Broadridge Financial Solutions Results Presentation Deck

C

D

00.00 (Unaudited)

0.0.

0

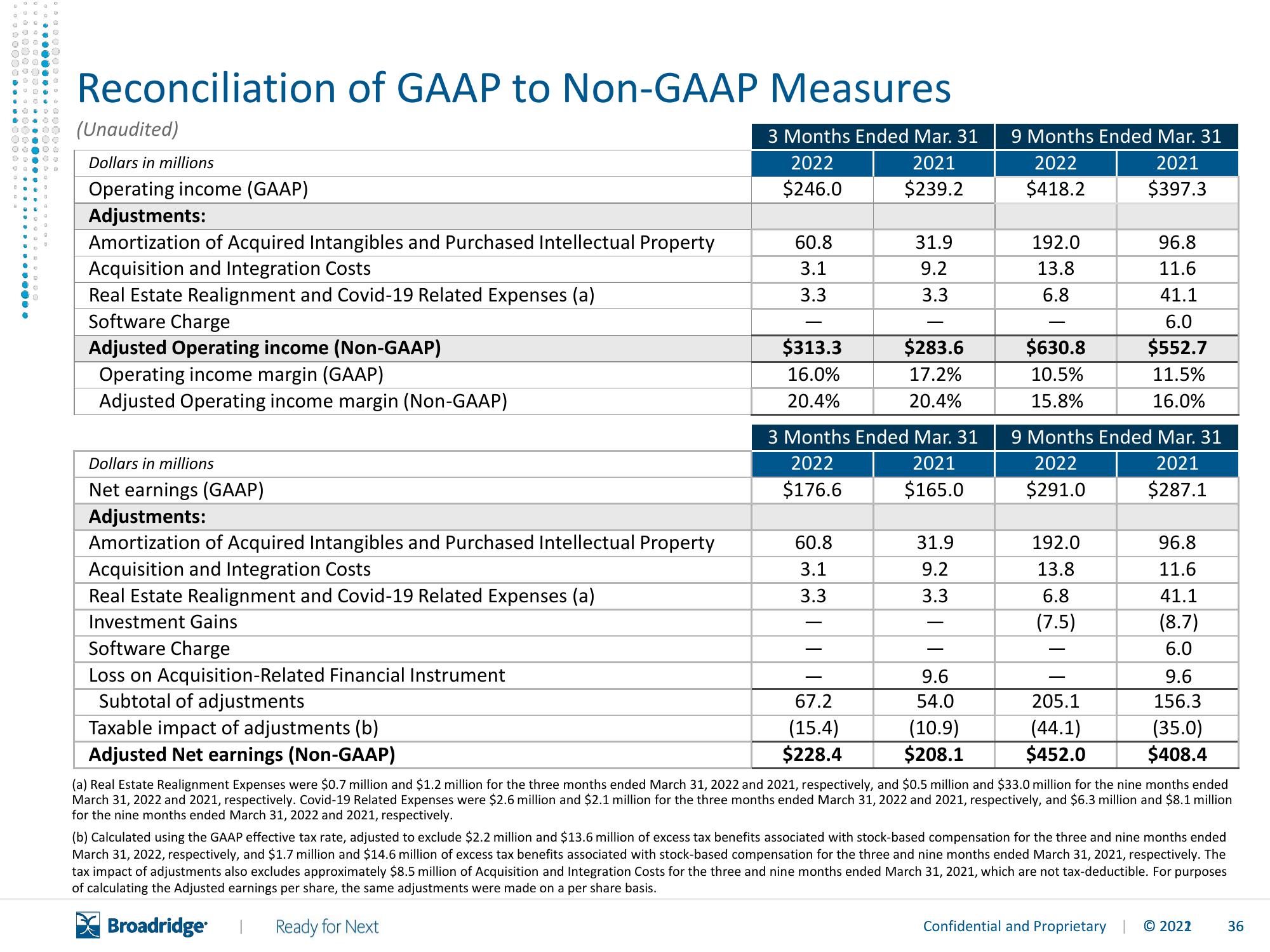

Reconciliation of GAAP to Non-GAAP Measures

3 Months Ended Mar. 31

2022

2021

$246.0

$239.2

D

Dollars in millions

Operating income (GAAP)

Adjustments:

Amortization of Acquired Intangibles and Purchased Intellectual Property

Acquisition and Integration Costs

Real Estate Realignment and Covid-19 Related Expenses (a)

Software Charge

Adjusted Operating income (Non-GAAP)

Operating income margin (GAAP)

Adjusted Operating income margin (Non-GAAP)

Dollars in millions

Net earnings (GAAP)

Adjustments:

Amortization of Acquired Intangibles and Purchased Intellectual Property

Acquisition and Integration Costs

Real Estate Realignment and Covid-19 Related Expenses (a)

Investment Gains

Software Charge

Loss on Acquisition-Related Financial Instrument

Subtotal of adjustments

Taxable impact of adjustments (b)

Adjusted Net earnings (Non-GAAP)

60.8

3.1

3.3

$313.3

16.0%

20.4%

2022

$176.6

60.8

3.1

3.3

-

31.9

9.2

3.3

67.2

(15.4)

$228.4

$283.6

17.2%

20.4%

3 Months Ended Mar. 31 9 Months Ended Mar. 31

2021

2022

2021

$165.0

$291.0

$287.1

31.9

9.2

3.3

9 Months Ended Mar. 31

2022

2021

$397.3

$418.2

9.6

54.0

(10.9)

$208.1

192.0

13.8

6.8

$630.8

10.5%

15.8%

192.0

13.8

6.8

(7.5)

96.8

11.6

41.1

6.0

$552.7

11.5%

16.0%

205.1

(44.1)

$452.0

96.8

11.6

41.1

(8.7)

6.0

9.6

156.3

(35.0)

$408.4

(a) Real Estate Realignment Expenses were $0.7 million and $1.2 million for the three months ended March 31, 2022 and 2021, respectively, and $0.5 million and $33.0 million for the nine months ended

March 31, 2022 and 2021, respectively. Covid-19 Related Expenses were $2.6 million and $2.1 million for the three months ended March 31, 2022 and 2021, respectively, and $6.3 million and $8.1 million

for the nine months ended March 31, 2022 and 2021, respectively.

(b) Calculated using the GAAP effective tax rate, adjusted to exclude $2.2 million and $13.6 million of excess tax benefits associated with stock-based compensation for the three and nine months ended

March 31, 2022, respectively, and $1.7 million and $14.6 million of excess tax benefits associated with stock-based compensation for the three and nine months ended March 31, 2021, respectively. The

tax impact of adjustments also excludes approximately $8.5 million of Acquisition and Integration Costs for the three and nine months ended March 31, 2021, which are not tax-deductible. For purposes

of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis.

Broadridge

I Ready for Next

Confidential and Proprietary © 2022

36View entire presentation