Micro Focus Fixed Income Presentation Deck

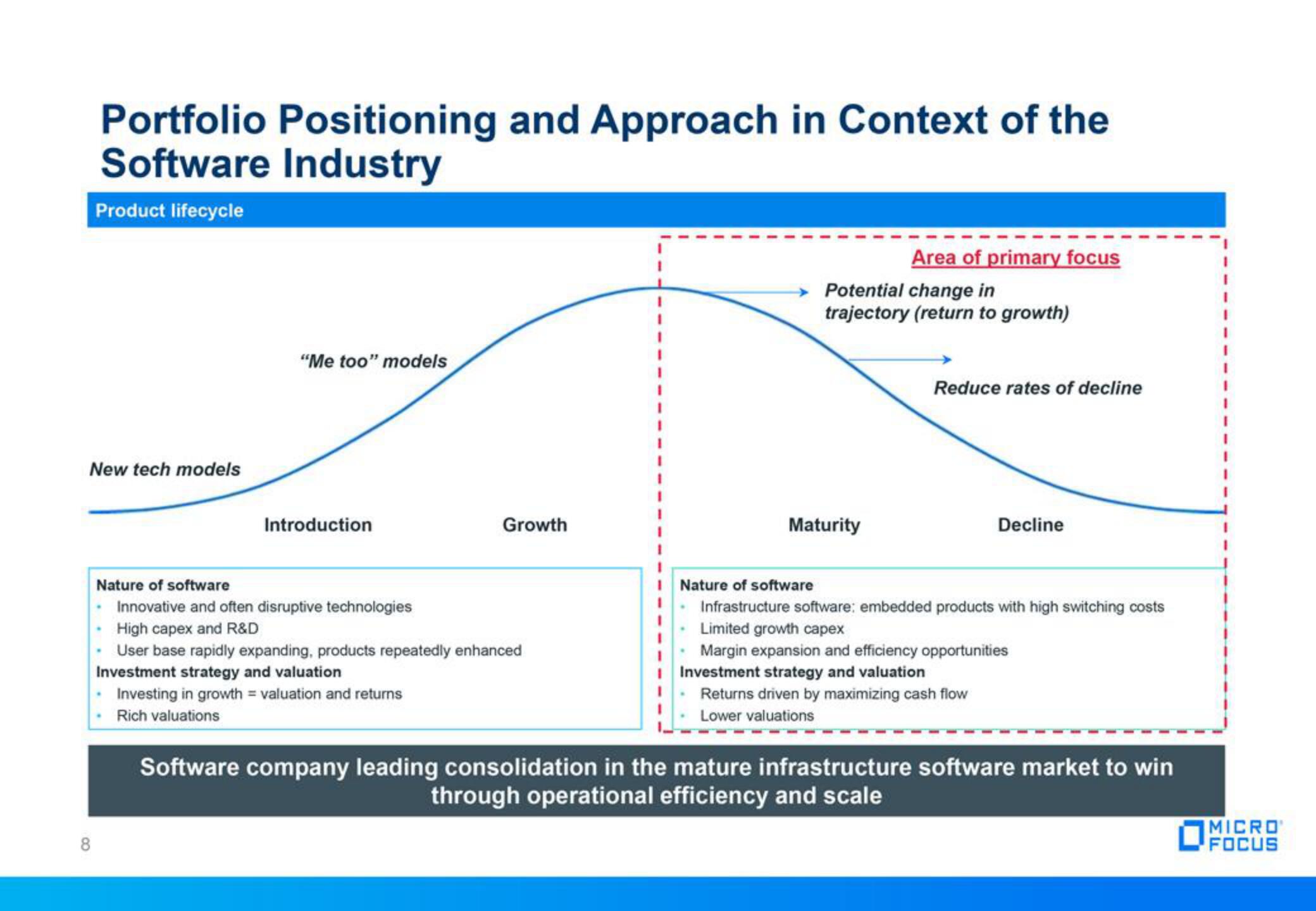

Portfolio Positioning and Approach in Context of the

Software Industry

Product lifecycle

New tech models

8

"Me too" models

Introduction

Growth

Nature of software

• Innovative and often disruptive technologies

High capex and R&D

User base rapidly expanding, products repeatedly enhanced

Investment strategy and valuation

. Investing in growth = valuation and returns

Rich valuations

Area of primary focus

Potential change in

trajectory (return to growth)

Maturity

Reduce rates of decline

Decline

1 Nature of software

Infrastructure software: embedded products with high switching costs

Limited growth capex

Margin expansion and efficiency opportunities

Investment strategy and valuation

Returns driven by maximizing cash flow

Lower valuations

Software company leading consolidation in the mature infrastructure software market to win

through operational efficiency and scale

MICRO

FOCUSView entire presentation