Micro Focus Fixed Income Presentation Deck

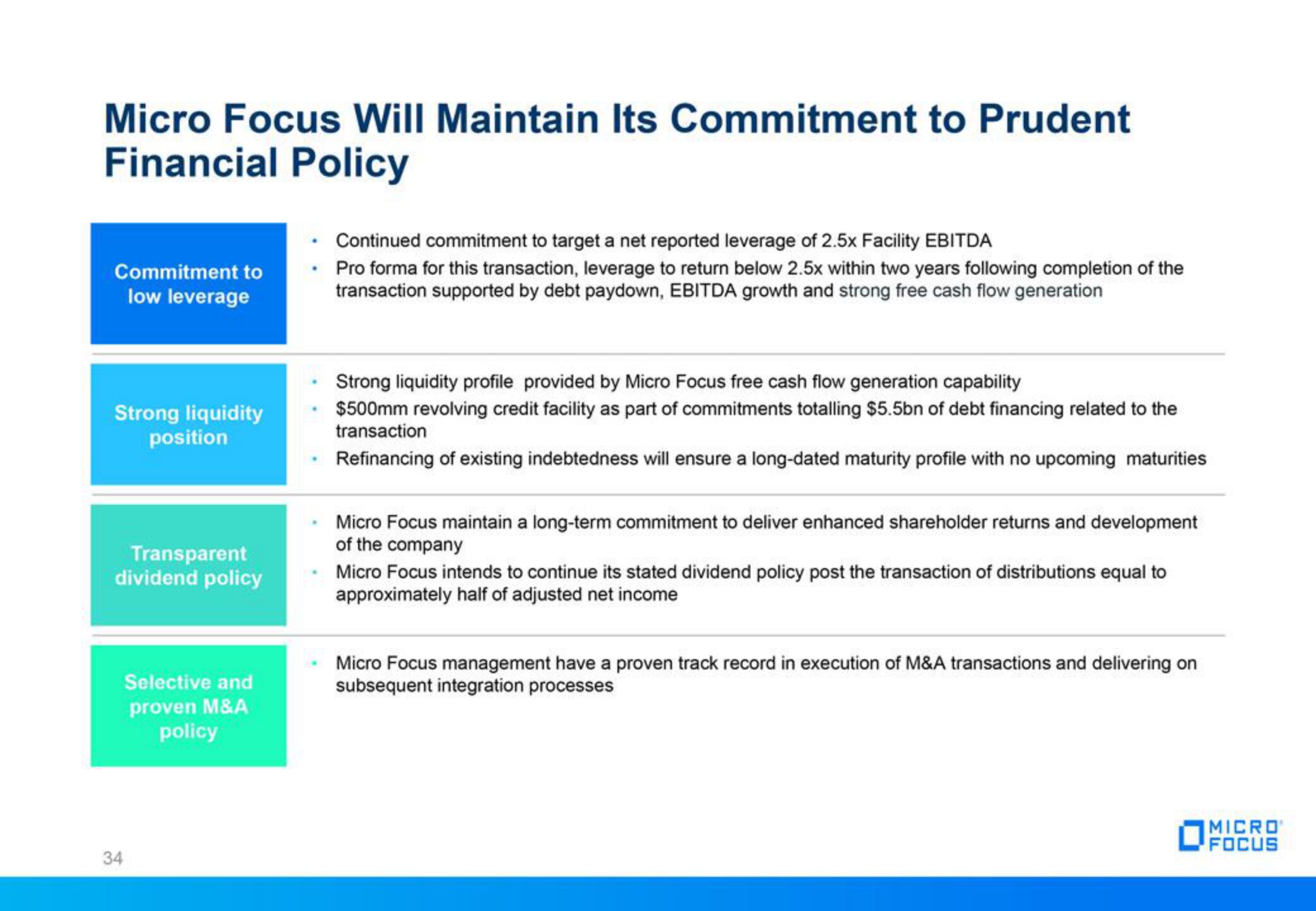

Micro Focus Will Maintain Its Commitment to Prudent

Financial Policy

Commitment to

low leverage

Strong liquidity

position

Transparent

dividend policy

Selective and

proven M&A

policy

34

Continued commitment to target a net reported leverage of 2.5x Facility EBITDA

Pro forma for this transaction, leverage to return below 2.5x within two years following completion of the

transaction supported by debt paydown, EBITDA growth and strong free cash flow generation

Strong liquidity profile provided by Micro Focus free cash flow generation capability

$500mm revolving credit facility as part of commitments totalling $5.5bn of debt financing related to the

transaction

Refinancing of existing indebtedness will ensure a long-dated maturity profile with no upcoming maturities

Micro Focus maintain a long-term commitment to deliver enhanced shareholder returns and development

of the company

Micro Focus intends to continue its stated dividend policy post the transaction of distributions equal to

approximately half of adjusted net income

Micro Focus management have a proven track record in execution of M&A transactions and delivering on

subsequent integration processes

MICRO

FOCUSView entire presentation