Apollo Global Management Investor Day Presentation Deck

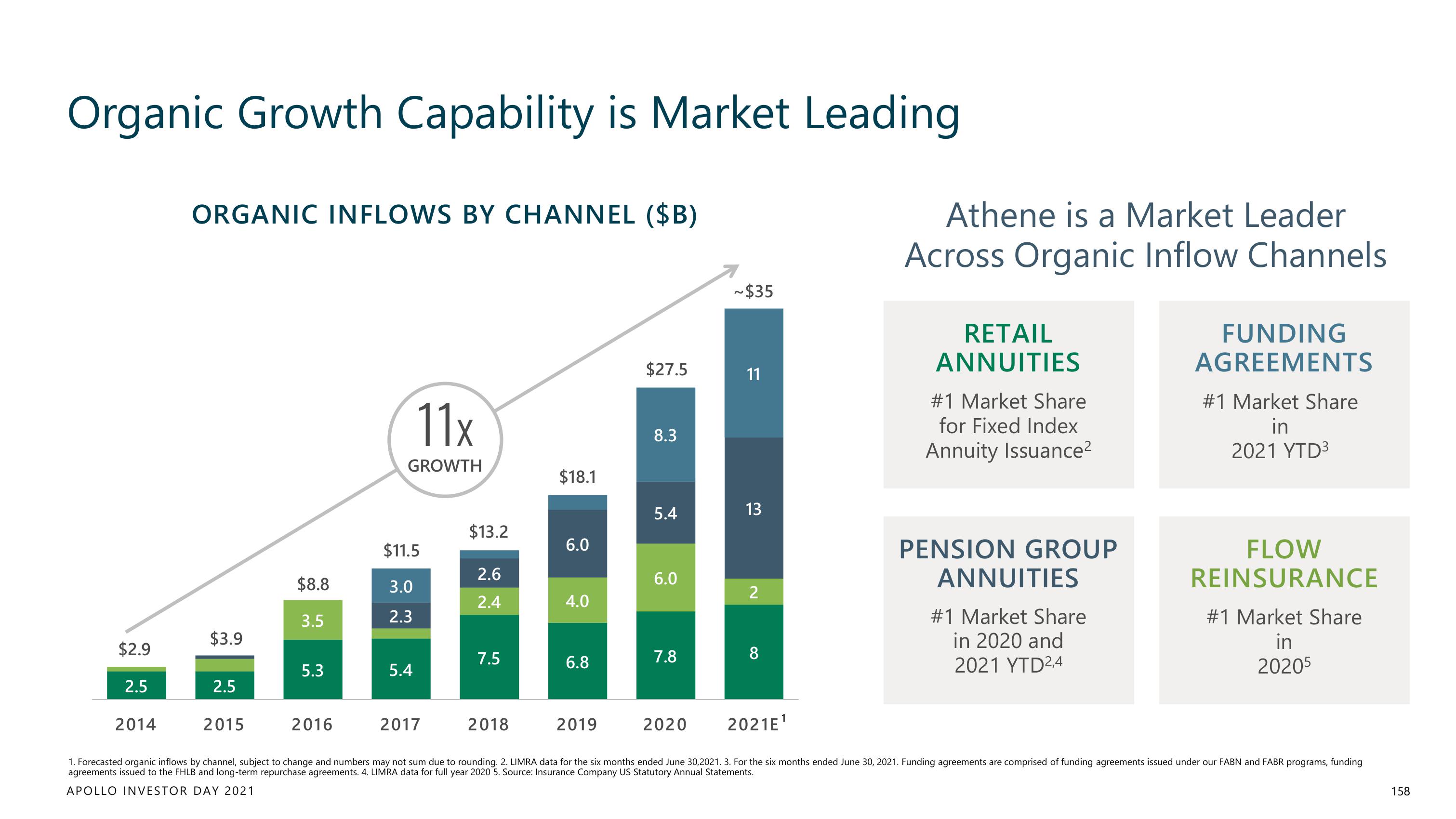

Organic Growth Capability is Market Leading

$2.9

2.5

2014

ORGANIC INFLOWS BY CHANNEL ($B)

$3.9

2.5

2015

$8.8

3.5

5.3

2016

11x

GROWTH

$11.5

3.0

2.3

5.4

2017

$13.2

2.6

2.4

7.5

2018

$18.1

6.0

4.0

6.8

2019

$27.5

8.3

5.4

6.0

7.8

2020

~$35

11

13

2

8

Athene is a Market Leader

Across Organic Inflow Channels

RETAIL

ANNUITIES

#1 Market Share

for Fixed Index

Annuity Issuance²

PENSION GROUP

ANNUITIES

#1 Market Share

in 2020 and

2021 YTD2,4

FUNDING

AGREEMENTS

#1 Market Share

in

2021 YTD³

FLOW

REINSURANCE

#1 Market Share

in

20205

2021E¹

1. Forecasted organic inflows by channel, subject to change and numbers may not sum due to rounding. 2. LIMRA data for the six months ended June 30,2021. 3. For the six months ended June 30, 2021. Funding agreements are comprised of funding agreements issued under our FABN and FABR programs, funding

agreements issued to the FHLB and long-term repurchase agreements. 4. LIMRA data for full year 2020 5. Source: Insurance Company US Statutory Annual Statements.

APOLLO INVESTOR DAY 2021

158View entire presentation