Paysafe Results Presentation Deck

Q1 financial highlights

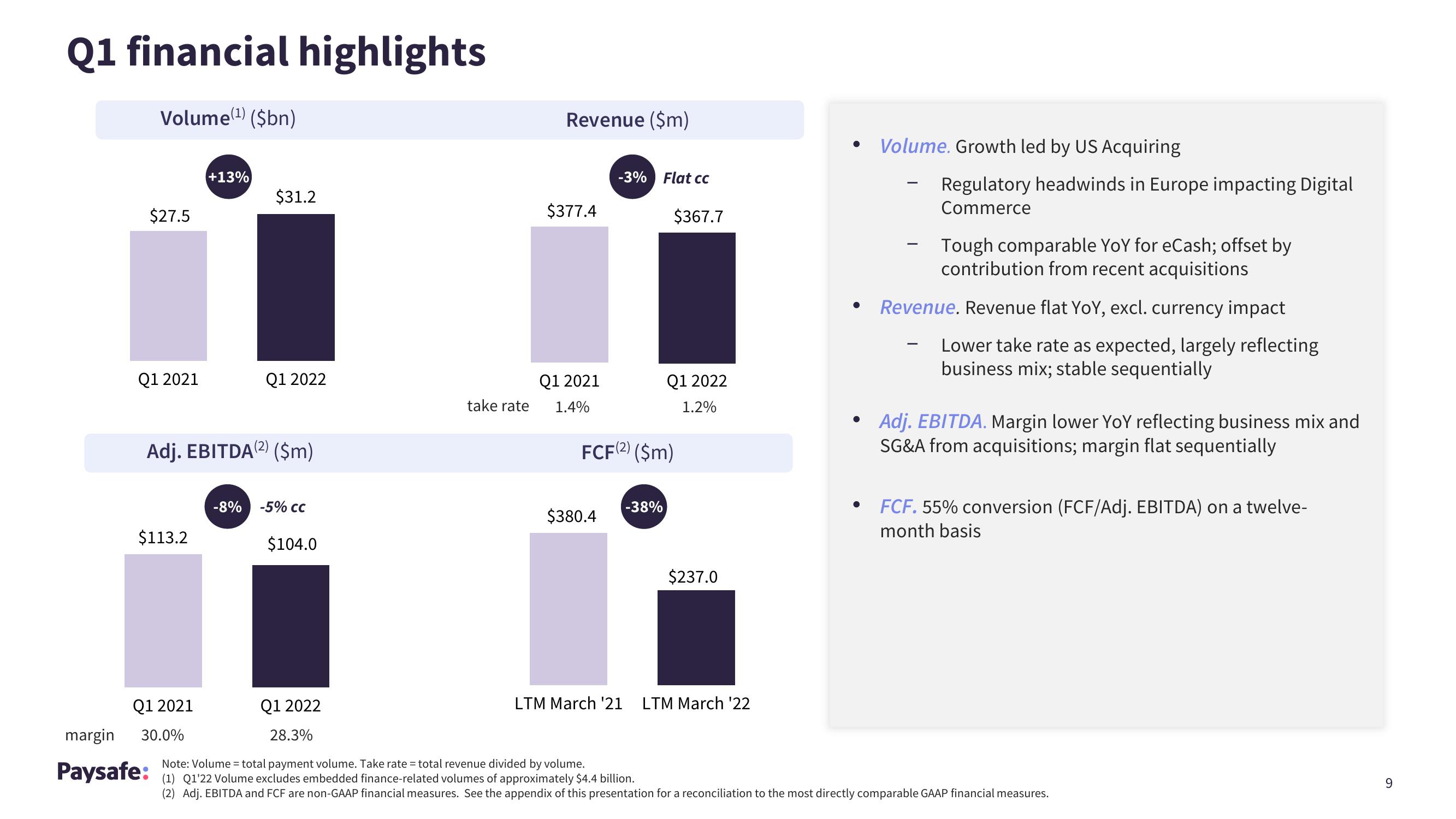

Volume(¹) ($bn)

margin

$27.5

Q1 2021

$113.2

+13%

Q1 2021

30.0%

$31.2

Adj. EBITDA (2) ($m)

Q1 2022

-8% -5% CC

$104.0

Q1 2022

28.3%

Revenue ($m)

$377.4

Q1 2021

take rate 1.4%

-3% Flat cc

$380.4

FCF(2) ($m)

-38%

$367.7

Q1 2022

1.2%

Note: Volume = total volume. Take rate = total revenue divided by volume.

Paysafe:122 Volume excludes embedded finance-related volumes of approximately $4.4 billion.

$237.0

LTM March '21 LTM March '22

●

●

Volume. Growth led by US Acquiring

Regulatory headwinds in Europe impacting Digital

Commerce

Tough comparable YoY for eCash; offset by

contribution from recent acquisitions

Revenue. Revenue flat YoY, excl. currency impact

Lower take rate as expected, largely reflecting

business mix; stable sequentially

Adj. EBITDA. Margin lower YoY reflecting business mix and

SG&A from acquisitions; margin flat sequentially

FCF. 55% conversion (FCF/Adj. EBITDA) on a twelve-

month basis

(2) Adj. EBITDA and FCF are non-GAAP financial measures. See the appendix of this presentation for a reconciliation to the most directly comparable GAAP financial measures.

9View entire presentation