KLA Investor Day Presentation Deck

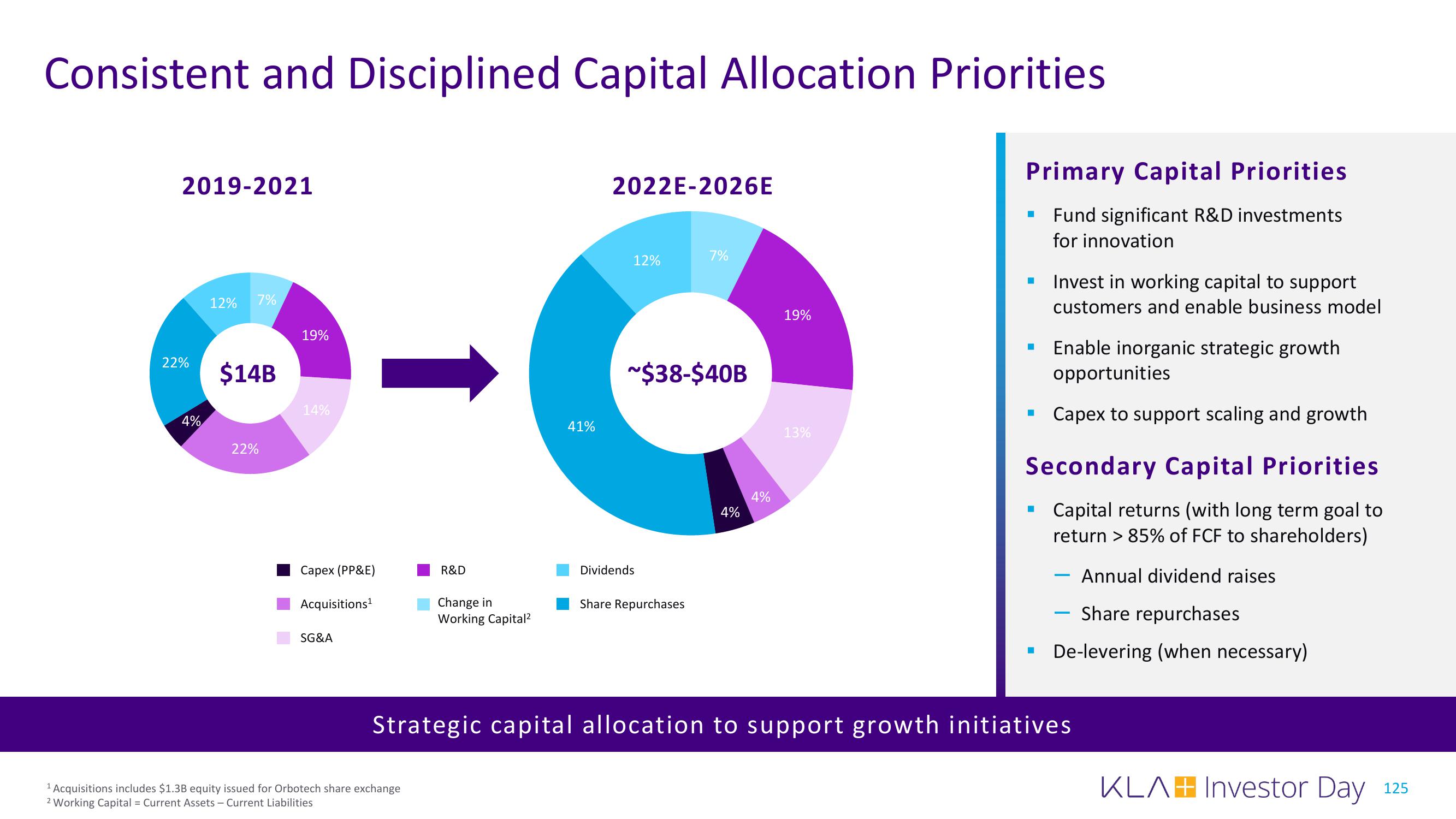

Consistent and Disciplined Capital Allocation Priorities

2019-2021

12% 7%

22% $14B

4%

22%

19%

14%

Capex (PP&E)

Acquisitions¹

SG&A

R&D

¹ Acquisitions includes $1.3B equity issued for Orbotech share exchange

2 Working Capital = Current Assets - Current Liabilities

Change in

Working Capital²

41%

2022E-2026E

12%

~$38-$40B

Dividends

7%

Share Repurchases

4%

4%

19%

13%

Primary Capital Priorities

Fund significant R&D investments

for innovation

■

■

■

I

Invest in working capital to support

customers and enable business model

Secondary Capital Priorities

Capital returns (with long term goal to

return >85% of FCF to shareholders)

Annual dividend raises

Share repurchases

De-levering (when necessary)

■

Enable inorganic strategic growth

opportunities

Capex to support scaling and growth

-

Strategic capital allocation to support growth initiatives

KLAH Investor Day 125View entire presentation