Apollo Global Management Investor Day Presentation Deck

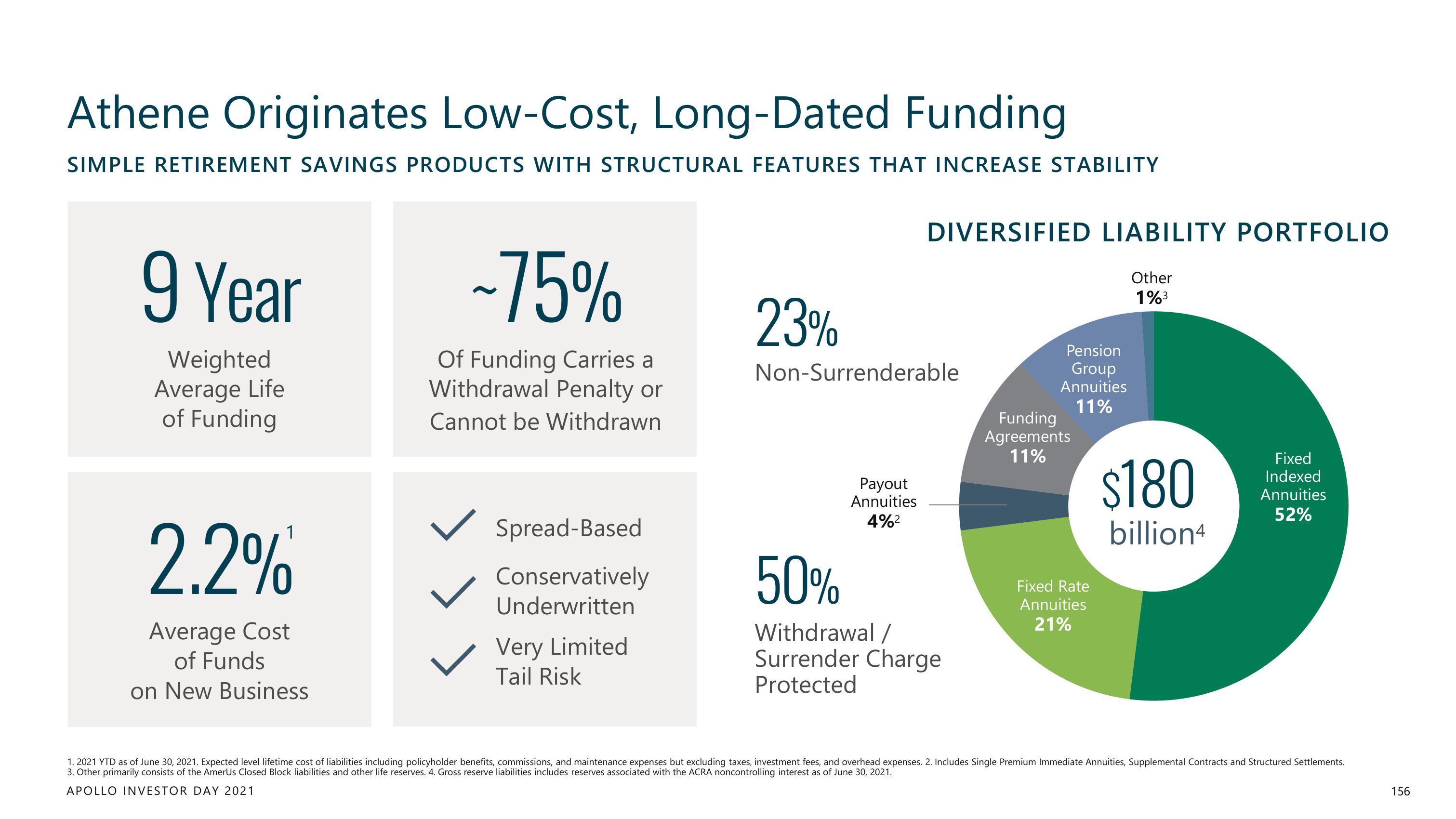

Athene Originates Low-Cost, Long-Dated Funding

SIMPLE RETIREMENT SAVINGS PRODUCTS WITH STRUCTURAL FEATURES THAT INCREASE STABILITY

9 Year

Weighted

Average Life

of Funding

2.2%

Average Cost

of Funds

on New Business

-75%

Of Funding Carries a

Withdrawal Penalty or

Cannot be Withdrawn

Spread-Based

Conservatively

Underwritten

Very Limited

Tail Risk

23%

DIVERSIFIED LIABILITY PORTFOLIO

Other

1%³

Non-Surrenderable

Payout

Annuities

4%²

50%

Withdrawal /

Surrender Charge

Protected

Pension

Group

Annuities

11%

Funding

Agreements

11%

Fixed Rate

Annuities

21%

$180

billion4

Fixed

Indexed

Annuities

52%

1.2021 YTD as of June 30, 2021. Expected level lifetime cost of liabilities including policyholder benefits, commissions, and maintenance expenses but excluding taxes, investment fees, and overhead expenses. 2. Includes Single Premium Immediate Annuities, Supplemental Contracts and Structured Settlements.

3. Other primarily consists of the AmerUs Closed Block liabilities and other life reserves. 4. Gross reserve liabilities includes reserves associated with the ACRA noncontrolling interest as of June 30, 2021.

APOLLO INVESTOR DAY 2021

156View entire presentation