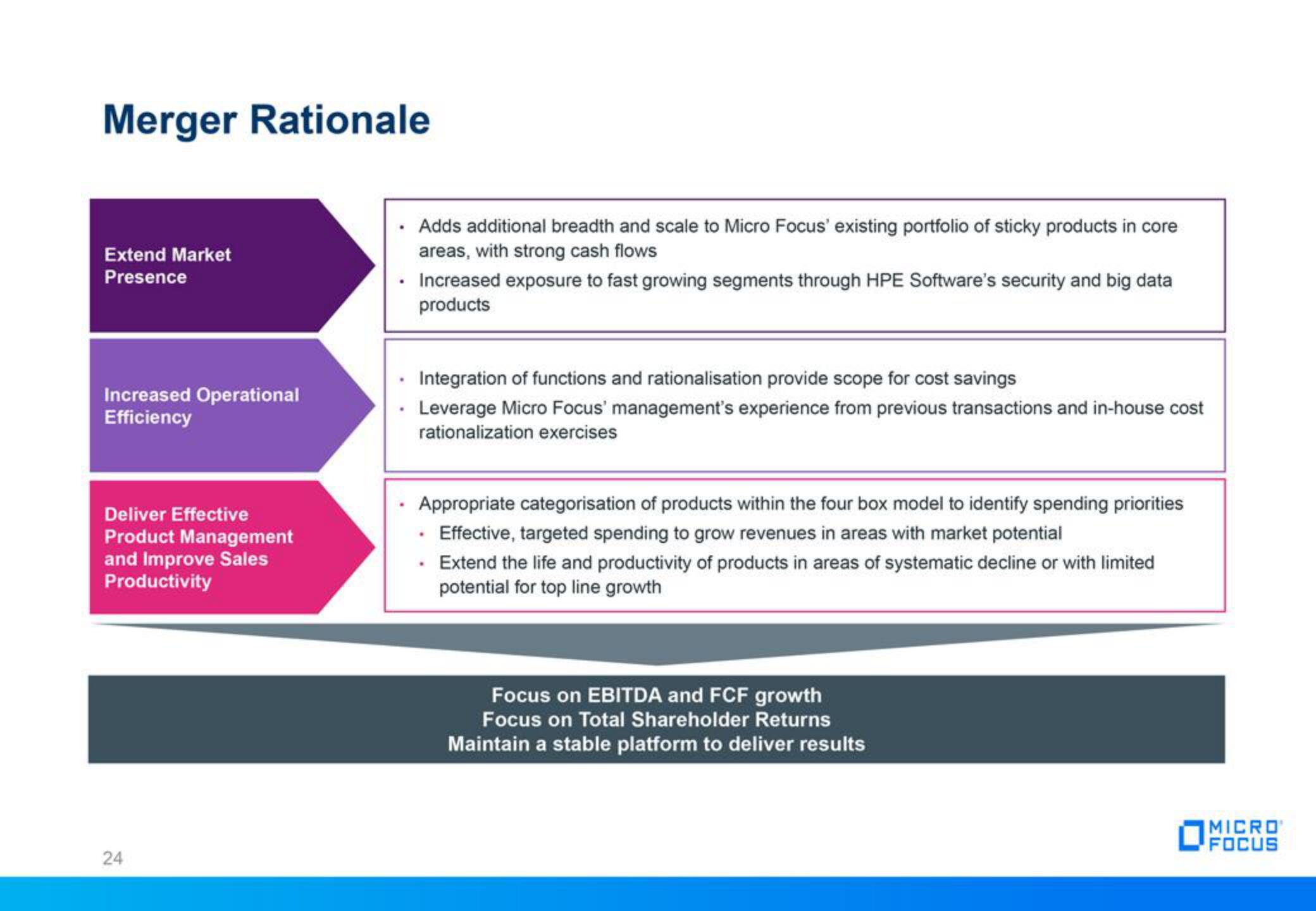

Merger Rationale

Extend Market

Presence

Increased Operational

Efficiency

Deliver Effective

Product Management

and Improve Sales

Productivity

24

.

Adds additional breadth and scale to Micro Focus' existing portfolio of sticky products in core

areas, with strong cash flows

Increased exposure to fast growing segments through HPE Software's security and big data

products

Integration of functions and rationalisation provide scope for cost savings

• Leverage Micro Focus' management's experience from previous transactions and in-house cost

rationalization exercises

Appropriate categorisation of products within the four box model to identify spending priorities

. Effective, targeted spending to grow revenues in areas with market potential

Extend the life and productivity of products in areas of systematic decline or with limited

potential for top line growth

Focus on EBITDA and FCF growth

Focus on Total Shareholder Returns

Maintain a stable platform to deliver results

MICRO

FOCUSView entire presentation