JD Sports Results Presentation Deck

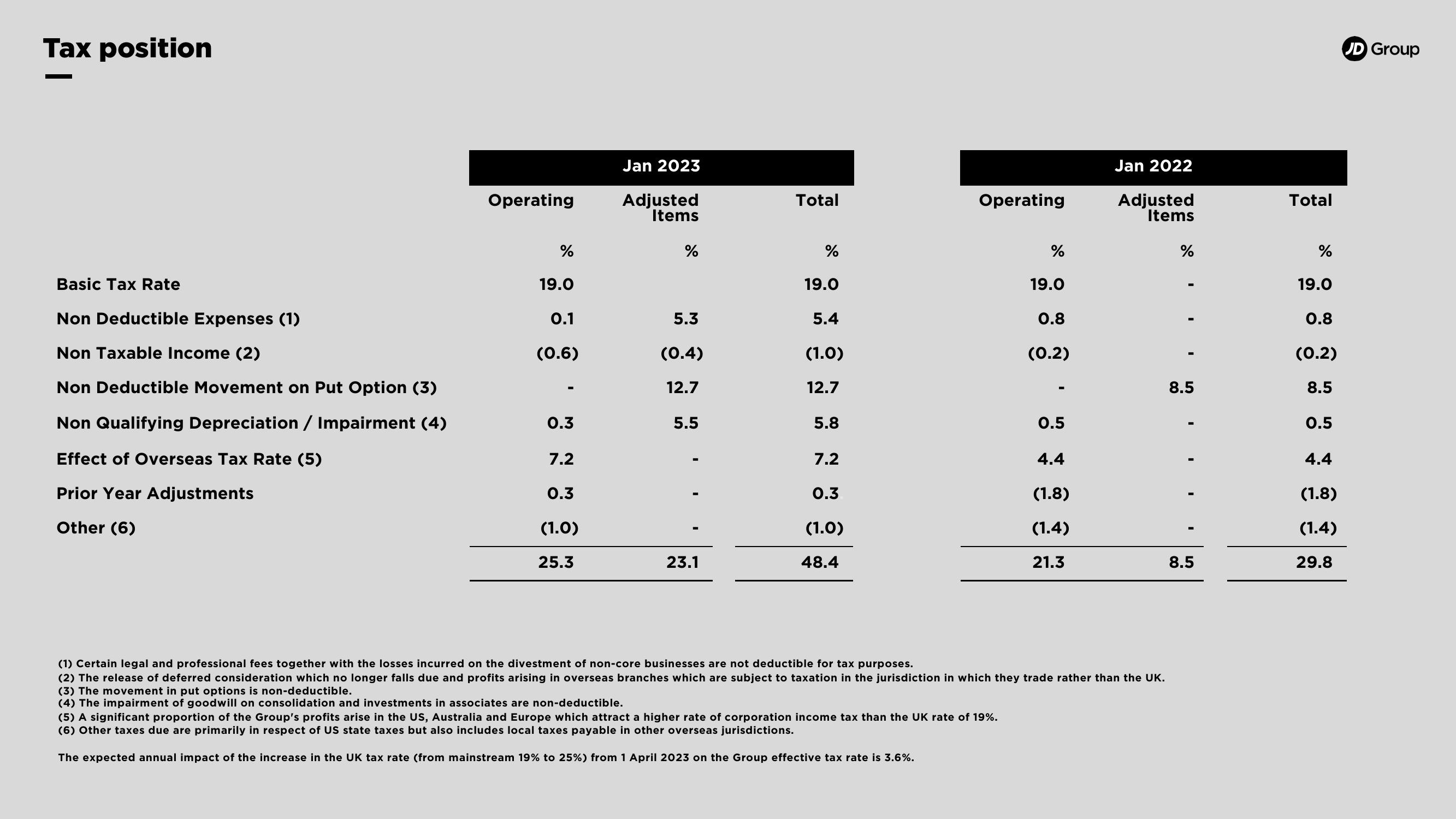

Tax position

Basic Tax Rate

Non Deductible Expenses (1)

Non Taxable Income (2)

Non Deductible Movement on Put Option (3)

Non Qualifying Depreciation / Impairment (4)

Effect of Overseas Tax Rate (5)

Prior Year Adjustments

Other (6)

Operating

%

19.0

0.1

(0.6)

0.3

7.2

0.3

(1.0)

25.3

Jan 2023

Adjusted

Items

%

5.3

(0.4)

12.7

5.5

-

23.1

Total

%

19.0

5.4

(1.0)

12.7

5.8

7.2

0.3

(1.0)

48.4

Operating

%

(5) A significant proportion of the Group's profits arise in the US, Australia and Europe which attract a higher rate of corporation income tax than the UK rate of 19%.

(6) Other taxes due are primarily in respect of US state taxes but also includes local taxes payable in other overseas jurisdictions.

The expected annual impact of the increase in the UK tax rate (from mainstream 19% to 25%) from 1 April 2023 on the Group effective tax rate is 3.6%.

19.0

0.8

(0.2)

I

0.5

4.4

(1.8)

(1.4)

21.3

Jan 2022

Adjusted

Items

(1) Certain legal and professional fees together with the losses incurred on the divestment of non-core businesses are not deductible for tax purposes.

(2) The release of deferred consideration which no longer falls due and profits arising in overseas branches which are subject to taxation in the jurisdiction in which they trade rather than the UK.

(3) The movement in put options is non-deductible.

(4) The impairment of goodwill on consolidation and investments in associates are non-deductible.

%

8.5

8.5

Total

%

19.0

0.8

(0.2)

8.5

0.5

4.4

(1.8)

(1.4)

29.8

JD GroupView entire presentation