Apollo Global Management Investor Day Presentation Deck

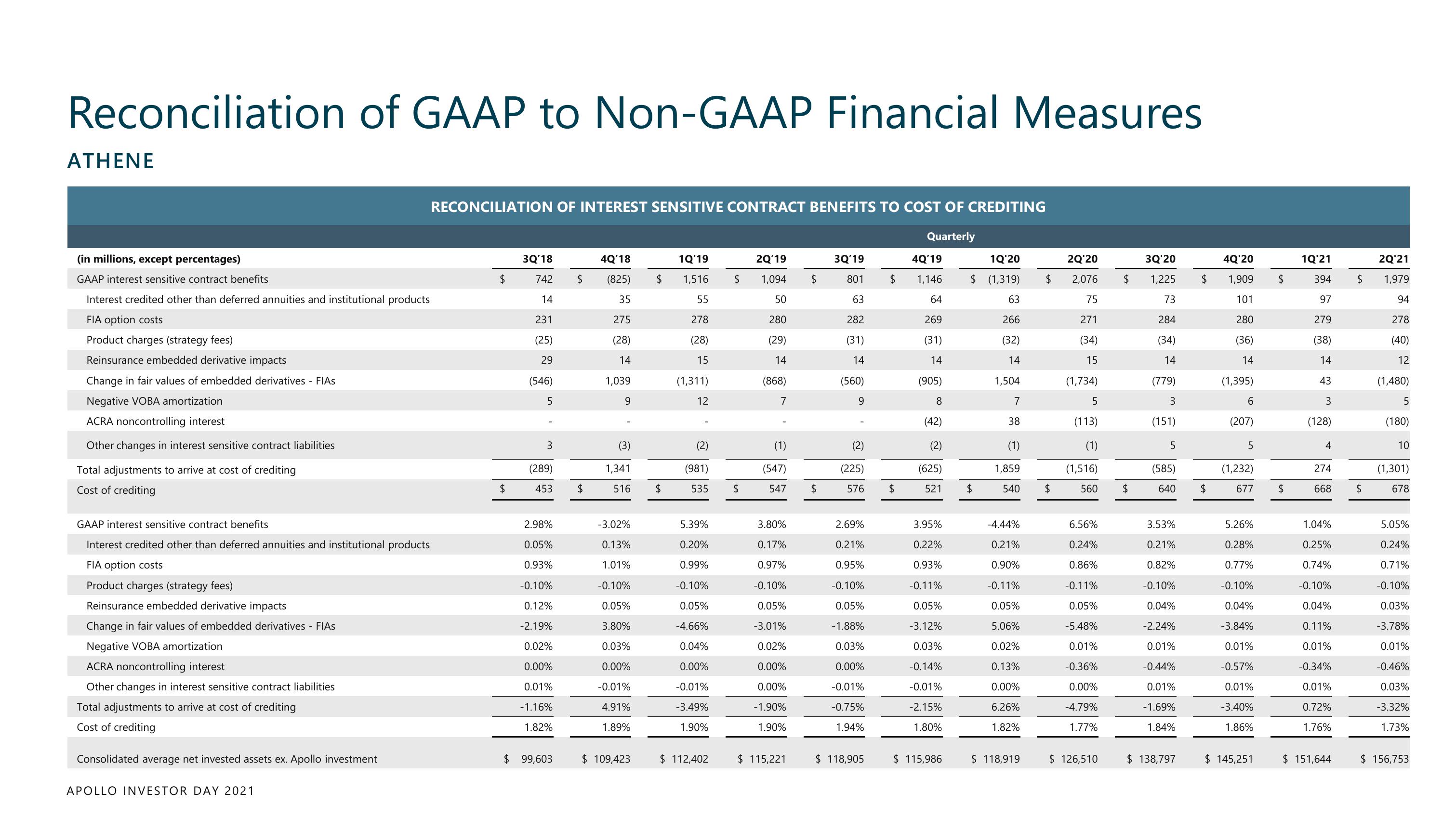

Reconciliation of GAAP to Non-GAAP Financial Measures

ATHENE

(in millions, except percentages)

GAAP interest sensitive contract benefits

Interest credited other than deferred annuities and institutional products

FIA option costs

Product charges (strategy fees)

Reinsurance embedded derivative impacts

Change in fair values of embedded derivatives - FIAS

Negative VOBA amortization

CRA noncontrolling interest

Other changes in interest sensitive contract liabilities

Total adjustments to arrive at cost of crediting

Cost of crediting

GAAP interest sensitive contract benefits

Interest credited other than deferred annuities and institutional products

FIA option costs

Product charges (strategy fees)

Reinsurance embedded derivative impacts

Change in fair values of embedded derivatives - FIAS

Negative VOBA amortization

ACRA noncontrolling interest

Other changes in interest sensitive contract liabilities

Total adjustments to arrive at cost of crediting

Cost of crediting

Consolidated average net invested assets ex. Apollo investment

APOLLO INVESTOR DAY 2021

RECONCILIATION OF INTEREST SENSITIVE CONTRACT BENEFITS TO COST OF CREDITING

Quarterly

$

$

3Q'18

742

14

231

(25)

29

(546)

5

3

(289)

453

2.98%

0.05%

0.93%

-0.10%

0.12%

-2.19%

0.02%

0.00%

0.01%

-1.16%

1.82%

$ 99,603

$

$

4Q'18

(825)

35

275

(28)

14

1,039

9

(3)

1,341

516 $

-3.02%

0.13%

1.01%

-0.10%

0.05%

3.80%

0.03%

0.00%

-0.01%

4.91%

1.89%

$

$ 109,423

1Q'19

1,516

55

278

(28)

15

(1,311)

12

(2)

(981)

535 $

5.39%

0.20%

0.99%

-0.10%

0.05%

-4.66%

0.04%

0.00%

-0.01%

-3.49%

1.90%

$

$ 112,402

2Q'19

1,094

50

280

(29)

14

(868)

7

(1)

(547)

547

3.80%

0.17%

0.97%

-0.10%

0.05%

-3.01%

0.02%

0.00%

0.00%

-1.90%

1.90%

$ 115,221

$

$

3Q'19

801

63

282

(31)

14

(560)

9

(225)

576 $

2.69%

0.21%

0.95%

-0.10%

0.05%

-1.88%

0.03%

0.00%

-0.01%

-0.75%

1.94%

$

118,905

4Q'19

1,146

64

269

(31)

14

(905)

8

(42)

(2)

(625)

521 $

3.95%

0.22%

0.93%

-0.11%

0.05%

-3.12%

0.03%

-0.14%

-0.01%

-2.15%

1.80%

1Q'20

2Q'20

$ (1,319) $ 2,076

63

75

266

271

(34)

(32)

14

15

$ 115,986

1,504

7

38

(1)

1,859

540

-4.44%

0.21%

0.90%

-0.11%

0.05%

5.06%

0.02%

0.13%

0.00%

6.26%

1.82%

$ 118,919

$

(1,734)

5

(113)

(1)

(1,516)

560

6.56%

0.24%

0.86%

-0.11%

0.05%

-5.48%

0.01%

-0.36%

0.00%

-4.79%

1.77%

$ 126,510

$

$

3Q'20

1,225

73

284

(34)

14

(779)

3

(151)

5

(585)

640

3.53%

0.21%

0.82%

-0.10%

0.04%

-2.24%

0.01%

-0.44%

0.01%

-1.69%

1.84%

$ 138,797

$

$

4Q'20

1,909

101

280

(36)

14

(1,395)

6

(207)

5

(1,232)

677

5.26%

0.28%

0.77%

-0.10%

0.04%

-3.84%

0.01%

-0.57%

0.01%

-3.40%

1.86%

$ 145,251

$

$

1Q'21

394

97

279

(38)

14

43

3

(128)

4

274

668

1.04%

0.25%

0.74%

-0.10%

0.04%

0.11%

0.01%

-0.34%

0.01%

0.72%

1.76%

$ 151,644

$

$

2Q'21

1,979

94

278

(40)

12

(1,480)

5

(180)

10

(1,301)

678

5.05%

0.24%

0.71%

-0.10%

0.03%

-3.78%

0.01%

-0.46%

0.03%

-3.32%

1.73%

$ 156,753View entire presentation