Apollo Global Management Investor Day Presentation Deck

Funding Agreements

Business Highlights

Athene maintains issuing capabilities across currencies in

North America and European markets

●

While at SunAmerica in the 1990s, Jim Belardi pioneered the

development of the Funding Agreement Backed Note (FABN),

which has since grown into a ~$250 billion market

WHAT IS A FUNDING AGREEMENT?

1

2

3

Traditional fixed income investors purchase a fixed

income investment (effectively a note or bond), and the

issuer guarantees a fixed or floating rate of return over a

certain tenor

The issuer re-invests the amount of the funding

agreement and seeks to earn more than the cost of the

funding agreement

Funding agreements are priced based on market

demand and the credit rating of the issuer

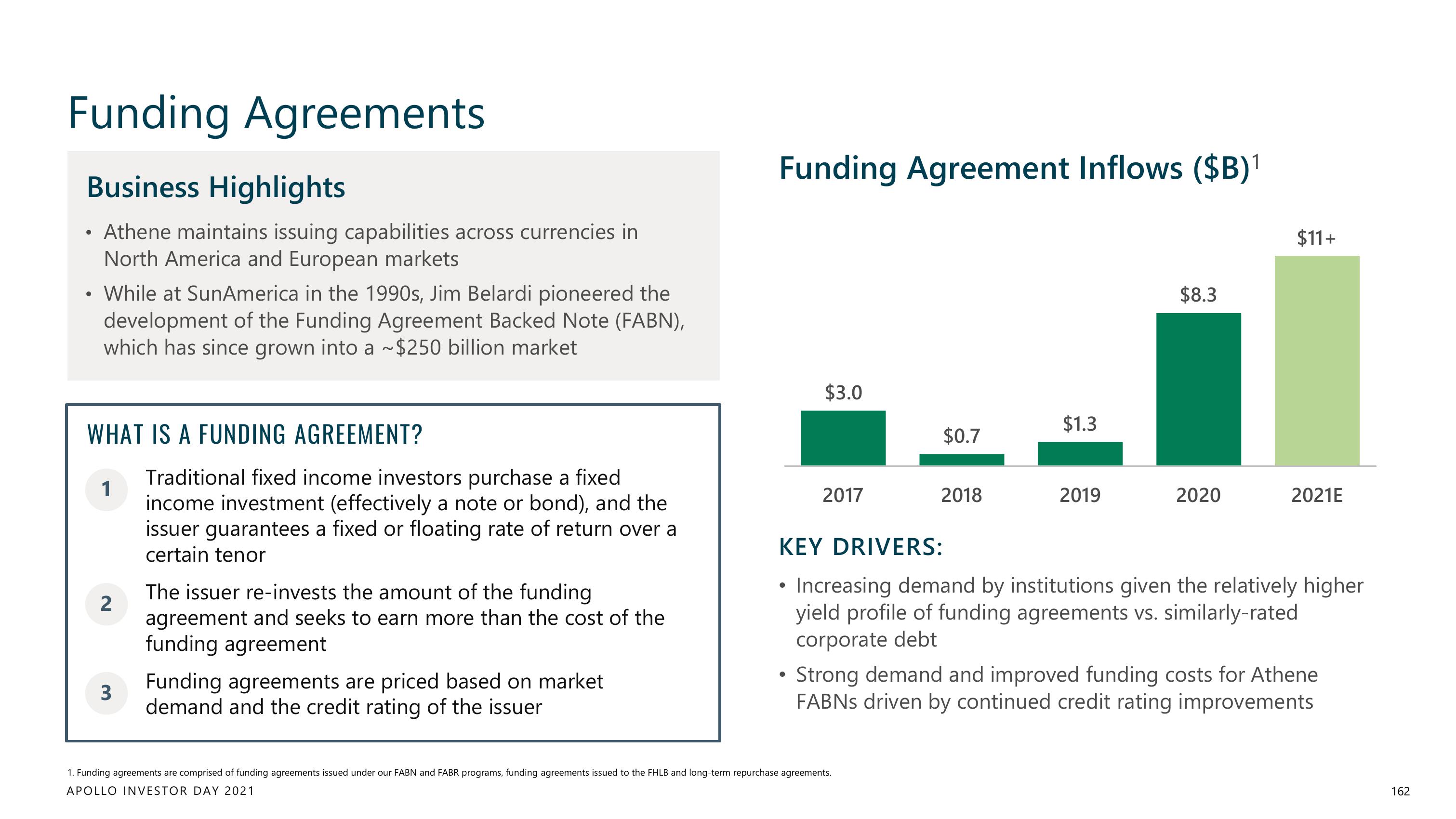

Funding Agreement Inflows ($B)¹

$3.0

●

2017

$0.7

2018

1. Funding agreements are comprised of funding agreements issued under our FABN and FABR programs, funding agreements issued to the FHLB and long-term repurchase agreements.

APOLLO INVESTOR DAY 2021

$1.3

2019

$8.3

2020

$11+

KEY DRIVERS:

• Increasing demand by institutions given the relatively higher

yield profile of funding agreements vs. similarly-rated

corporate debt

2021E

Strong demand and improved funding costs for Athene

FABNS driven by continued credit rating improvements

162View entire presentation