Apollo Global Management Investor Day Presentation Deck

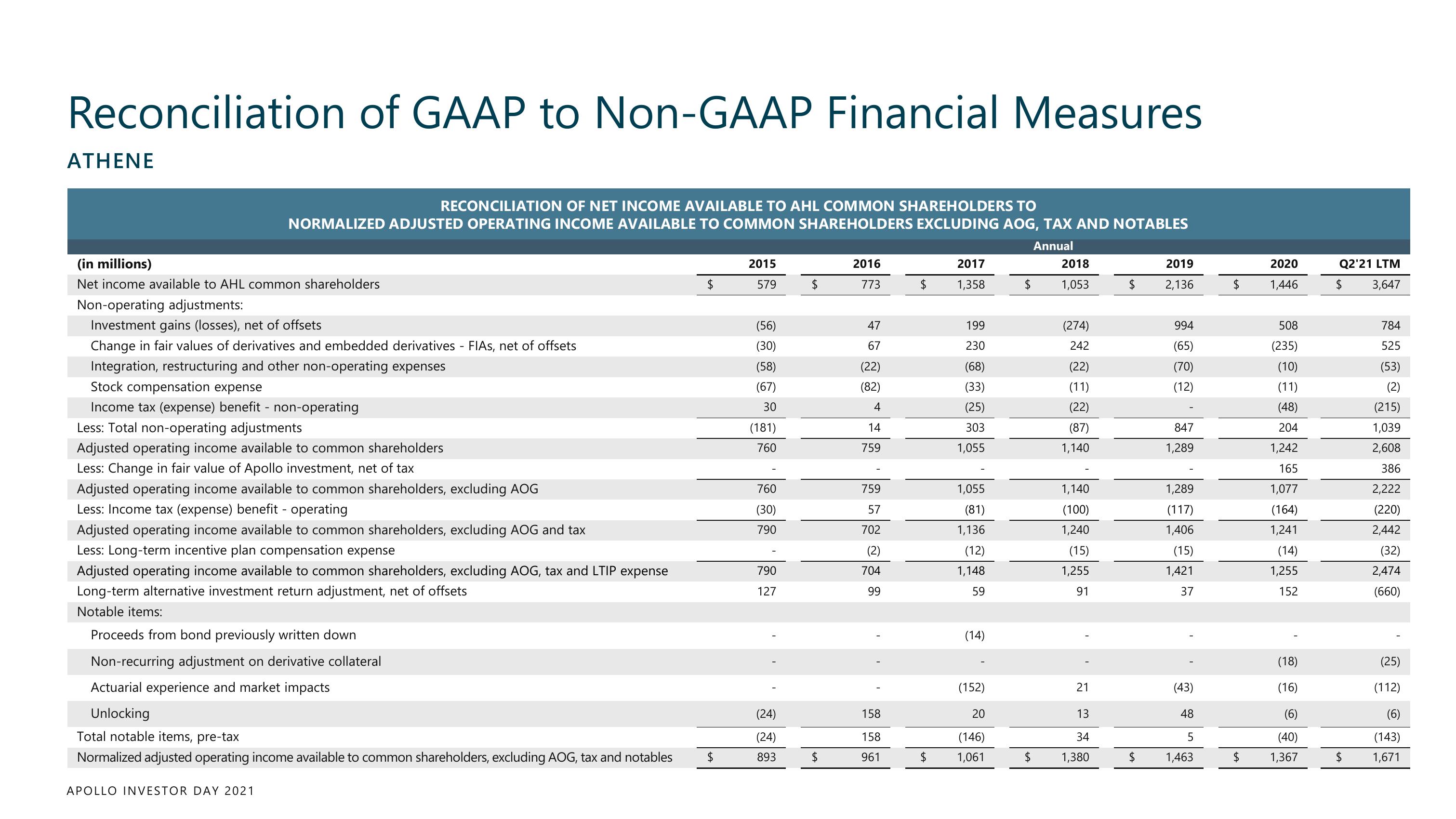

Reconciliation of GAAP to Non-GAAP Financial Measures

ATHENE

RECONCILIATION OF NET INCOME AVAILABLE TO AHL COMMON SHAREHOLDERS TO

NORMALIZED ADJUSTED OPERATING INCOME AVAILABLE TO COMMON SHAREHOLDERS EXCLUDING AOG, TAX AND NOTABLES

Annual

(in millions)

Net income available to AHL common shareholders

Non-operating adjustments:

Investment gains (losses), net of offsets

Change in fair values of derivatives and embedded derivatives - FIAS, net of offsets

Integration, restructuring and other non-operating expenses

Stock compensation expense

Income tax (expense) benefit - non-operating

Less: Total non-operating adjustments

Adjusted operating income available to common shareholders

Less: Change in fair value of Apollo investment, net of tax

Adjusted operating income available to common shareholders, excluding AOG

Less: Income tax (expense) benefit - operating

Adjusted operating income available to common shareholders, excluding AOG and tax

Less: Long-term incentive plan compensation expense

Adjusted operating income available to common shareholders, excluding AOG, tax and LTIP expense

Long-term alternative investment return adjustment, net of offsets

Notable items:

APOLLO INVESTOR DAY 2021

$

Proceeds from bond previously written down

Non-recurring adjustment on derivative collateral

Actuarial experience and market impacts

Unlocking

Total notable items, pre-tax

Normalized adjusted operating income available to common shareholders, excluding AOG, tax and notables $

2015

579

(56)

(30)

(58)

(67)

30

(181)

760

760

(30)

790

790

127

(24)

(24)

893

$

$

2016

773

47

67

(22)

(82)

4

14

759

759

57

702

(2)

704

99

158

158

961

$

$

2017

1,358

199

230

(68)

(33)

(25)

303

1,055

1,055

(81)

1,136

(12)

1,148

59

(14)

(152)

20

(146)

1,061

$

2018

1,053

(274)

242

(22)

(11)

(22)

(87)

1,140

1,140

(100)

1,240

(15)

1,255

91

21

13

34

1,380

$

2019

2,136

994

(65)

(70)

(12)

847

1,289

1,289

(117)

1,406

(15)

1,421

37

(43)

48

5

1,463

$

$

2020

1,446

508

(235)

(10)

(11)

(48)

204

1,242

165

1,077

(164)

1,241

(14)

1,255

152

(18)

(16)

(6)

(40)

1,367

Q2'21 LTM

3,647

$

784

525

(53)

(215)

1,039

2,608

386

2,222

(220)

2,442

(32)

2,474

(660)

(25)

(112)

(6)

(143)

1,671View entire presentation