KLA Investor Day Presentation Deck

■

■

I

■

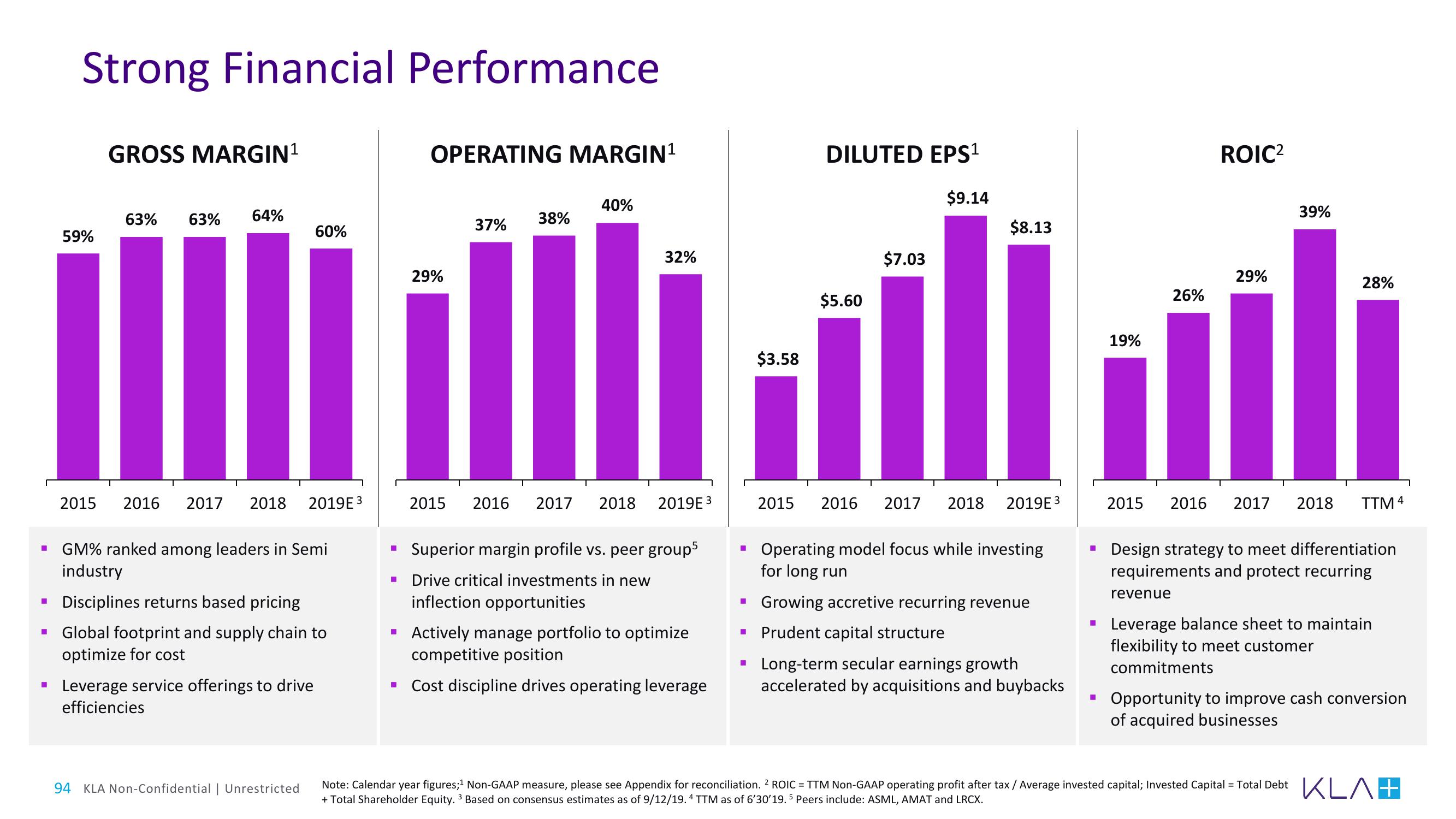

Strong Financial Performance

59%

GROSS MARGIN¹

63%

63% 64%

2015 2016 2017 2018

60%

2019E3

GM% ranked among leaders in Semi

industry

Disciplines returns based pricing

Global footprint and supply chain to

optimize for cost

Leverage service offerings to drive

efficiencies

94 KLA Non-Confidential | Unrestricted

■

■

OPERATING MARGIN¹

■

29%

37%

38%

40%

Superior margin profile vs. peer group5

■ Drive critical investments in new

inflection opportunities

32%

2015 2016 2017 2018 2019E3

Actively manage portfolio to optimize

competitive position

Cost discipline drives operating leverage

■

■

$3.58

■

2015

DILUTED EPS¹

$5.60

$7.03

$9.14

2016 2017 2018

$8.13

2019E3

Growing accretive recurring revenue

▪ Prudent capital structure

Operating model focus while investing

for long run

Long-term secular earnings growth

accelerated by acquisitions and buybacks

I

■

19%

26%

ROIC²

revenue

29%

2015 2016 2017 2018

39%

28%

Design strategy to meet differentiation

requirements and protect recurring

TTM 4

Note: Calendar year figures;¹ Non-GAAP measure, please see Appendix for reconciliation. 2 ROIC = TTM Non-GAAP operating profit after tax / Average invested capital; Invested Capital = Total Debt

+ Total Shareholder Equity. 3 Based on consensus estimates as of 9/12/19.4 TTM as of 6'30'19. 5 Peers include: ASML, AMAT and LRCX.

Leverage balance sheet to maintain

flexibility to meet customer

commitments

Opportunity to improve cash conversion

of acquired businesses

KLA+View entire presentation