SuperGroup Investor Day Presentation Deck

Proposed Transaction Summary

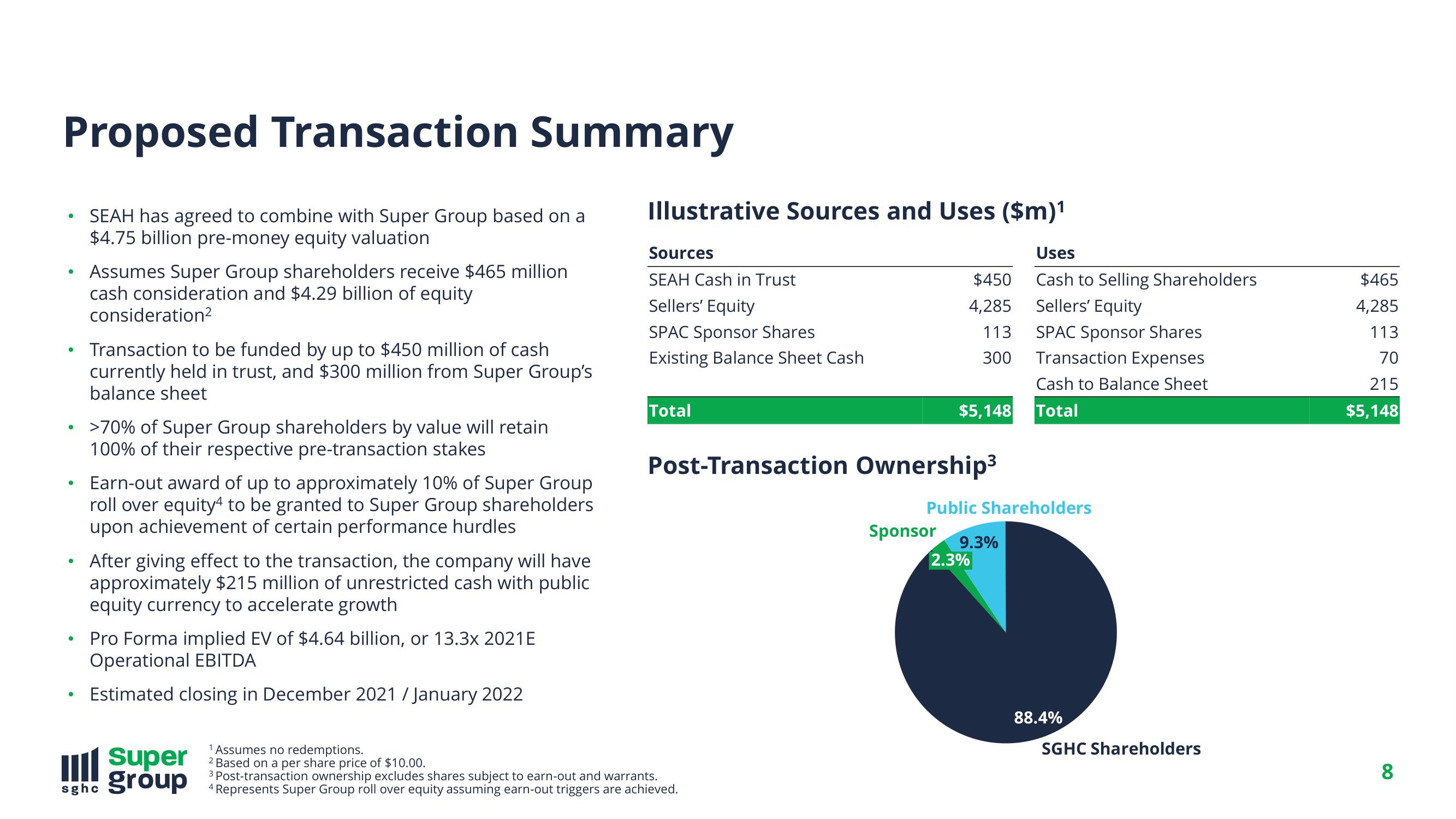

SEAH has agreed to combine with Super Group based on a

$4.75 billion pre-money equity valuation

Assumes Super Group shareholders receive $465 million

cash consideration and $4.29 billion of equity

consideration²

●

●

●

●

Transaction to be funded by up to $450 million of cash

currently held in trust, and $300 million from Super Group's

balance sheet

>70% of Super Group shareholders by value will retain

100% of their respective pre-transaction stakes

Earn-out award of up to approximately 10% of Super Group

roll over equity4 to be granted to Super Group shareholders

upon achievement of certain performance hurdles

After giving effect to the transaction, the company will have

approximately $215 million of unrestricted cash with public

equity currency to accelerate growth

Pro Forma implied EV of $4.64 billion, or 13.3x 2021E

Operational EBITDA

Estimated closing in December 2021 January 2022

Super

sghe group

Illustrative Sources and Uses ($m)¹

Sources

SEAH Cash in Trust

Sellers' Equity

SPAC Sponsor Shares

Existing Balance Sheet Cash

Total

1 Assumes no redemptions.

2 Based on a per share price of $10.00.

3 Post-transaction ownership excludes shares subject to earn-out and warrants.

4 Represents Super Group roll over equity assuming earn-out triggers are achieved.

Post-Transaction Ownership³

$450

4,285

113

300

$5,148

Sponsor

Public Shareholders

9.3%

2.3%

Uses

Cash to Selling Shareholders

Sellers' Equity

SPAC Sponsor Shares

Transaction Expenses

Cash to Balance Sheet

Total

88.4%

SGHC Shareholders

$465

4,285

113

70

215

$5,148

8View entire presentation