Broadridge Financial Solutions Results Presentation Deck

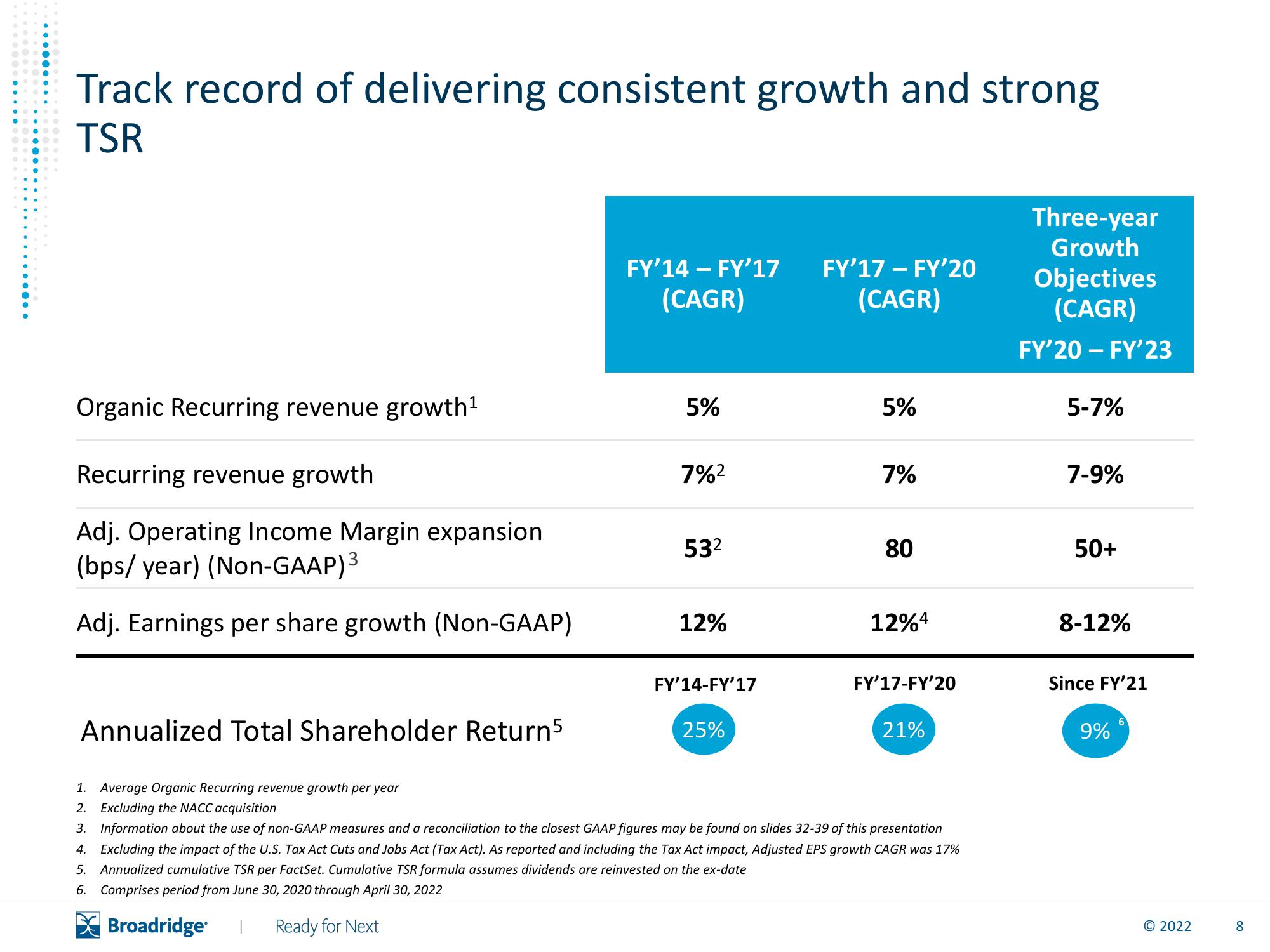

Track record of delivering consistent growth and strong

TSR

Organic Recurring revenue growth¹

Recurring revenue growth

Adj. Operating Income Margin expansion

(bps/year) (Non-GAAP) ³

Adj. Earnings per share growth (Non-GAAP)

Annualized Total Shareholder Return5

FY'14 - FY'17 FY'17- FY'20

(CAGR)

(CAGR)

5%

7%²

53²

12%

FY'14-FY'17

25%

5%

7%

80

12%4

FY'17-FY'20

21%

1. Average Organic Recurring revenue growth per year

2. Excluding the NACC acquisition

3. Information about the use of non-GAAP measures and a reconciliation to the closest GAAP figures may be found on slides 32-39 of this presentation

4. Excluding the impact of the U.S. Tax Act Cuts and Jobs Act (Tax Act). As reported and including the Tax Act impact, Adjusted EPS growth CAGR was 17%

5. Annualized cumulative TSR per FactSet. Cumulative TSR formula assumes dividends are reinvested on the ex-date

6. Comprises period from June 30, 2020 through April 30, 2022

Broadridge I Ready for Next

Three-year

Growth

Objectives

(CAGR)

FY'20 - FY'23

5-7%

7-9%

50+

8-12%

Since FY'21

9%

© 2022

8View entire presentation