Apollo Global Management Investor Day Presentation Deck

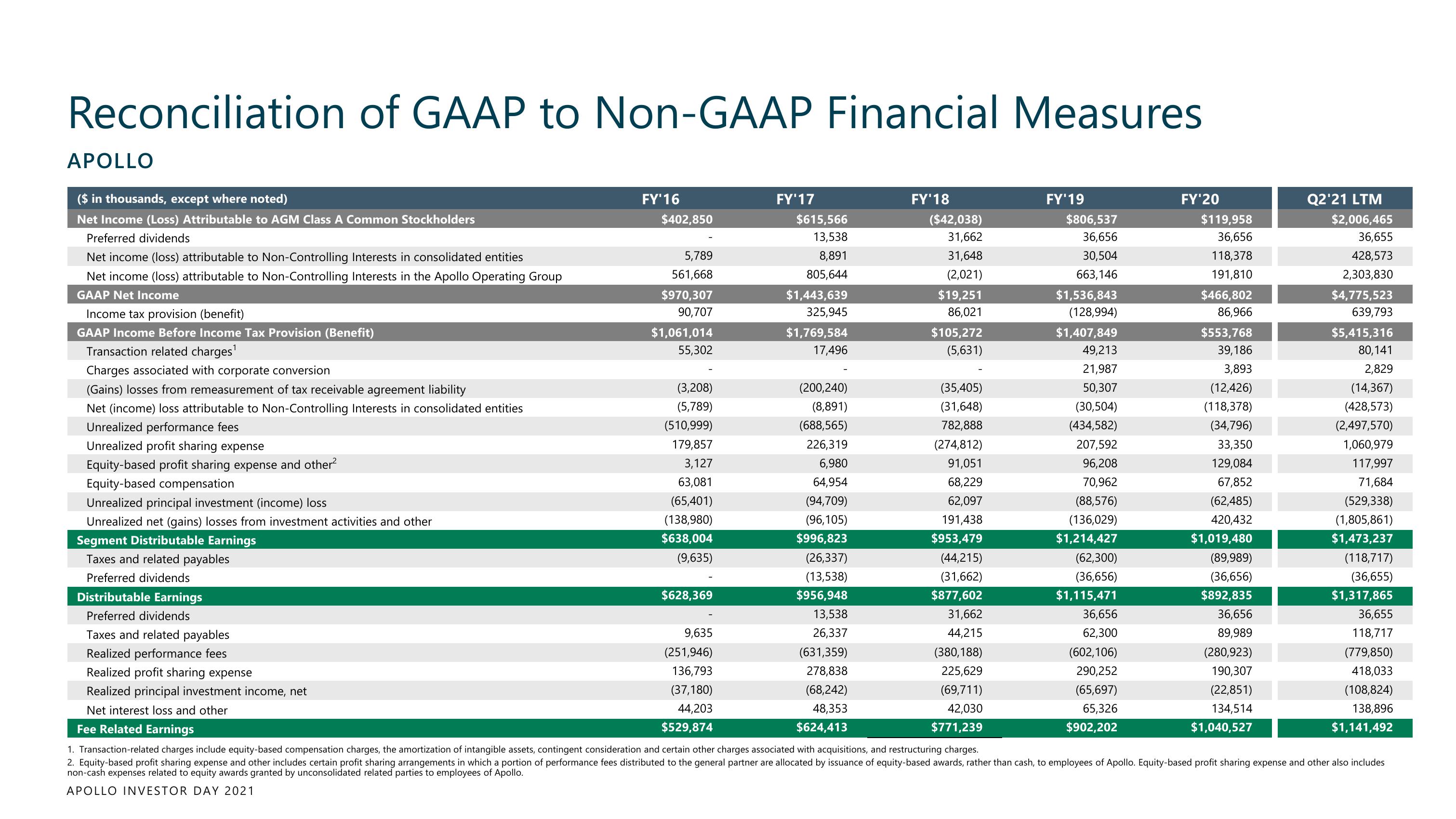

Reconciliation of GAAP to Non-GAAP Financial Measures

APOLLO

($ in thousands, except where noted)

Net Income (Loss) Attributable to AGM Class A Common Stockholders

Preferred dividends

Net income (loss) attributable to Non-Controlling Interests in consolidated entities

Net income (loss) attributable to Non-Controlling Interests in the Apollo Operating Group

GAAP Net Income

Income tax provision (benefit)

GAAP Income Before Income Tax Provision (Benefit)

Transaction related charges¹

Charges associated with corporate conversion

(Gains) losses from remeasurement of tax receivable agreement liability

Net (income) loss attributable to Non-Controlling Interests in consolidated entities

Unrealized performance fees

Unrealized profit sharing expense

Equity-based profit sharing expense and other²

Equity-based compensation

Unrealized principal investment (income) loss

Unrealized net (gains) losses from investment activities and other

Segment Distributable Earnings

Taxes and related payables

Preferred dividends

Distributable Earnings

Preferred dividends

FY' 16

$402,850

5,789

561,668

$970,307

90,707

$1,061,014

55,302

(3,208)

(5,789)

(510,999)

179,857

3,127

63,081

(65,401)

(138,980)

$638,004

(9,635)

$628,369

9,635

(251,946)

136,793

(37,180)

44,203

$529,874

FY'17

$615,566

13,538

8,891

805,644

$1,443,639

325,945

$1,769,584

17,496

(200,240)

(8,891)

(688,565)

226,319

6,980

64,954

(94,709)

(96,105)

$996,823

(26,337)

(13,538)

$956,948

13,538

26,337

FY'18

(631,359)

278,838

(68,242)

48,353

$624,413

($42,038)

31,662

31,648

(2,021)

$19,251

86,021

$105,272

(5,631)

(35,405)

(31,648)

782,888

(274,812)

91,051

68,229

62,097

191,438

$953,479

(44,215)

(31,662)

$877,602

31,662

44,215

FY'19

(380,188)

225,629

(69,711)

42,030

$771,239

$806,537

36,656

30,504

663,146

$1,536,843

(128,994)

$1,407,849

49,213

21,987

50,307

(30,504)

(434,582)

207,592

96,208

70,962

(88,576)

(136,029)

$1,214,427

(62,300)

(36,656)

$1,115,471

36,656

62,300

FY'20

(602,106)

290,252

(65,697)

65,326

$902,202

$119,958

36,656

118,378

191,810

$466,802

86,966

$553,768

39,186

3,893

(12,426)

(118,378)

(34,796)

33,350

129,084

67,852

(62,485)

420,432

$1,019,480

(89,989)

(36,656)

$892,835

36,656

89,989

Taxes and related payables

Realized performance fees

Realized profit sharing expense

Realized principal investment income, net

Net interest loss and other

Fee Related Earnings

1. Transaction-related charges include equity-based compensation charges, the amortization of intangible assets, contingent consideration and certain other charges associated with acquisitions, and restructuring charges.

2. Equity-based profit sharing expense and other includes certain profit sharing arrangements in which a portion of performance fees distributed to the general partner are allocated by issuance of equity-based awards, rather than cash, to employees of Apollo. Equity-based profit sharing expense and other also includes

non-cash expenses related to equity awards granted by unconsolidated related parties to employees of Apollo.

APOLLO INVESTOR DAY 2021

Q2'21 LTM

(280,923)

190,307

(22,851)

134,514

$1,040,527

$2,006,465

36,655

428,573

2,303,830

$4,775,523

639,793

$5,415,316

80,141

2,829

(14,367)

(428,573)

(2,497,570)

1,060,979

117,997

71,684

(529,338)

(1,805,861)

$1,473,237

(118,717)

(36,655)

$1,317,865

36,655

118,717

(779,850)

418,033

(108,824)

138,896

$1,141,492View entire presentation