Nexters Investor Presentation Deck

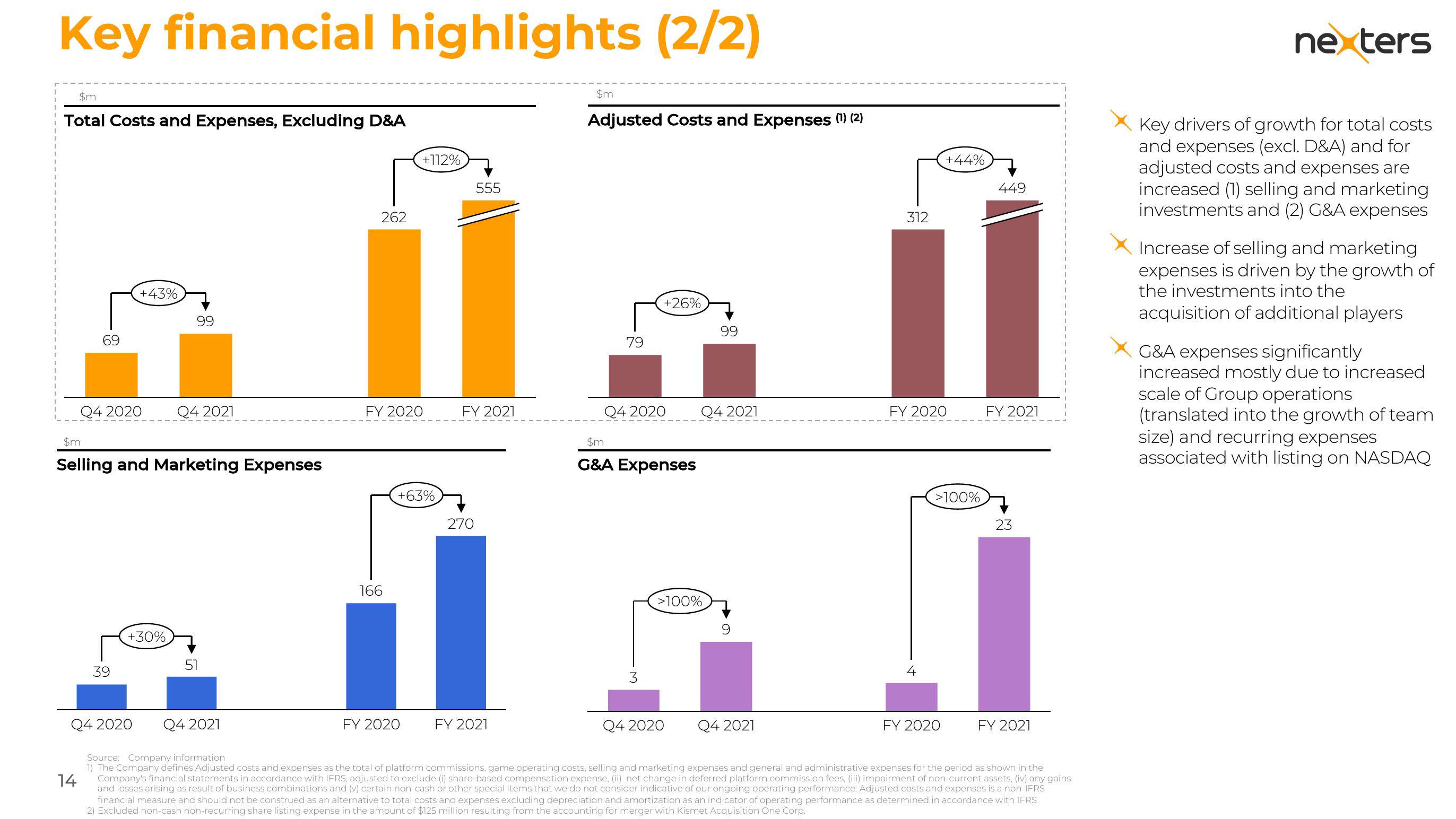

Key financial highlights (2/2)

$m

Total Costs and Expenses, Excluding D&A

+43%

Q4 2020 Q4 2021

39

99

$m

Selling and Marketing Expenses

+30%

51

262

FY 2020

166

+112%

+63%

FY 2020

555

FY 2021

270

$m

FY 2021

Adjusted Costs and Expenses (1) (2)

79

+26%

Q4 2020

$m

G&A Expenses

>100%

99

Q4 2021

Q4 2020

9

312

Q4 2021

+44%

FY 2020

>100%

Q4 2020 Q4 2021

14

Source: Company information

1) The Company defines Adjusted costs and expenses as the total of platform commissions, game operating costs, selling and marketing expenses and general and administrative expenses for the period as shown in the

Company's financial statements in accordance with IFRS, adjusted to exclude (i) share-based compensation expense, (ii) net change in deferred platform commission fees, (iii) impairment of non-current assets, (iv) any gains

and losses arising as result of business combinations and (v) certain non-cash or other special items that we do not consider indicative of our ongoing operating performance. Adjusted costs and expenses is a non-IFRS

financial measure and should not be construed as an alternative to total costs and expenses excluding depreciation and amortization as an indicator of operating performance as determined in accordance with IFRS

2) Excluded non-cash non-recurring share listing expense in the amount of $125 million resulting from the accounting for merger with Kismet Acquisition One Corp.

FY 2020

449

FY 2021

23

FY 2021

nexters

Key drivers of growth for total costs

and expenses (excl. D&A) and for

adjusted costs and expenses are

increased (1) selling and marketing

investments and (2) G&A expenses

Increase of selling and marketing

expenses is driven by the growth of

the investments into the

acquisition of additional players

G&A expenses significantly

increased mostly due to increased

scale of Group operations

(translated into the growth of team

size) and recurring expenses

associated with listing on NASDAQView entire presentation