Apollo Global Management Investor Day Presentation Deck

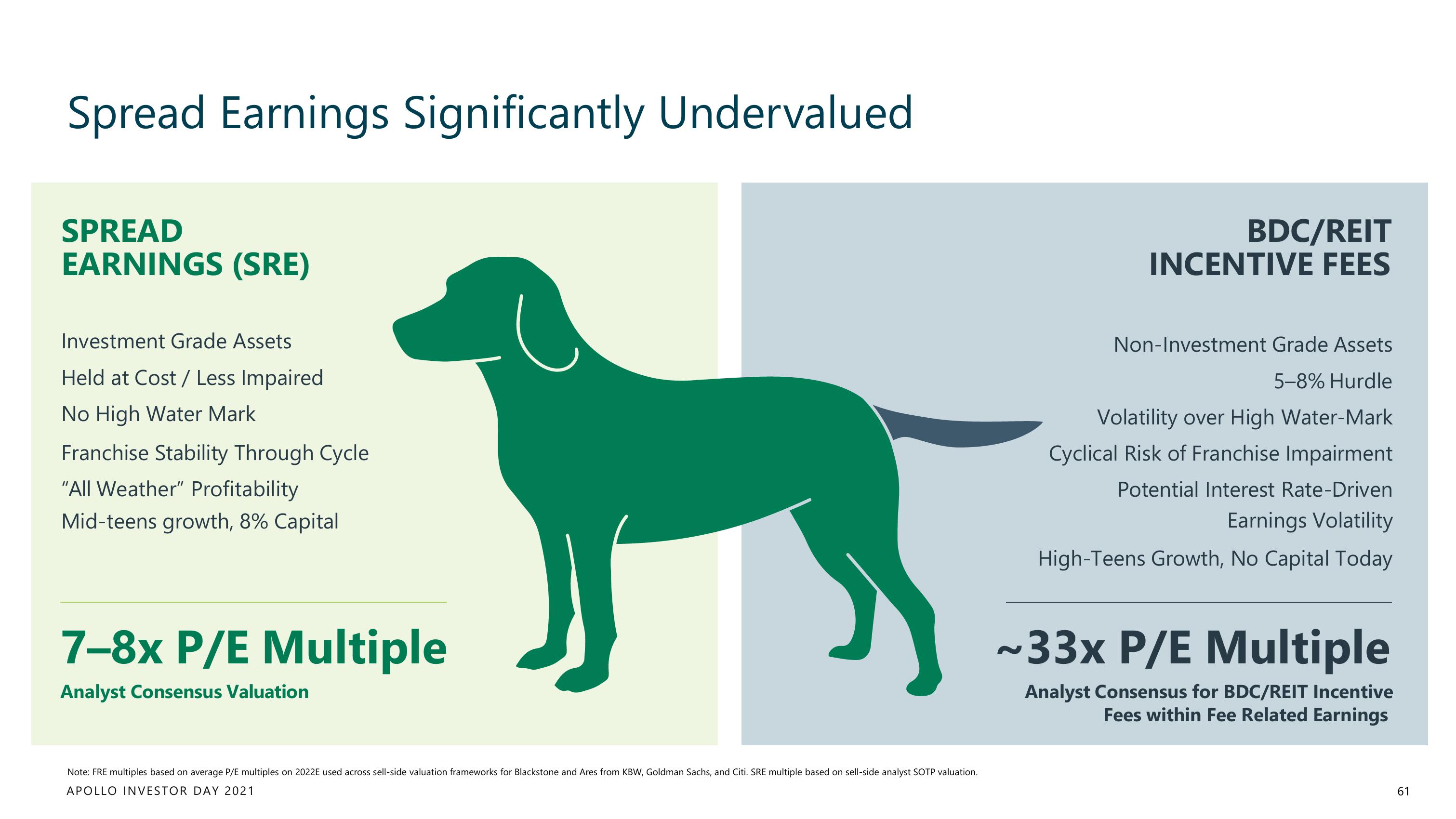

Spread Earnings Significantly Undervalued

SPREAD

EARNINGS (SRE)

Investment Grade Assets

Held at Cost / Less Impaired

No High Water Mark

Franchise Stability Through Cycle

"All Weather" Profitability

Mid-teens growth, 8% Capital

7-8x P/E Multiple

Analyst Consensus Valuation

Note: FRE multiples based on average P/E multiples on 2022E used across sell-side valuation frameworks for Blackstone and Ares from KBW, Goldman Sachs, and Citi. SRE multiple based on sell-side analyst SOTP valuation.

APOLLO INVESTOR DAY 2021

BDC/REIT

INCENTIVE FEES

Non-Investment Grade Assets

5-8% Hurdle

Volatility over High Water-Mark

Cyclical Risk of Franchise Impairment

Potential Interest Rate-Driven

Earnings Volatility

High-Teens Growth, No Capital Today

~33x P/E Multiple

Analyst Consensus for BDC/REIT Incentive

Fees within Fee Related Earnings

61View entire presentation