Apollo Global Management Investor Day Presentation Deck

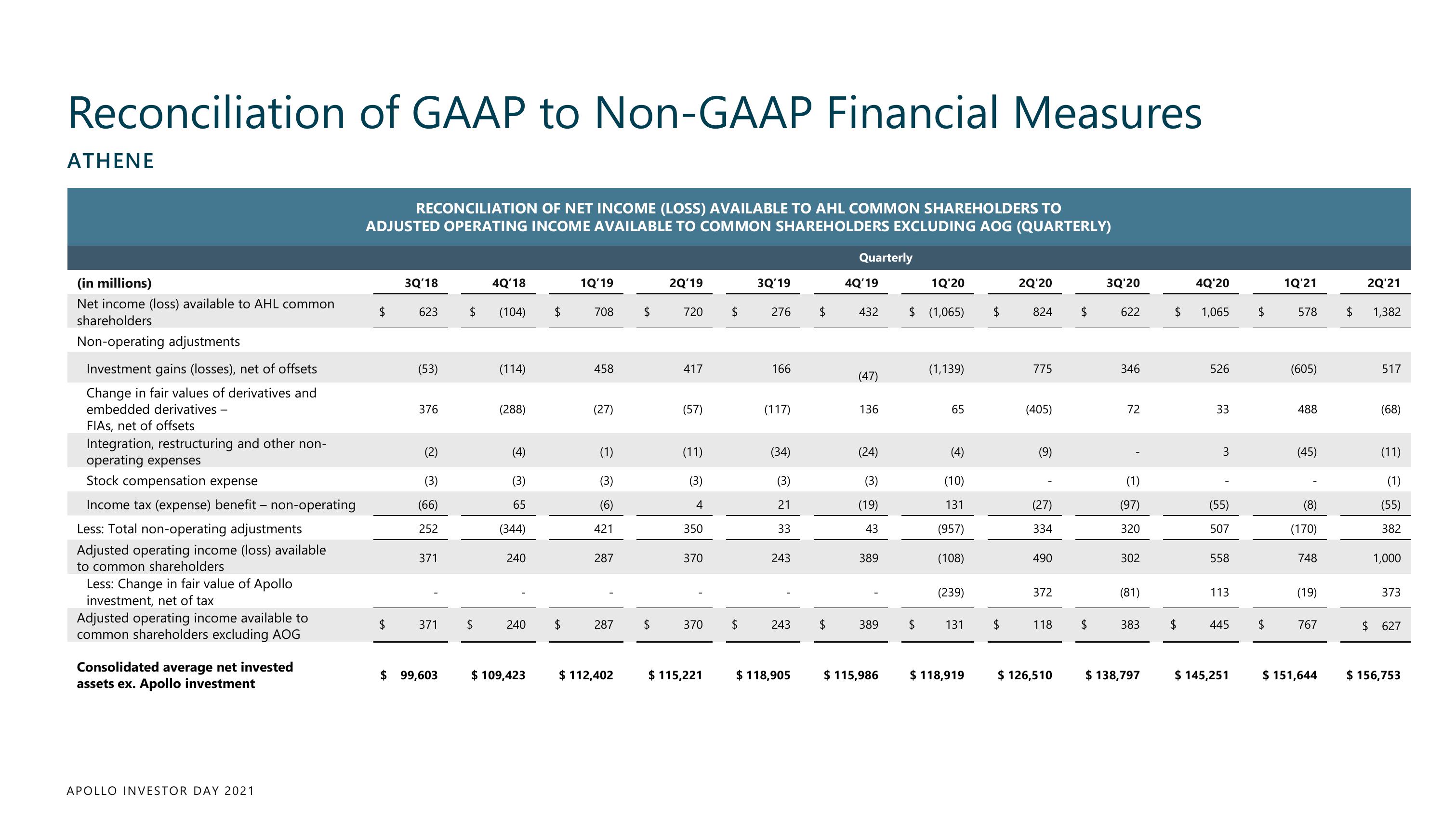

Reconciliation of GAAP to Non-GAAP Financial Measures

ATHENE

(in millions)

Net income (loss) available to AHL common

shareholders

Non-operating adjustments

Investment gains (losses), net of offsets

Change in fair values of derivatives and

embedded derivatives -

FIAS, net of offsets

Integration, restructuring and other non-

operating expenses

Stock compensation expense

Income tax (expense) benefit - non-operating

Less: Total non-operating adjustments

Adjusted operating income (loss) available

to common shareholders

Less: Change in fair value of Apollo

investment, net of tax

Adjusted operating income available to

common shareholders excluding AOG

Consolidated average net invested

assets ex. Apollo investment

APOLLO INVESTOR DAY 2021

RECONCILIATION OF NET INCOME (LOSS) AVAILABLE TO AHL COMMON SHAREHOLDERS TO

ADJUSTED OPERATING INCOME AVAILABLE TO COMMON SHAREHOLDERS EXCLUDING AOG (QUARTERLY)

$

$

3Q'18

623

(53)

376

(2)

(3

(66)

252

371

$

371 $

$ 99,603

4Q'18

(104)

(114)

(288)

(4)

(3)

65

(344)

240

240

$ 109,423

$

$

1Q'19

708

458

(27)

(1)

(3)

(6)

421

287

287

$ 112,402

$

$

2Q'19

720 $

417

(57)

(11)

(3)

4

350

370

370

$ 115,221

$

3Q'19

276

166

(117)

(34)

(3

21

33

243

243

$ 118,905

$

$

Quarterly

4Q'19

432

(47)

136

(24)

(3)

(19)

43

389

389

$ 115,986

1Q'20

$ (1,065)

$

(1,139)

65

(4)

(10)

131

(957)

(108)

(239)

131

$ 118,919

$

$

2Q'20

824 $

775

(405)

(9)

(27)

334

490

372

118

$ 126,510

$

3Q'20

622

346

72

(1)

(97)

320

302

(81)

383

$ 138,797

$

4Q'20

1,065

526

33

3

(55)

507

558

113

445

$ 145,251

$

$

1Q'21

578

(605)

488

(45)

(8)

(170)

748

(19)

767

$ 151,644

2Q'21

$

LA

1,382

517

(68)

(11)

(1)

(55)

382

1,000

373

627

$ 156,753View entire presentation