KLA Investor Day Presentation Deck

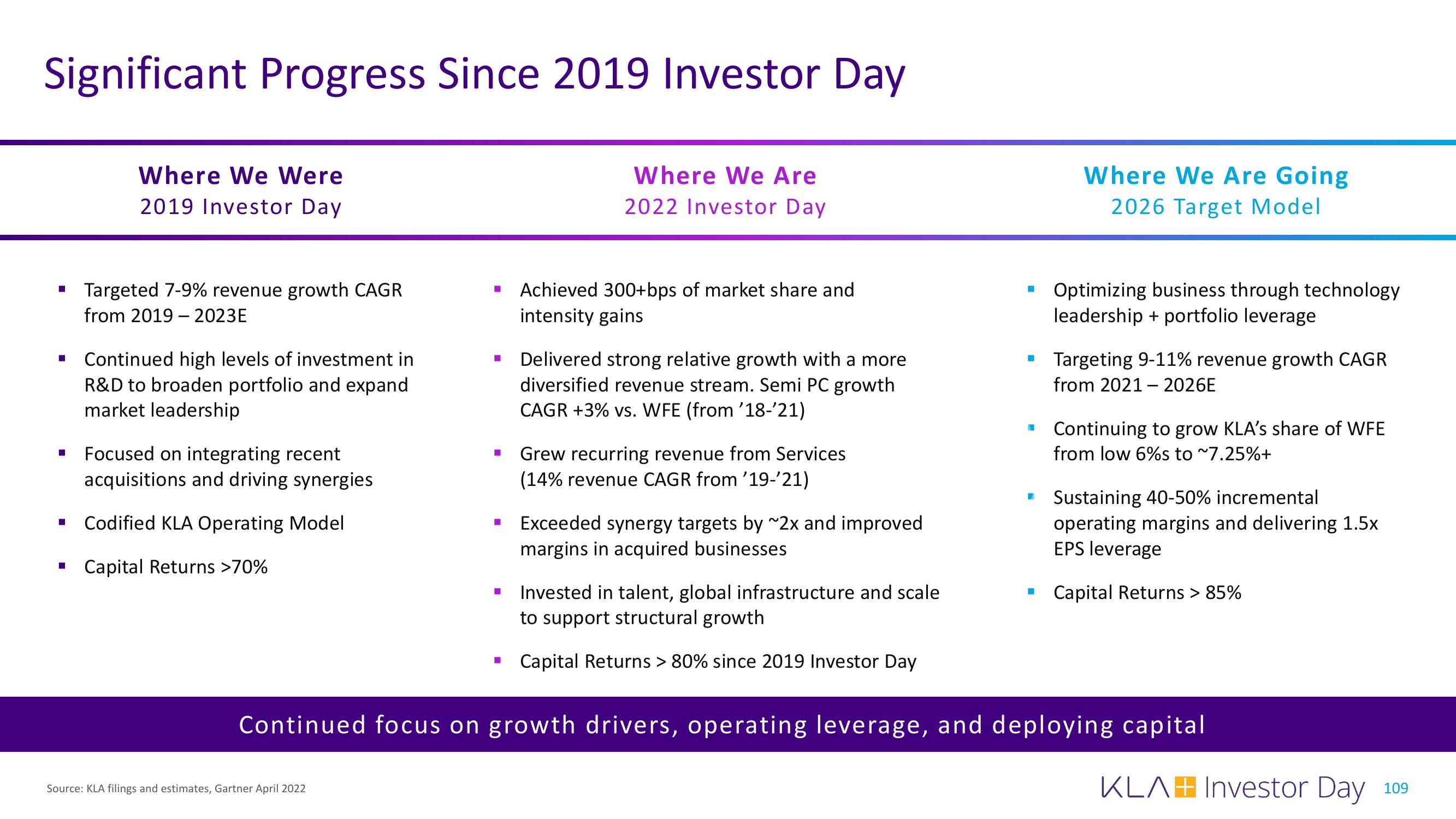

Significant Progress Since 2019 Investor Day

Where We Were

2019 Investor Day

Where We Are

2022 Investor Day

■

■

Targeted 7-9% revenue growth CAGR

from 2019 2023E

Continued high levels of investment in

R&D to broaden portfolio and expand

market leadership

Focused on integrating recent

acquisitions and driving synergies

Codified KLA Operating Model

Capital Returns >70%

■

Source: KLA filings and estimates, Gartner April 2022

■

■

Achieved 300+bps of market share and

intensity gains

Delivered strong relative growth with a more

diversified revenue stream. Semi PC growth

CAGR +3% vs. WFE (from '18-'21)

Grew recurring revenue from Services

(14% revenue CAGR from '19-'21)

Exceeded synergy targets by ~2x and improved

margins in acquired businesses

Invested in talent, global infrastructure and scale

to support structural growth

Capital Returns > 80% since 2019 Investor Day

Where We Are Going

2026 Target Model

Optimizing business through technology

leadership + portfolio leverage

Targeting 9-11% revenue growth CAGR

from 2021 2026E

Continuing to grow KLA's share of WFE

from low 6%s to ~7.25%+

Sustaining 40-50% incremental

operating margins and delivering 1.5x

EPS leverage

Capital Returns > 85%

Continued focus on growth drivers, operating leverage, and deploying capital

KLAH Investor Day

109View entire presentation