KLA Investor Day Presentation Deck

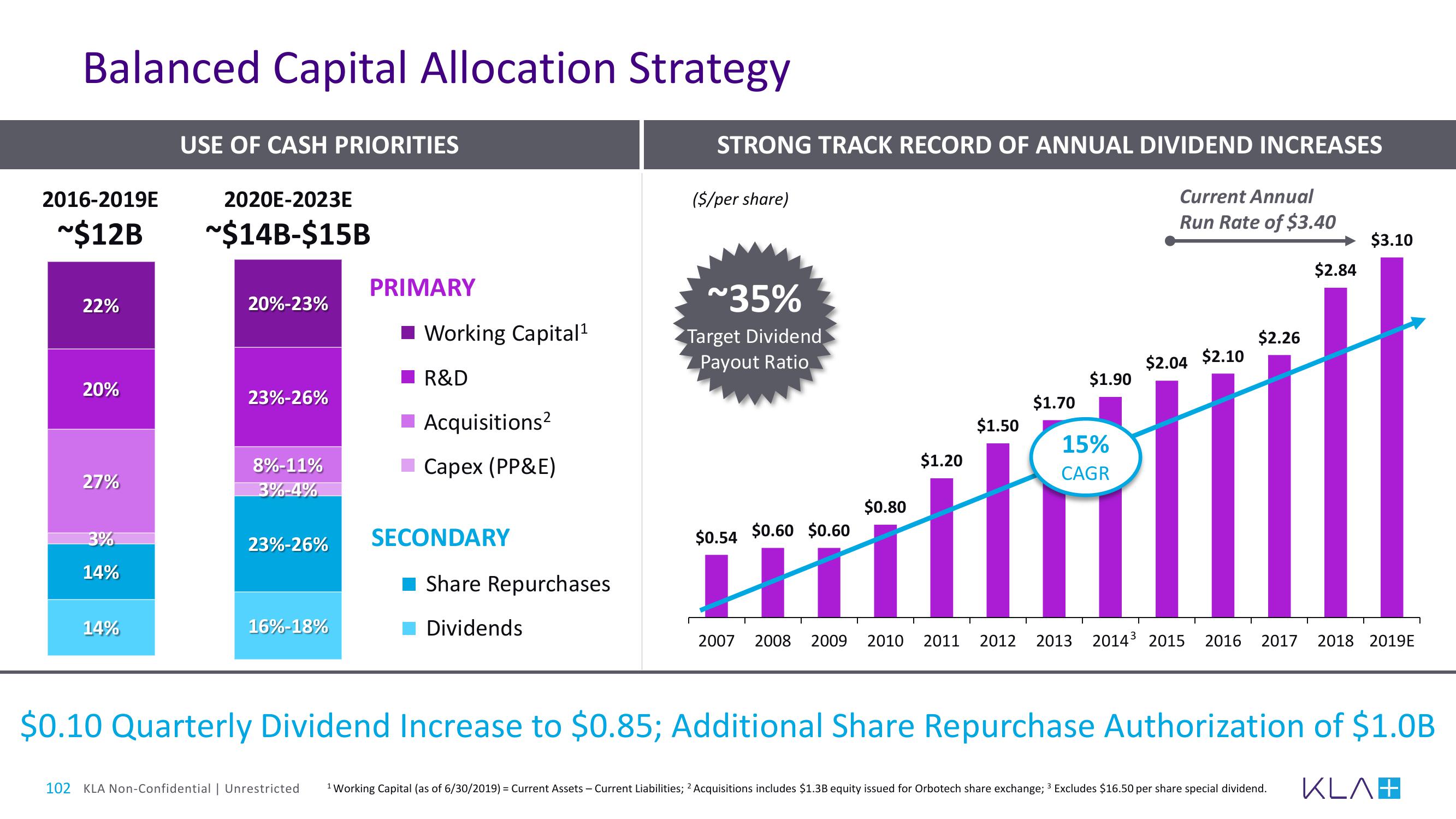

Balanced Capital Allocation Strategy

2016-2019E

2020E-2023E

~$12B ~$14B-$15B

22%

20%

27%

3%

14%

USE OF CASH PRIORITIES

14%

20%-23%

23%-26%

8%-11%

3%-4%

23%-26%

16%-18%

PRIMARY

Working Capital ¹

R&D

■ Acquisitions²

■Capex (PP&E)

SECONDARY

■Share Repurchases

Dividends

STRONG TRACK RECORD OF ANNUAL DIVIDEND INCREASES

($/per share)

~35%

Target Dividend

Payout Ratio

$0.80

$1.70

$1.50

H

$1.20

$1.90

15%

CAGR

Current Annual

Run Rate of $3.40

$2.04 $2.10

$2.26

$0.54 $0.60 $0.60

H

2007 2008 2009 2010 2011 2012 2013 2014³ 2015 2016 2017

$2.84

102 KLA Non-Confidential | Unrestricted ¹ Working Capital (as of 6/30/2019) = Current Assets - Current Liabilities; 2 Acquisitions includes $1.3B equity issued for Orbotech share exchange; ³ Excludes $16.50 per share special dividend.

3

$3.10

2018 2019E

$0.10 Quarterly Dividend Increase to $0.85; Additional Share Repurchase Authorization of $1.0B

KLA+View entire presentation