KLA Investor Day Presentation Deck

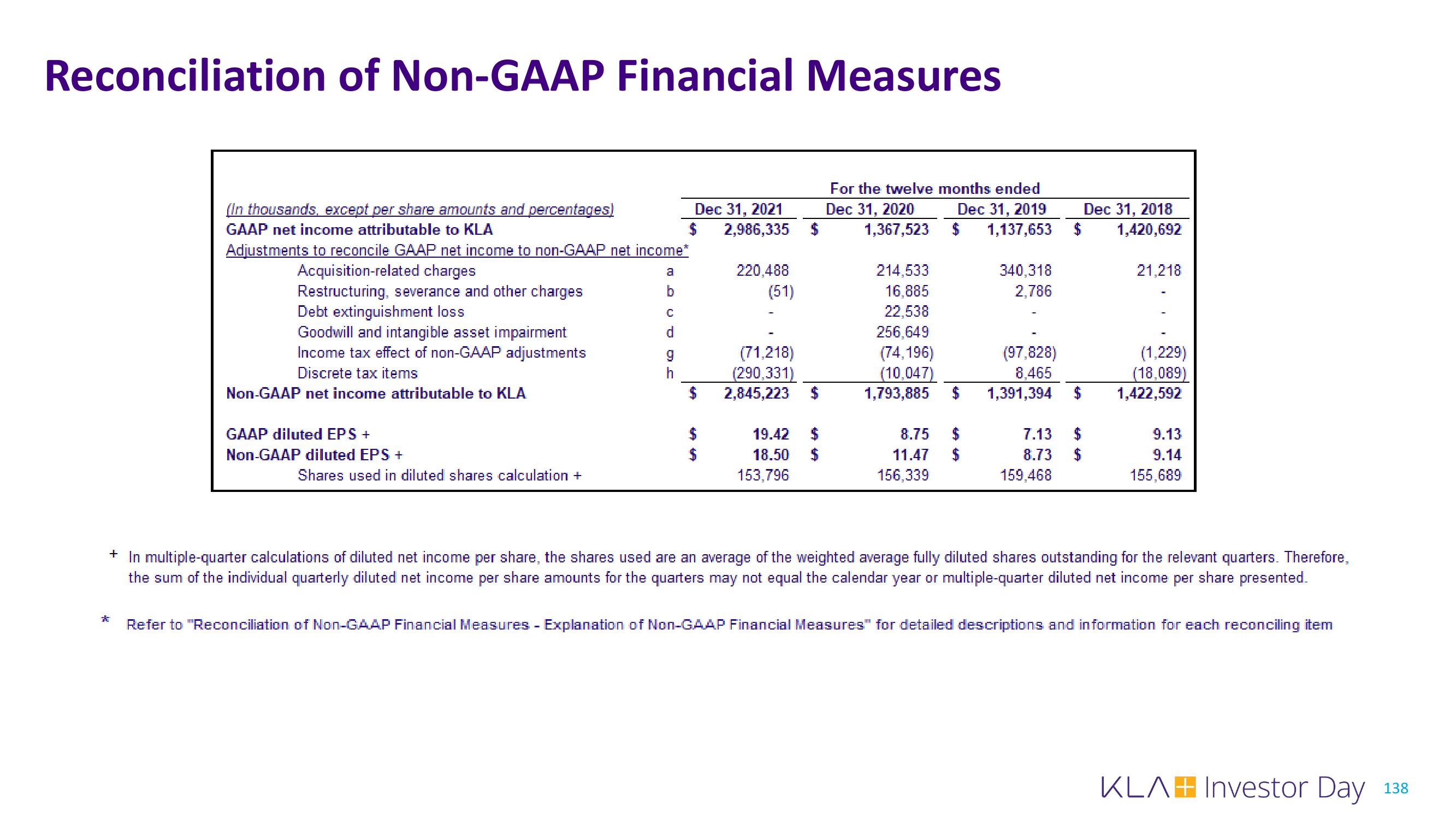

Reconciliation of Non-GAAP Financial Measures

(In thousands, except per share amounts and percentages)

GAAP net income attributable to KLA

*

Adjustments to reconcile GAAP net income to non-GAAP net income*

Acquisition-related charges

Restructuring, severance and other charges

Debt extinguishment loss

Goodwill and intangible asset impairment

Income tax effect of non-GAAP adjustments

Discrete tax items

Non-GAAP net income attributable to KLA

GAAP diluted EPS +

Non-GAAP diluted EPS +

Shares used in diluted shares calculation +

a

b

Dec 31, 2021

$

2,986,335

C

d

9

$

$

$

220,488

(51)

(71,218)

(290,331)

2,845,223

19.42

18.50

153,796

For the twelve months ended

Dec 31, 2020 Dec 31, 2019

$ 1,137,653

$

1,367,523

$

214,533

16,885

22,538

256,649

(74,196)

(10,047)

1,793,885 $ 1,391,394

8.75 $

11.47 $

156,339

340,318

2,786

(97,828)

8,465

$

7.13 $

8.73 $

159,468

Dec 31, 2018

1,420,692

21,218

(1,229)

(18,089)

1,422,592

9.13

9.14

155,689

+ In multiple-quarter calculations of diluted net income per share, the shares used are an average of the weighted average fully diluted shares outstanding for the relevant quarters. Therefore,

the sum of the individual quarterly diluted net income per share amounts for the quarters may not equal the calendar year or multiple-quarter diluted net income per share presented.

Refer to "Reconciliation of Non-GAAP Financial Measures - Explanation of Non-GAAP Financial Measures" for detailed descriptions and information for each reconciling item

KLAH Investor Day

138View entire presentation