KLA Investor Day Presentation Deck

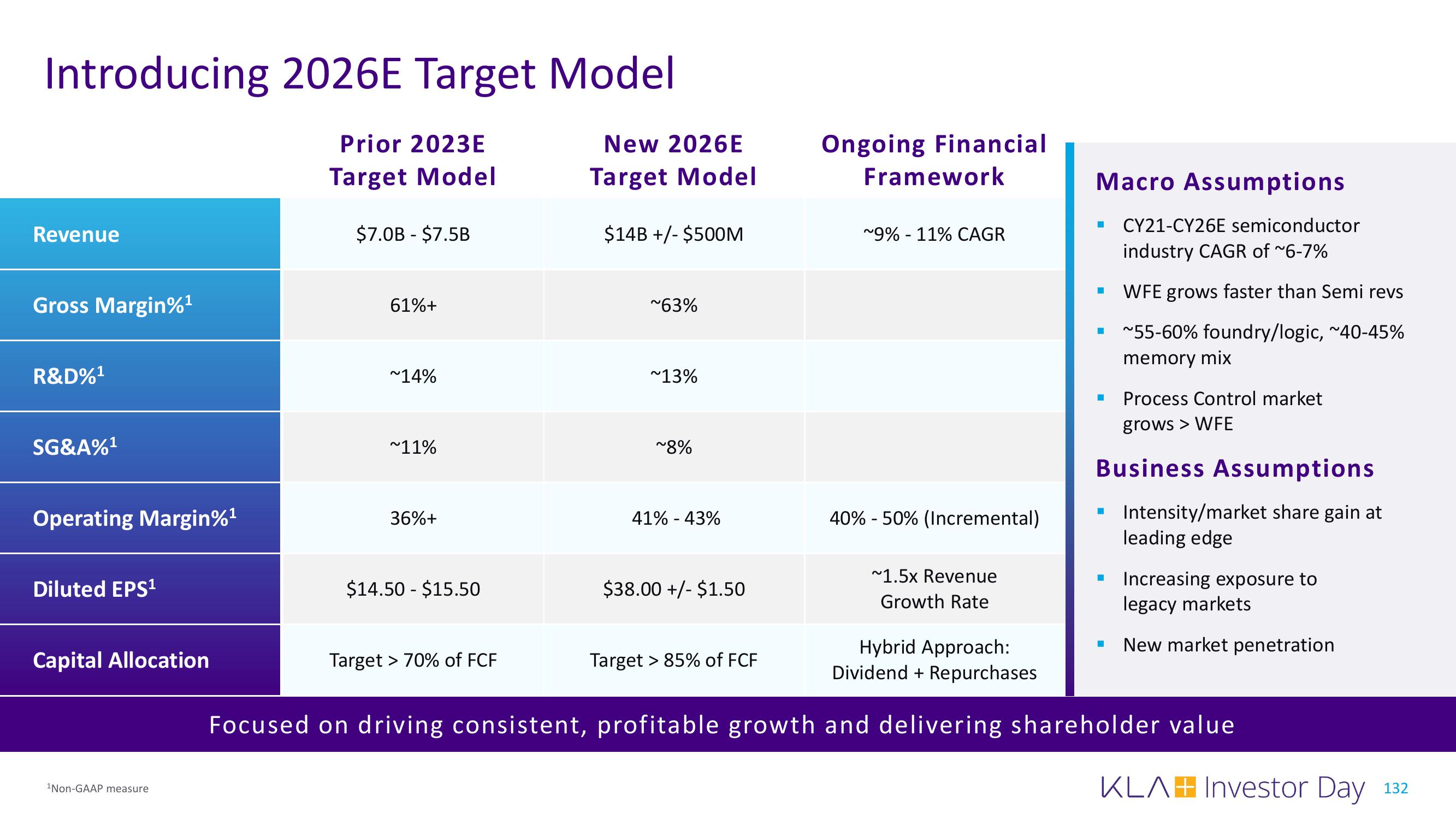

Introducing 2026E Target Model

Prior 2023E

Target Model

Revenue

Gross Margin%¹

R&D%¹

SG&A%¹

Operating Margin%¹

Diluted EPS¹

Capital Allocation

¹Non-GAAP measure

$7.0B - $7.5B

61%+

~14%

~11%

36%+

$14.50 - $15.50

New 2026E

Target Model

$14B +/- $500M

Target > 70% of FCF

~63%

~13%

~8%

41% - 43%

$38.00 +/- $1.50

Ongoing Financial

Target >85% of FCF

Framework

~9% -11% CAGR

40% -50% (Incremental)

~1.5x Revenue

Growth Rate

Macro Assumptions

■ CY21-CY26E semiconductor

industry CAGR of ~6-7%

WFE grows faster than Semi revs

■

■

■

Process Control market

grows > WFE

Business Assumptions

Intensity/market share gain at

leading edge

■

■

~55-60% foundry/logic, ~40-45%

memory mix

Hybrid Approach:

Dividend + Repurchases

Focused on driving consistent, profitable growth and delivering shareholder value

■

Increasing exposure to

legacy markets

New market penetration

KLAH Investor Day 132View entire presentation