KLA Investor Day Presentation Deck

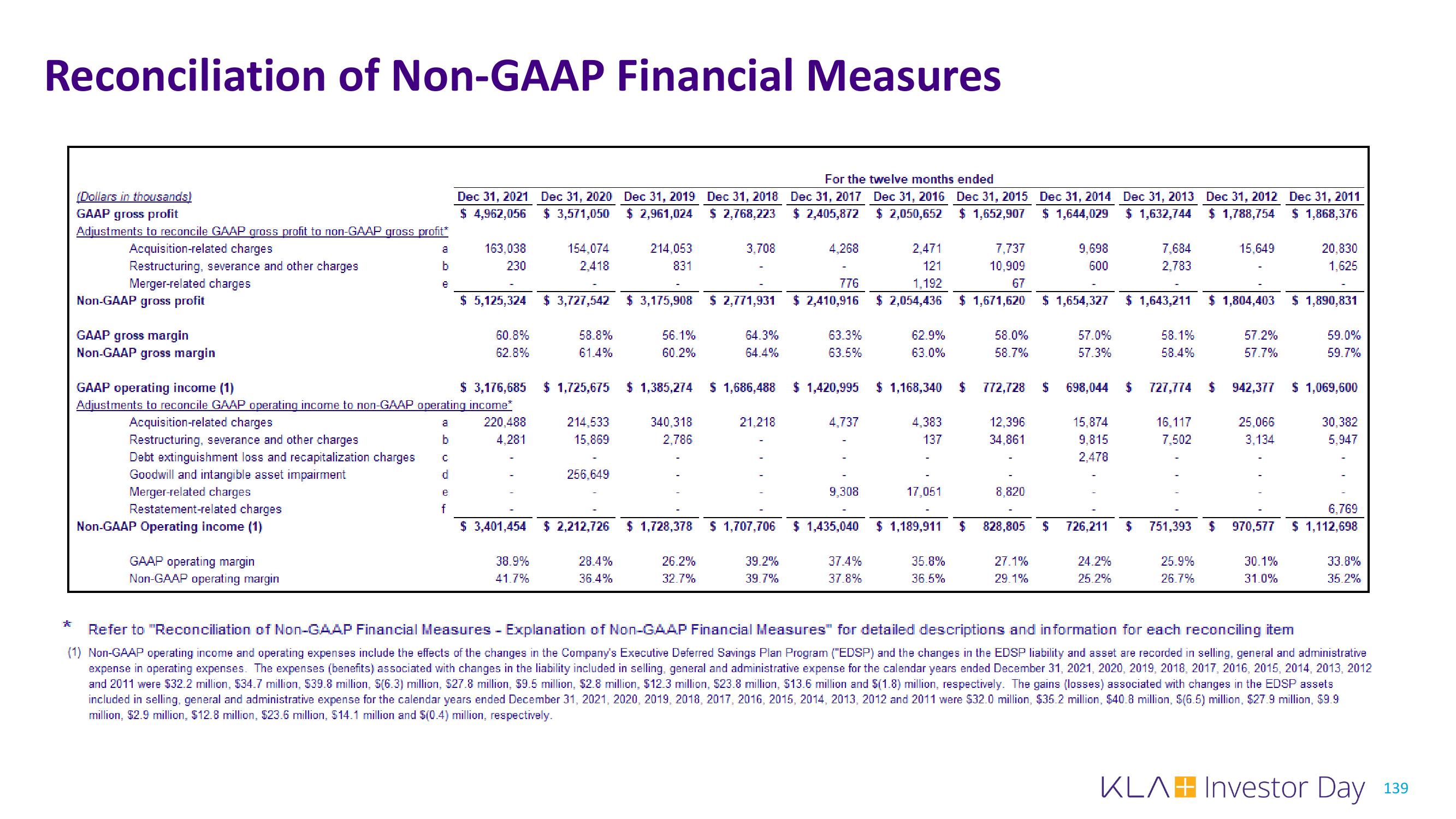

Reconciliation of Non-GAAP Financial Measures

*

(Dollars in thousands)

GAAP gross profit

Adjustments to reconcile GAAP gross profit to non-GAAP gross profit*

Acquisition-related charges

Restructuring, severance and other charges

Merger-related charges

Non-GAAP gross profit

GAAP gross margin

Non-GAAP gross margin

Restructuring, severance and other charges

Debt extinguishment loss and recapitalization charges

Goodwill and intangible asset impairment

Merger-related charges

Restatement-related charges

Non-GAAP Operating income (1)

b

GAAP operating margin

Non-GAAP operating margin

e

GAAP operating income (1)

Adjustments to reconcile GAAP operating income to non-GAAP operating income*

Acquisition-related charges

a

b

C

d

e

Dec 31, 2021 Dec 31, 2020

$ 4,962,056 $ 3,571,050

f

163,038

230

$ 5,125,324

60.8%

62.8%

220,488

4,281

154,074

2,418

$ 3,176,685 $ 1,725,675

38.9%

41.7%

58.8%

61.4%

$3,727,542 $ 3,175,908

214,533

15,869

256,649

$ 3,401,454 $ 2,212,726

Dec 31, 2019 Dec 31, 2018

$ 2,961,024 $ 2,768,223

28.4%

36.4%

214,053

831

56.1%

60.2%

340,318

2,786

3,708

$ 2,771,931

$ 1,385,274 $ 1,686,488

26.2%

32.7%

64.3%

64.4%

21,218

For the twelve months ended

Dec 31, 2016

$ 2,050,652

39.2%

39.7%

Dec 31, 2017

$ 2,405,872

2,471

121

1,192

776

$ 2,410,916 $ 2,054,436

4,268

63.3%

63.5%

$ 1,420,995

4,737

$ 1,728,378 $ 1,707,706 $ 1,435,040

9,308

37.4%

37.8%

62.9%

63.0%

$ 1,168,340

4,383

137

17,051

Dec 31, 2015

$ 1,652,907

35.8%

36.5%

7,737

10,909

67

$ 1,671,620

$

58.0%

58.7%

772,728

12,396

34,861

8,820

$ 1,189,911 $ 828,805

27.1%

29.1%

Dec 31, 2014

$ 1,644,029

$

9,698

600

$

57.0%

57.3%

698,044

15,874

9,815

2,478

$ 1,654,327 $ 1,643,211 $ 1,804,403 $ 1,890,831

726,211

Dec 31, 2013

$ 1,632,744

24.2%

25.2%

7,684

2,783

$

58.1%

58.4%

16,117

7,502

Dec 31, 2012

$ 1,788,754

$ 751,393

727,774 $ 942,377

25.9%

26.7%

15,649

$

57.2%

57.7%

25,066

3,134

Dec 31, 2011

$ 1,868,376

20,830

1,625

30.1%

31.0%

59.0%

59.7%

$ 1,069,600

30,382

5,947

6,769

970,577 $ 1,112,698

33.8%

35.2%

Refer to "Reconciliation of Non-GAAP Financial Measures - Explanation of Non-GAAP Financial Measures" for detailed descriptions and information for each reconciling item

(1) Non-GAAP operating income and operating expenses include the effects of the changes in the Company's Executive Deferred Savings Plan Program ("EDSP) and the changes in the EDSP liability and asset are recorded in selling, general and administrative

expense in operating expenses. The expenses (benefits) associated with changes in the liability included in selling, general and administrative expense for the calendar years ended December 31, 2021, 2020, 2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012

and 2011 were $32.2 million, $34.7 million, $39.8 million, $(6.3) million, $27.8 million, $9.5 million, $2.8 million, $12.3 million, $23.8 million, $13.6 million and $(1.8) million, respectively. The gains (losses) associated with changes in the EDSP assets

included in selling, general and administrative expense for the calendar years ended December 31, 2021, 2020, 2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012 and 2011 were $32.0 million, $35.2 million, $40.8 million, $(6.5) million, $27.9 million, $9.9

million, $2.9 million, $12.8 million, $23.6 million, $14.1 million and $(0.4) million, respectively.

KLAH Investor Day 139View entire presentation