Apollo Global Management Investor Day Presentation Deck

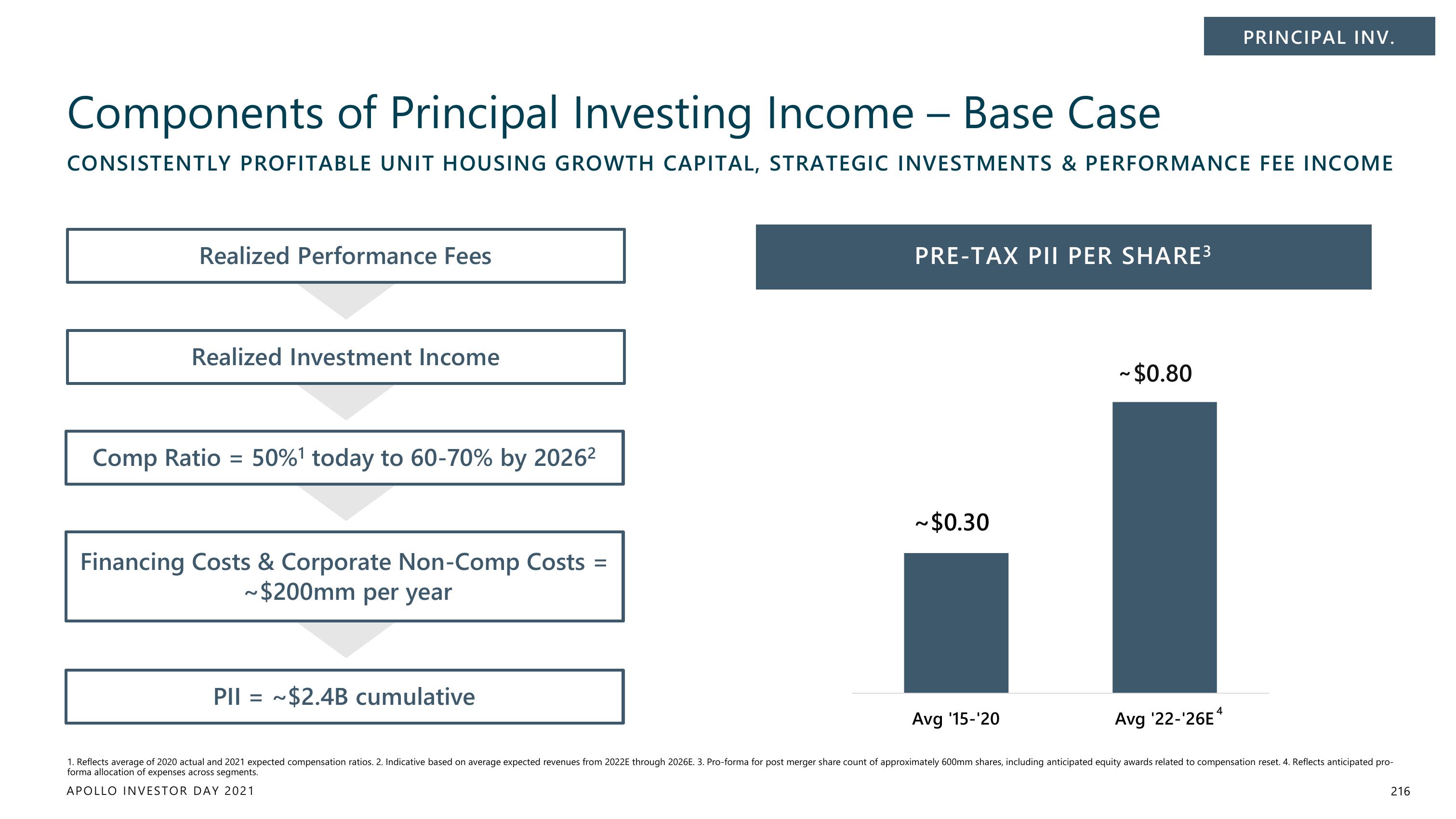

Components of Principal Investing Income - Base Case

CONSISTENTLY PROFITABLE UNIT HOUSING GROWTH CAPITAL, STRATEGIC INVESTMENTS & PERFORMANCE FEE INCOME

Realized Performance Fees

Realized Investment Income

Comp Ratio = 50%¹ today to 60-70% by 2026²

Financing Costs & Corporate Non-Comp Costs =

~$200mm per year

PII = ~$2.4B cumulative

PRE-TAX PII PER SHARE³

~$0.30

Avg '15-'20

PRINCIPAL INV.

~$0.80

Avg '22-¹26E4

1. Reflects average of 2020 actual and 2021 expected compensation ratios. 2. Indicative based on average expected revenues from 2022E through 2026E. 3. Pro-forma for post merger share count of approximately 600mm shares, including anticipated equity awards related to compensation reset. 4. Reflects anticipated pro-

forma allocation of expenses across segments.

APOLLO INVESTOR DAY 2021

216View entire presentation