Apollo Global Management Investor Day Presentation Deck

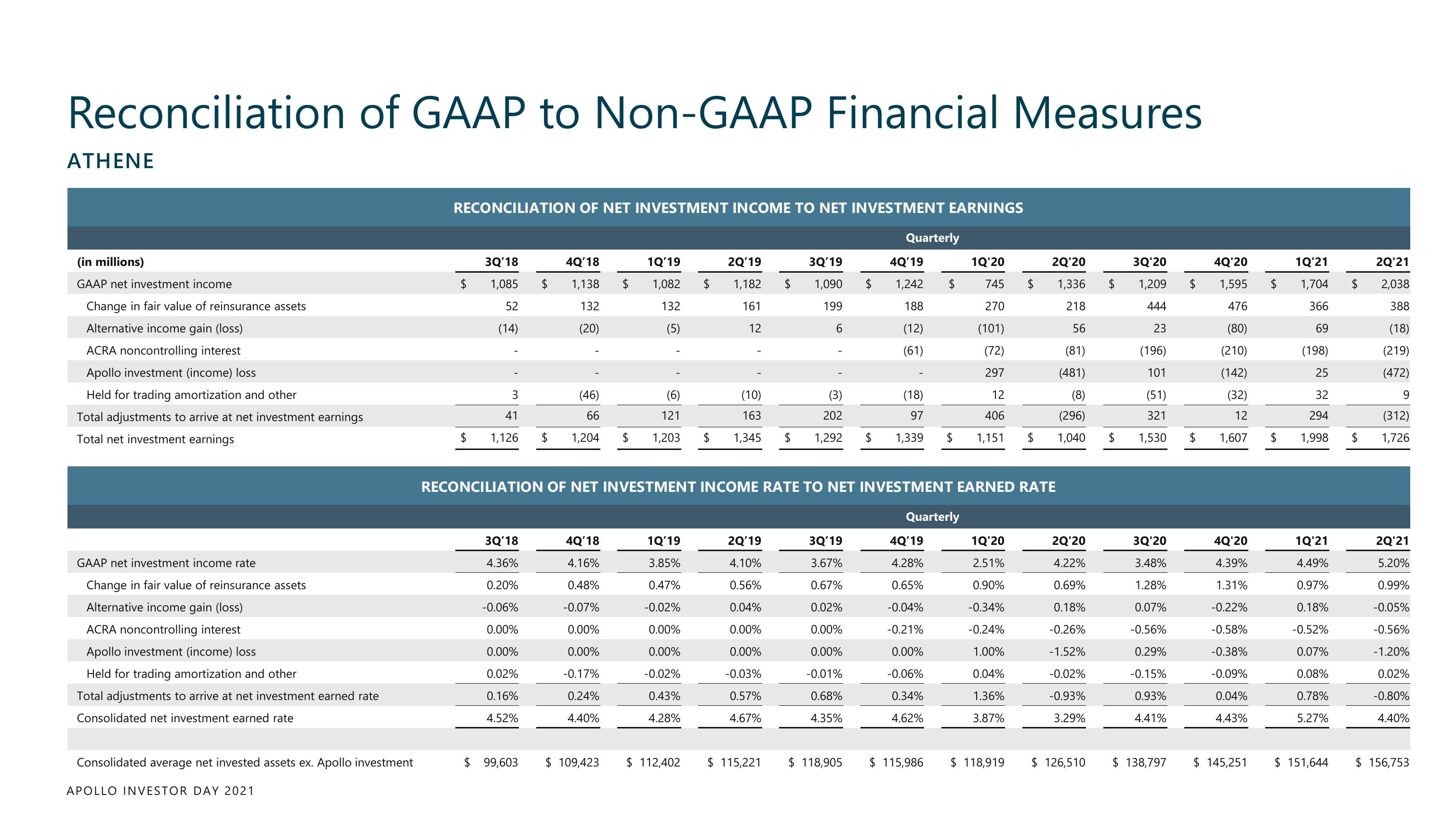

Reconciliation of GAAP to Non-GAAP Financial Measures

ATHENE

(in millions)

GAAP net investment income

Change in fair value of reinsurance assets

Alternative income gain (loss)

ACRA noncontrolling interest

Apollo investment (income) loss

Held for trading amortization and other

Total adjustments to arrive at net investment earnings

Total net investment earnings

GAAP net investment income rate

Change in fair value of reinsurance assets

Alternative income gain (loss)

ACRA noncontrolling interest

Apollo investment (income) loss

Held for trading amortization and other

Total adjustments to arrive at net investment earned rate

Consolidated net investment earned rate

Consolidated average net invested assets ex. Apollo investment

APOLLO INVESTOR DAY 2021

RECONCILIATION OF NET INVESTMENT INCOME TO NET INVESTMENT EARNINGS

$

$

3Q'18

1,085

52

(14)

3

41

1,126

3Q'18

4.36%

0.20%

-0.06%

0.00%

0.00%

0.02%

0.16%

4.52%

4Q'18

$ 1,138

132

(20)

$ 99,603

(46)

66

$ 1,204

4Q'18

4.16%

0.48%

-0.07%

0.00%

0.00%

-0.17%

0.24%

4.40%

$

$ 109,423

1Q'19

1,082

132

(5)

(6)

121

$ 1,203

1Q'19

3.85%

0.47%

-0.02%

0.00%

0.00%

-0.02%

0.43%

4.28%

$ 112,402

2Q'19

1,182 $

161

12

2Q'20

$ 1,336

218

56

(81)

(481)

(8)

202

(296)

$ 1,345 $ 1,292 $ 1,339 $ 1,151 $ 1,040

(10)

163

RECONCILIATION OF NET INVESTMENT INCOME RATE TO NET INVESTMENT EARNED RATE

2Q'19

4.10%

0.56%

0.04%

0.00%

0.00%

-0.03%

0.57%

4.67%

3Q'19

1,090

199

6

$ 115,221

3Q'19

3.67%

0.67%

0.02%

0.00%

0.00%

-0.01%

0.68%

4.35%

Quarterly

$

$ 118,905

4Q'19

1,242

188

(12)

(61)

(18)

97

Quarterly

4Q'19

4.28%

0.65%

-0.04%

-0.21%

0.00%

-0.06%

0.34%

4.62%

1Q'20

745

270

(101)

(72)

297

$ 115,986

12

406

1Q'20

2.51%

0.90%

-0.34%

-0.24%

1.00%

0.04%

1.36%

3.87%

$ 118,919

2Q'20

4.22%

0.69%

0.18%

-0.26%

-1.52%

-0.02%

-0.93%

3.29%

$ 126,510

3Q'20

1,209

444

23

(196)

101

(51)

321

$ 1,530

$

3Q'20

3.48%

1.28%

0.07%

-0.56%

0.29%

-0.15%

0.93%

4.41%

$ 138,797

4Q'20

1,595

476

(80)

(210)

(142)

(32)

12

$ 1,607 $

4Q'20

4.39%

1.31%

-0.22%

-0.58%

-0.38%

-0.09%

0.04%

4.43%

$ 145,251

1Q'21

$ 1,704

366

69

(198)

25

32

294

1,998

1Q'21

4.49%

0.97%

0.18%

-0.52%

0.07%

0.08%

0.78%

5.27%

$ 151,644

$

$

2Q'21

2,038

388

(18)

(219)

(472)

9

(312)

1,726

2Q'21

5.20%

0.99%

-0.05%

-0.56%

-1.20%

0.02%

-0.80%

4.40%

$ 156,753View entire presentation