Apollo Global Management Investor Day Presentation Deck

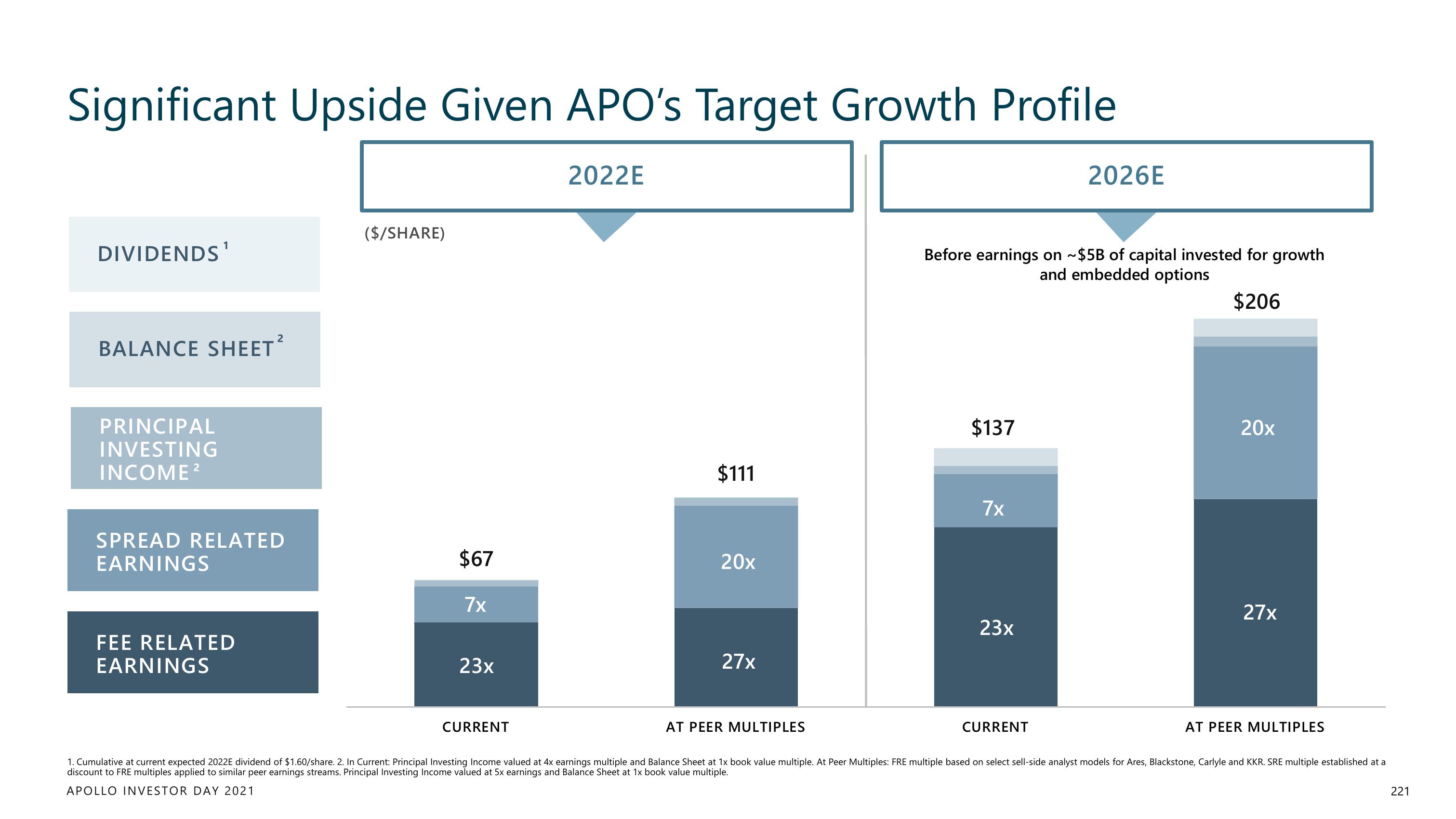

Significant Upside Given APO's Target Growth Profile

DIVIDENDS'

BALANCE SHEET²

PRINCIPAL

INVESTING

INCOME ²

SPREAD RELATED

EARNINGS

FEE RELATED

EARNINGS

($/SHARE)

$67

7x

23x

CURRENT

2022E

$111

20x

27x

AT PEER MULTIPLES

Before earnings on ~$5B of capital invested for growth

and embedded options

$206

$137

7x

23x

2026E

CURRENT

20x

27x

AT PEER MULTIPLES

1. Cumulative at current expected 2022E dividend of $1.60/share. 2. In Current: Principal Investing Income valued at 4x earnings multiple and Balance Sheet at 1x book value multiple. At Peer Multiples: FRE multiple based on select sell-side analyst models for Ares, Blackstone, Carlyle and KKR. SRE multiple established at a

discount to FRE multiples applied to similar peer earnings streams. Principal Investing Income valued at 5x earnings and Balance Sheet at 1x book value multiple.

APOLLO INVESTOR DAY 2021

221View entire presentation