Apollo Global Management Investor Day Presentation Deck

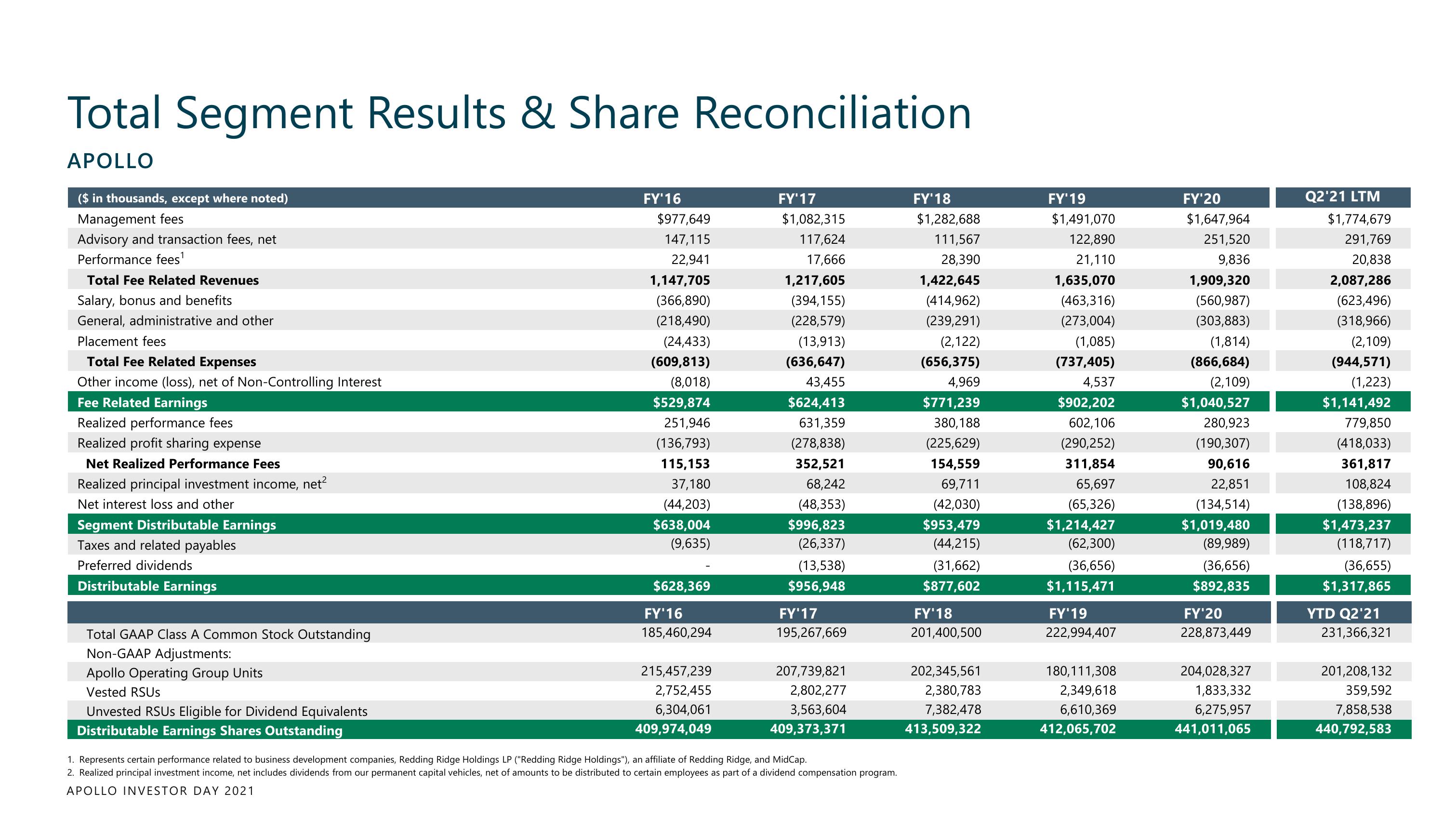

Total Segment Results & Share Reconciliation

APOLLO

($ in thousands, except where noted)

Management fees

Advisory and transaction fees, net

Performance fees¹

Total Fee Related Revenues

Salary, bonus and benefits

General, administrative and other

Placement fees

Total Fee Related Expenses

Other income (loss), net of Non-Controlling Interest

Fee Related Earnings

Realized performance fees

Realized profit sharing expense

Net Realized Performance Fees

Realized principal investment income, net²

Net interest loss and other

Segment Distributable Earnings

Taxes and related payables

Preferred dividends

Distributable Earnings

Total GAAP Class A Common Stock Outstanding

Non-GAAP Adjustments:

Apollo Operating Group Units

Vested RSUS

Unvested RSUS Eligible for Dividend Equivalents

Distributable Earnings Shares Outstanding

FY'16

$977,649

147,115

22,941

1,147,705

(366,890)

(218,490)

(24,433)

(609,813)

(8,018)

$529,874

251,946

(136,793)

115,153

37,180

(44,203)

$638,004

(9,635)

$628,369

FY'16

185,460,294

215,457,239

2,752,455

6,304,061

409,974,049

FY'17

$1,082,315

117,624

17,666

1,217,605

(394,155)

(228,579)

(13,913)

(636,647)

43,455

$624,413

631,359

(278,838)

352,521

68,242

(48,353)

$996,823

(26,337)

(13,538)

$956,948

FY'17

195,267,669

207,739,821

2,802,277

3,563,604

409,373,371

1. Represents certain performance related to business development companies, Redding Ridge Holdings LP ("Redding Ridge Holdings"), an affiliate of Redding Ridge, and MidCap.

2. Realized principal investment income, net includes dividends from our permanent capital vehicles, net of amounts to be distributed to certain employees as part of a dividend compensation program.

APOLLO INVESTOR DAY 2021

FY'18

$1,282,688

111,567

28,390

1,422,645

(414,962)

(239,291)

(2,122)

(656,375)

4,969

$771,239

380,188

(225,629)

154,559

69,711

(42,030)

$953,479

(44,215)

(31,662)

$877,602

FY'18

201,400,500

202,345,561

2,380,783

7,382,478

413,509,322

FY'19

$1,491,070

122,890

21,110

1,635,070

(463,316)

(273,004)

(1,085)

(737,405)

4,537

$902,202

602,106

(290,252)

311,854

65,697

(65,326)

$1,214,427

(62,300)

(36,656)

$1,115,471

FY'19

222,994,407

180,111,308

2,349,618

6,610,369

412,065,702

FY'20

$1,647,964

251,520

9,836

1,909,320

(560,987)

(303,883)

(1,814)

(866,684)

(2,109)

$1,040,527

280,923

(190,307)

90,616

22,851

(134,514)

$1,019,480

(89,989)

(36,656)

$892,835

FY'20

228,873,449

204,028,327

1,833,332

6,275,957

441,01 1,065

Q2'21 LTM

$1,774,679

291,769

20,838

2,087,286

(623,496)

(318,966)

(2,109)

(944,571)

(1,223)

$1,141,492

779,850

(418,033)

361,817

108,824

(138,896)

$1,473,237

(118,717)

(36,655)

$1,317,865

YTD Q2'21

231,366,321

201,208,132

359,592

7,858,538

440,792,583View entire presentation