Apollo Global Management Investor Day Presentation Deck

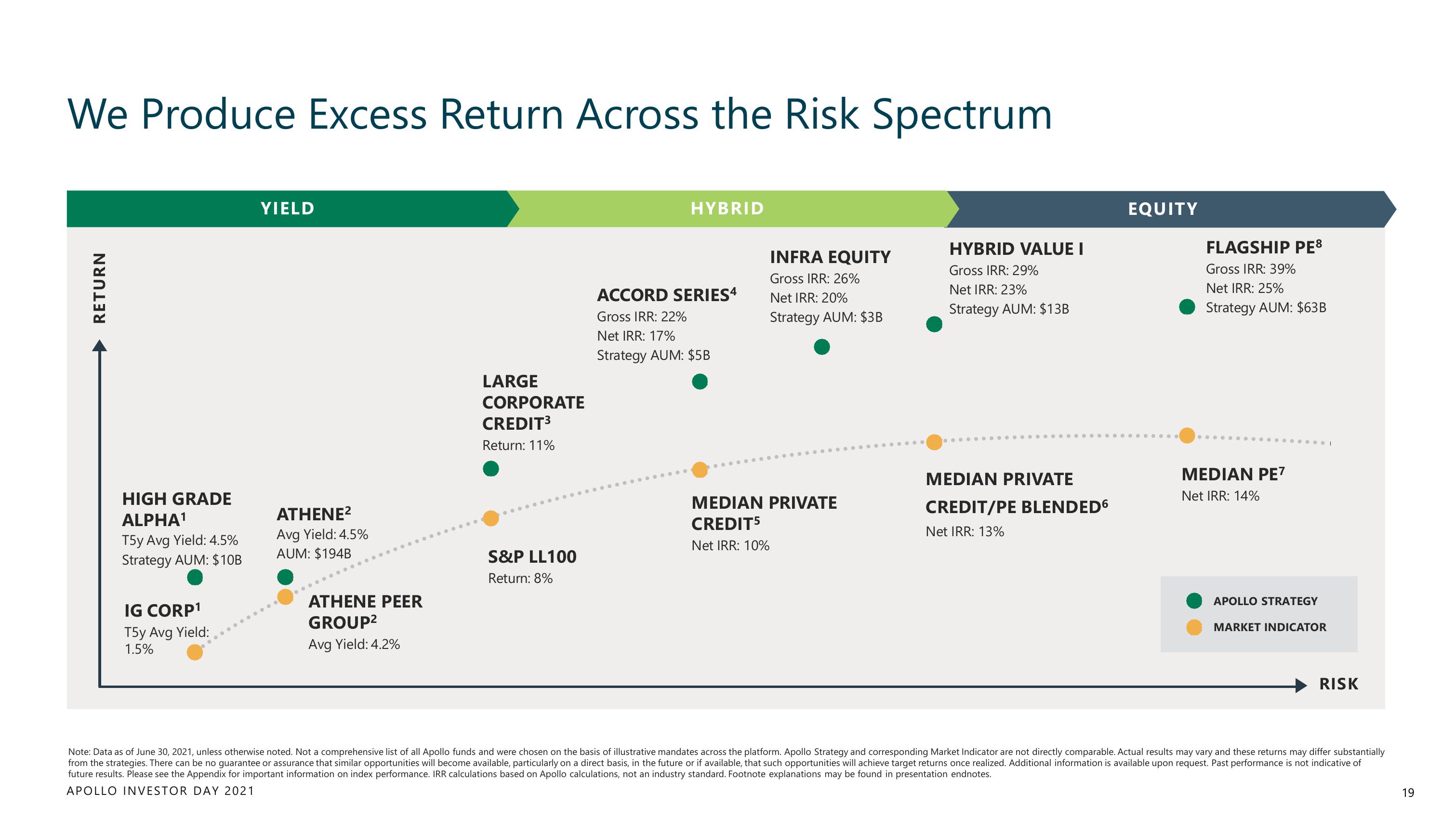

We Produce Excess Return Across the Risk Spectrum

RETURN

HIGH GRADE

ALPHA¹

T5y Avg Yield: 4.5%

Strategy AUM: $10B

IG CORP1

T5y Avg Yield:

1.5%

YIELD

ATHENE²

Avg Yield: 4.5%

AUM: $194B

ATHENE PEER

GROUP²

Avg Yield: 4.2%

LARGE

CORPORATE

CREDIT³

Return: 11%

S&P LL100

Return: 8%

HYBRID

ACCORD SERIES4

Gross IRR: 22%

Net IRR: 17%

Strategy AUM: $5B

INFRA EQUITY

Gross IRR: 26%

Net IRR: 20%

Strategy AUM: $3B

MEDIAN PRIVATE

CREDIT5

Net IRR: 10%

HYBRID VALUE I

Gross IRR: 29%

Net IRR: 23%

Strategy AUM: $13B

MEDIAN PRIVATE

CREDIT/PE BLENDED6

Net IRR: 13%

EQUITY

.........

FLAGSHIP PE8

Gross IRR: 39%

Net IRR: 25%

Strategy AUM: $63B

MEDIAN PE7

Net IRR: 14%

APOLLO STRATEGY

MARKET INDICATOR

RISK

Note: Data as of June 30, 2021, unless otherwise noted. Not a comprehensive list of all Apollo funds and were chosen on the basis of illustrative mandates across the platform. Apollo Strategy and corresponding Market Indicator are not directly comparable. Actual results may vary and these returns may differ substantially

from the strategies. There can be no guarantee or assurance that similar opportunities will become available, particularly on a direct basis, in the future or if available, that such opportunities will achieve target returns once realized. Additional information is available upon request. Past performance is not indicative of

future results. Please see the Appendix for important information on index performance. IRR calculations based on Apollo calculations, not an industry standard. Footnote explanations may be found in presentation endnotes.

APOLLO INVESTOR DAY 2021

19View entire presentation