Broadridge Financial Solutions Results Presentation Deck

00

D

00.00

0.0.

Co

G

0

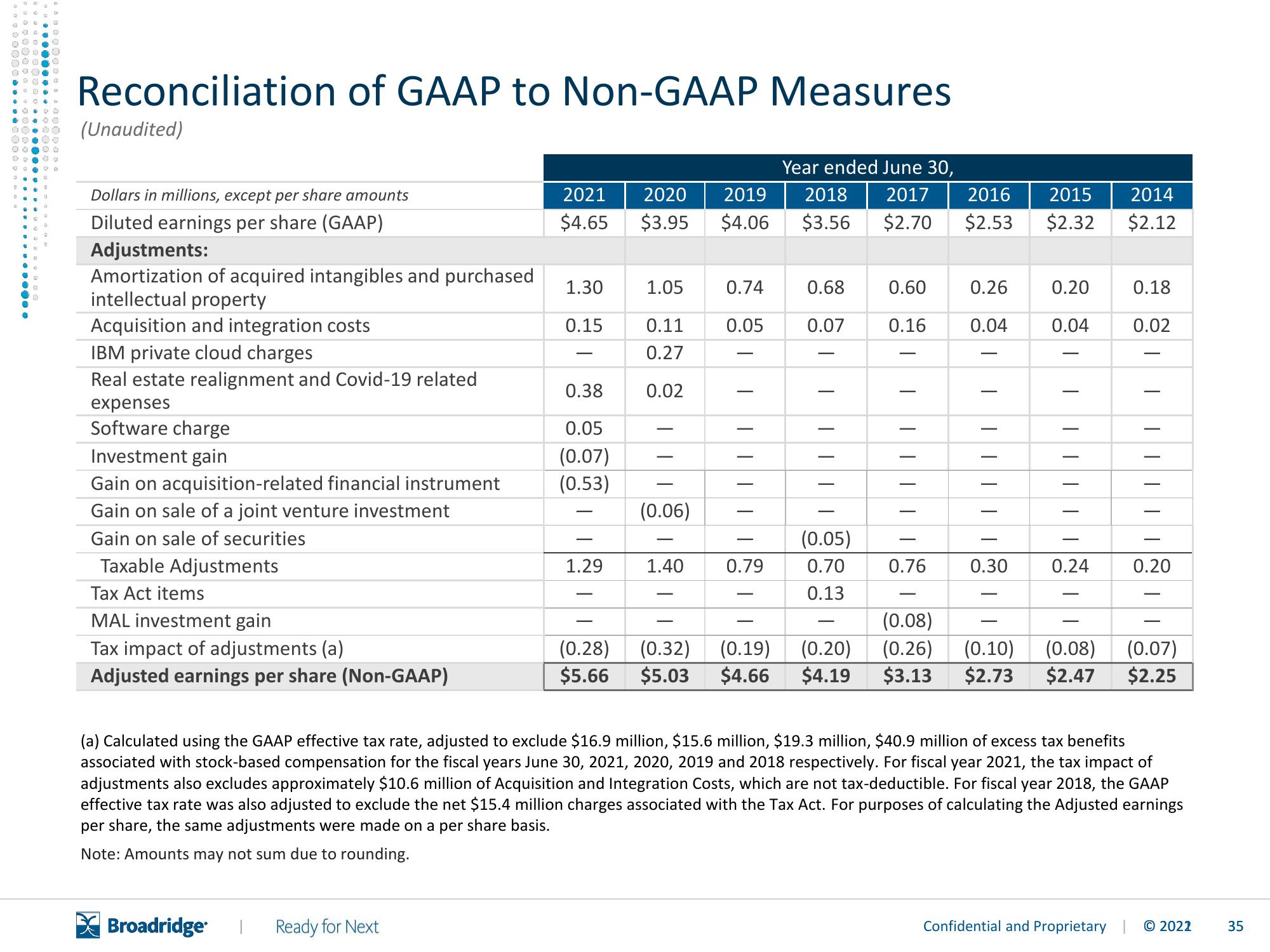

Reconciliation of GAAP to Non-GAAP Measures

(Unaudited)

Dollars in millions, except per share amounts

Diluted earnings per share (GAAP)

Adjustments:

Amortization of acquired intangibles and purchased

intellectual property

Acquisition and integration costs

IBM private cloud charges

Real estate realignment and Covid-19 related

expenses

Software charge

Investment gain

Gain on acquisition-related financial instrument

Gain on sale of a joint venture investment

Gain on sale of securities

Taxable Adjustments

Tax Act items

MAL investment gain

Tax impact of adjustments (a)

Adjusted earnings per share (Non-GAAP)

Broadridge

2021

$4.65 $3.95

Ready for Next

1.30

0.15

0.38

0.05

(0.07)

(0.53)

||N

2020 2019

$4.06

1.29

1.05

0.11

0.27

0.02

(0.06)

0.74

0.05

||||||

1.40 0.79

Year ended June 30,

2018 2017 2016

$3.56

0.68

0.07

|||||

2015

$2.70 $2.53 $2.32

0.60

0.16

|||||

(0.05)

0.70 0.76

0.13

0.26

0.04

|||||||

0.30

0.20

0.04

|||||||

0.24

(0.08)

(0.28) (0.32) (0.19) (0.20) (0.26) (0.10) (0.08)

$5.66 $5.03 $4.66 $4.19 $3.13 $2.73 $2.47

-

2014

$2.12

Confidential and Proprietary

0.18

0.02

T

|||||

(a) Calculated using the GAAP effective tax rate, adjusted to exclude $16.9 million, $15.6 million, $19.3 million, $40.9 million of excess tax benefits

associated with stock-based compensation for the fiscal years June 30, 2021, 2020, 2019 and 2018 respectively. For fiscal year 2021, the tax impact of

adjustments also excludes approximately $10.6 million of Acquisition and Integration Costs, which are not tax-deductible. For fiscal year 2018, the GAAP

effective tax rate was also adjusted to exclude the net $15.4 million charges associated with the Tax Act. For purposes of calculating the Adjusted earnings

per share, the same adjustments were made on a per share basis.

Note: Amounts may not sum due to rounding.

0.20

(0.07)

$2.25

© 2022

35View entire presentation