Apollo Global Management Investor Day Presentation Deck

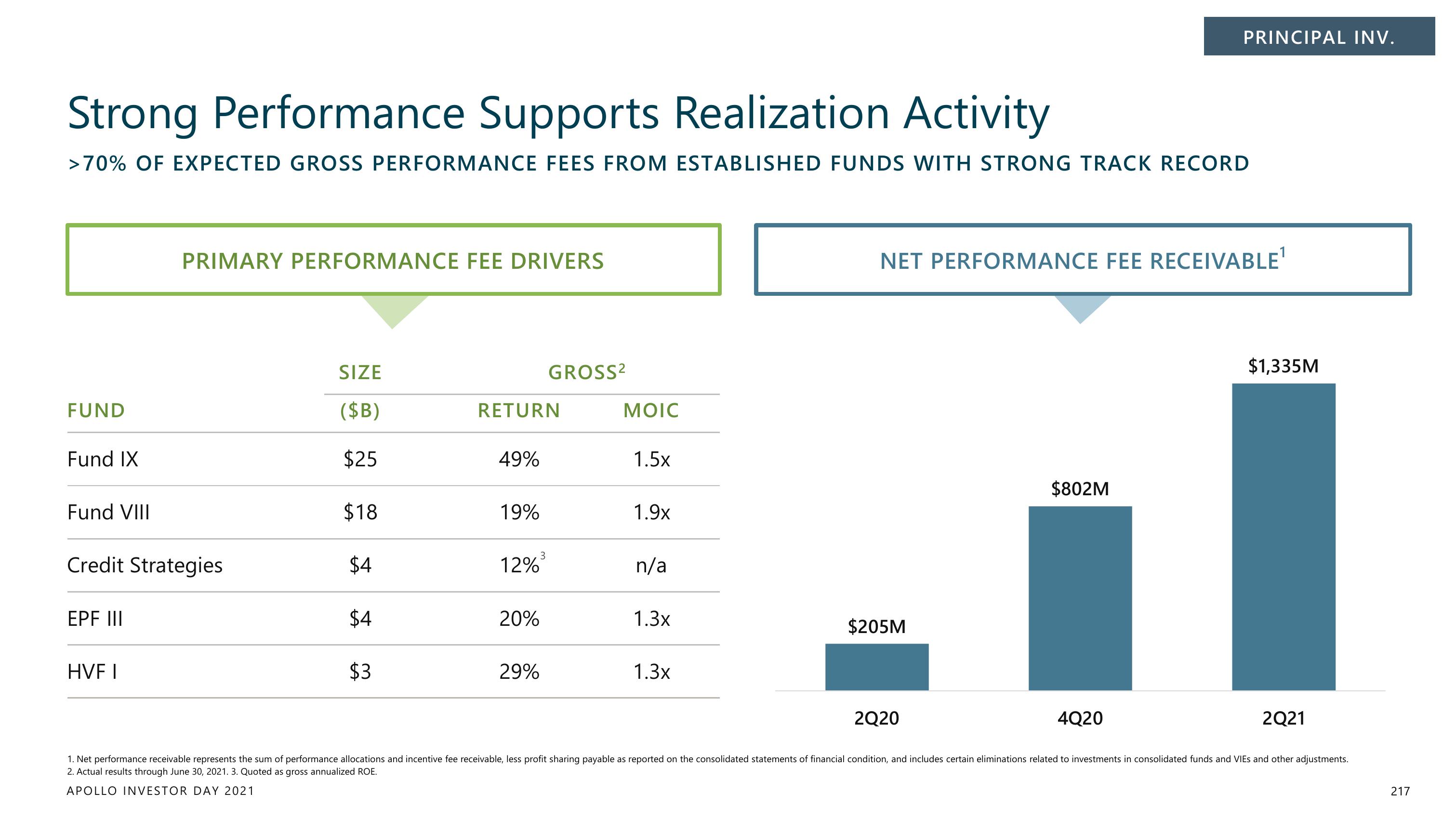

Strong Performance Supports Realization Activity

>70% OF EXPECTED GROSS PERFORMANCE FEES FROM ESTABLISHED FUNDS WITH STRONG TRACK RECORD

FUND

Fund IX

Fund VIII

Credit Strategies

EPF III

PRIMARY PERFORMANCE FEE DRIVERS

HVF I

SIZE

($B)

$25

$18

$4

$4

$3

RETURN

49%

19%

12%

20%

29%

GROSS²

3

MOIC

1.5x

1.9x

n/a

1.3x

1.3x

NET PERFORMANCE FEE RECEIVABLE¹

$205M

2Q20

PRINCIPAL INV.

$802M

4Q20

$1,335M

2Q21

1. Net performance receivable represents the sum of performance allocations and incentive fee receivable, less profit sharing payable as reported on the consolidated statements of financial condition, and includes certain eliminations related to investments in consolidated funds and VIEs and other adjustments.

2. Actual results through June 30, 2021. 3. Quoted as gross annualized ROE.

APOLLO INVESTOR DAY 2021

217View entire presentation