KLA Investor Day Presentation Deck

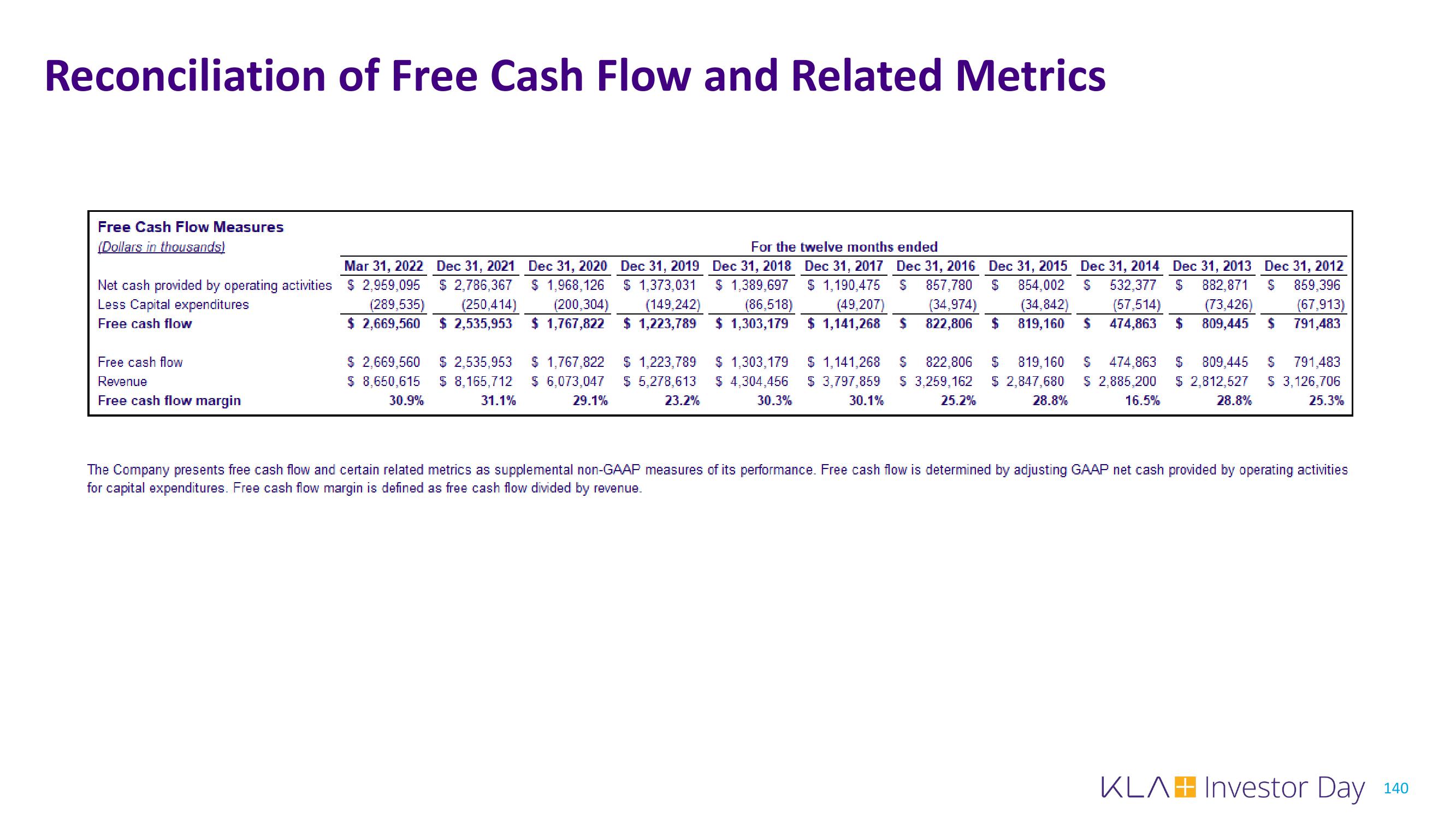

Reconciliation of Free Cash Flow and Related Metrics

Free Cash Flow Measures

(Dollars in thousands)

Net cash provided by operating activities

Less Capital expenditures

Free cash flow

Free cash flow

Revenue

Free cash flow margin

Mar 31, 2022 Dec 31, 2021

$ 2,959,095 $ 2,786,367

(289,535)

(250,414)

$ 2,669,560

$ 2,535,953

$ 2,669,560

$ 8,650,615

30.9%

$ 2,535,953

$ 8,165,712

31.1%

Dec 31, 2020

$ 1,968,126

(200,304)

$ 1,767,822

$ 1,767,822

$ 6,073,047

29.1%

Dec 31, 2019

$ 1,373,031

(149,242)

$ 1,223,789

$ 1,223,789

$ 5,278,613

23.2%

For the twelve months ended

Dec 31, 2018 Dec 31, 2017

$ 1,389,697 $ 1,190,475

(86,518) (49,207)

$ 1,303,179

$ 1,141,268

$ 1,303,179

$ 4,304,456

30.3%

$ 1,141,268

$ 3,797,859

30.1%

Dec 31, 2016 Dec 31, 2015 Dec 31, 2014 Dec 31, 2013 Dec 31, 2012

$ 857,780

854,002 $ 532,377 S 882,871 $

(34,974) (34,842) (57,514) (73,426)

$ 822,806 $ 819,160

474,863

809,445

S 822,806

$ 3,259,162

25.2%

$ 819,160

$ 2,847,680

28.8%

$

$

$

859,396

(67,913)

791,483

S 474,863 S

809,445 S 791,483

$ 2,885,200 $ 2,812,527 $ 3,126,706

16.5%

28.8%

25.3%

The Company presents free cash flow and certain related metrics as supplemental non-GAAP measures of its performance. Free cash flow is determined by adjusting GAAP net cash provided by operating activities

for capital expenditures. Free cash flow margin is defined as free cash flow divided by revenue.

KLA# Investor Day 140View entire presentation