KLA Investor Day Presentation Deck

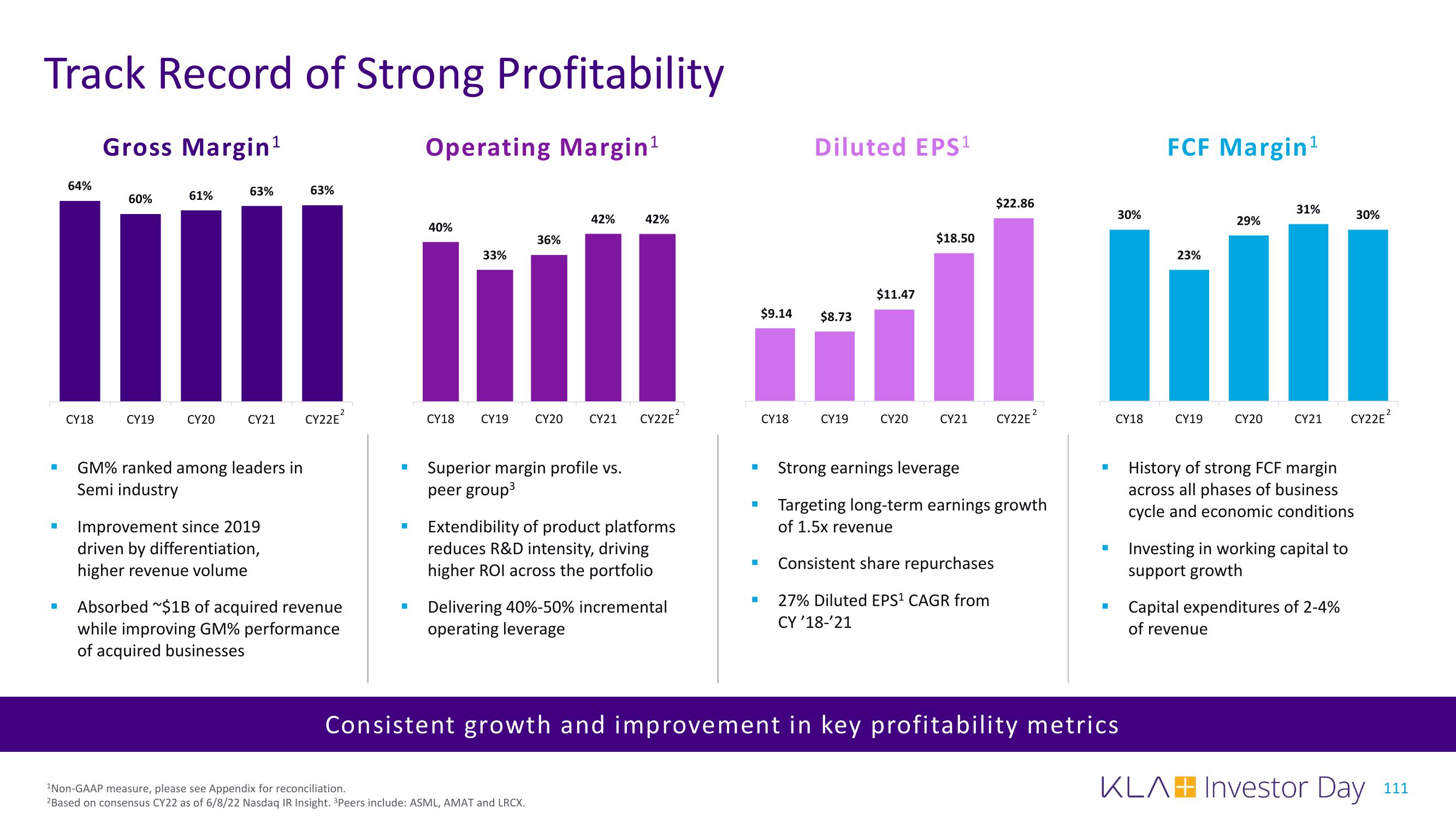

Track Record of Strong Profitability

Gross Margin¹

Operating Margin¹

64%

60%

m

■

■

■

CY18

CY19

61%

CY20

63%

CY21

GM% ranked among leaders in

Semi industry

Improvement since 2019

driven by differentiation,

higher revenue volume

63%

CY22E²

Absorbed ~$1B of acquired revenue

while improving GM% performance

of acquired businesses

I

40%

33%

36%

42%

CY18 CY19 CY20 CY21

Superior margin profile vs.

peer group³

42%

¹Non-GAAP measure, please see Appendix for reconciliation.

2Based on consensus CY22 as of 6/8/22 Nasdaq IR Insight. ³Peers include: ASML, AMAT and LRCX.

CY22E²

Extendibility of product platforms

reduces R&D intensity, driving

higher ROI across the portfolio

Delivering 40%-50% incremental

operating leverage

H

■

M

$9.14

CY18

Diluted EPS¹

$8.73

CY19

$11.47

CY20

$18.50

$22.86

CY21 CY22E²

Strong earnings leverage

Targeting long-term earnings growth

of 1.5x revenue

Consistent share repurchases

■ 27% Diluted EPS¹ CAGR from

CY '18-'21

■

I

30%

CY18

Consistent growth and improvement in key profitability metrics

FCF Margin¹

23%

CY19

29%

CY20

31%

CY21 CY22E²

History of strong FCF margin

across all phases of business

cycle and economic conditions

Investing in working capital to

support growth

30%

Capital expenditures of 2-4%

of revenue

KLAH Investor Day

111View entire presentation