Apollo Global Management Investor Day Presentation Deck

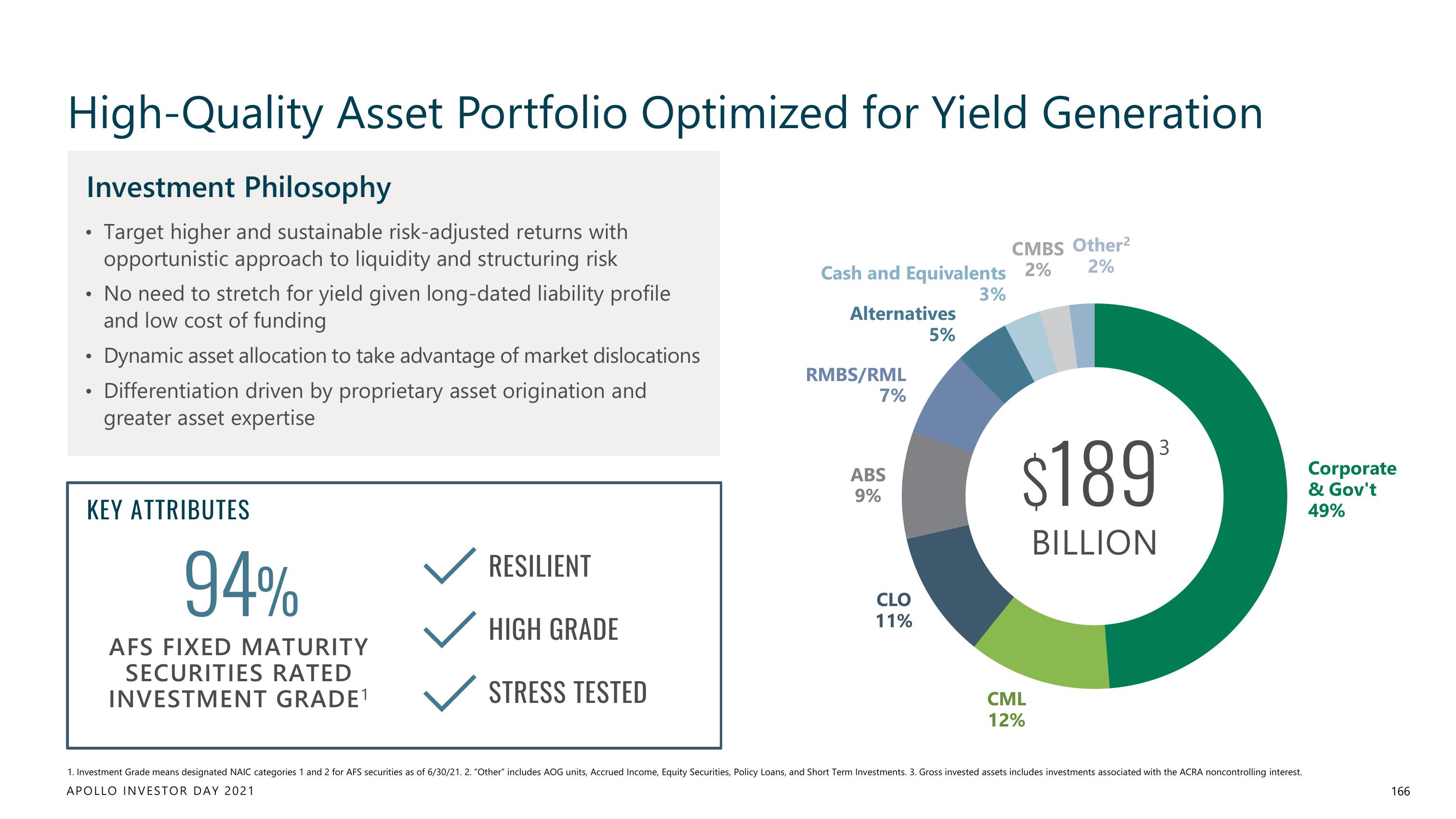

High-Quality Asset Portfolio Optimized for Yield Generation

Investment Philosophy

Target higher and sustainable risk-adjusted returns with

opportunistic approach to liquidity and structuring risk

●

No need to stretch for yield given long-dated liability profile

and low cost of funding

Dynamic asset allocation to take advantage of market dislocations

Differentiation driven by proprietary asset origination and

greater asset expertise

KEY ATTRIBUTES

94%

AFS FIXED MATURITY

SECURITIES RATED

INVESTMENT GRADE¹

RESILIENT

HIGH GRADE

STRESS TESTED

Cash and Equivalents 2%

Alternatives

RMBS/RML

7%

ABS

9%

CLO

11%

5%

CMBS Other²

2%

3%

3

$189

BILLION

CML

12%

1. Investment Grade means designated NAIC categories 1 and 2 for AFS securities as of 6/30/21. 2. "Other" includes AOG units, Accrued Income, Equity Securities, Policy Loans, and Short Term Investments. 3. Gross invested assets includes investments associated with the ACRA noncontrolling interest.

APOLLO INVESTOR DAY 2021

Corporate

& Gov't

49%

166View entire presentation