Apollo Global Management Investor Day Presentation Deck

Minimal Credit Losses Historically and During COVID-19

●

DISCIPLINED RISK APPETITE

●

Risk appetite is to avoid a credit rating

downgrade in a typical "recession" scenario, and

maintain an investment grade credit rating in a

"deep recession" scenario like 2008/2009

• Risk management is deeply embedded in all

business decisions and processes

The enterprise risk appetite is established using

stress testing and is cascaded to the business

through risk limits

Constant communication with rating agencies

and reinsurance counterparties

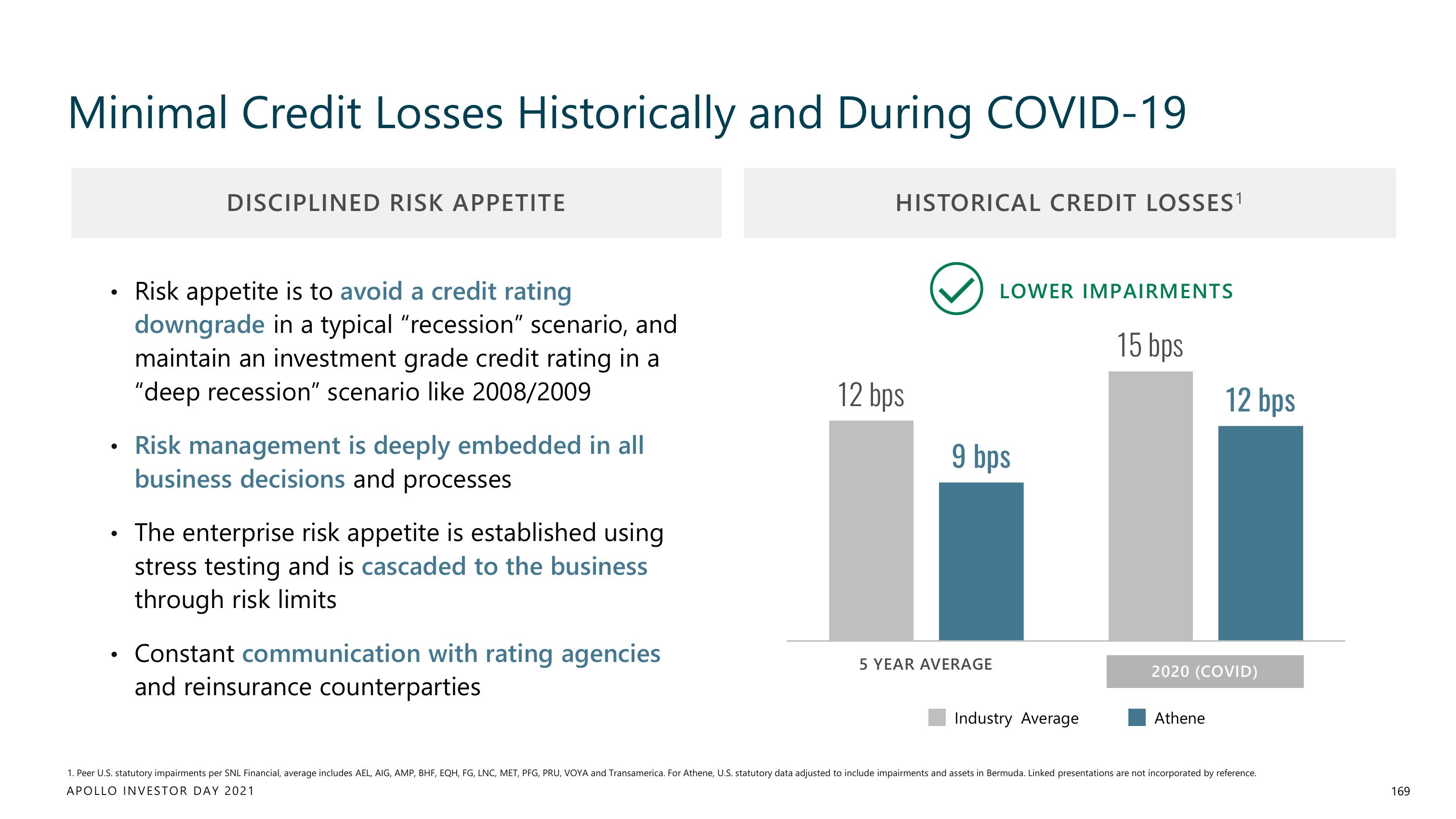

HISTORICAL CREDIT LOSSES¹

12 bps

LOWER IMPAIRMENTS

9 bps

5 YEAR AVERAGE

Industry Average

15 bps

12 bps

2020 (COVID)

Athene

1. Peer U.S. statutory impairments per SNL Financial, average includes AEL, AIG, AMP, BHF, EQH, FG, LNC, MET, PFG, PRU, VOYA and Transamerica. For Athene, U.S. statutory data adjusted to include impairments and assets in Bermuda. Linked presentations are not incorporated by reference.

APOLLO INVESTOR DAY 2021

169View entire presentation