Central Pacific Financial Investor Presentation Deck

Solid Capital Position

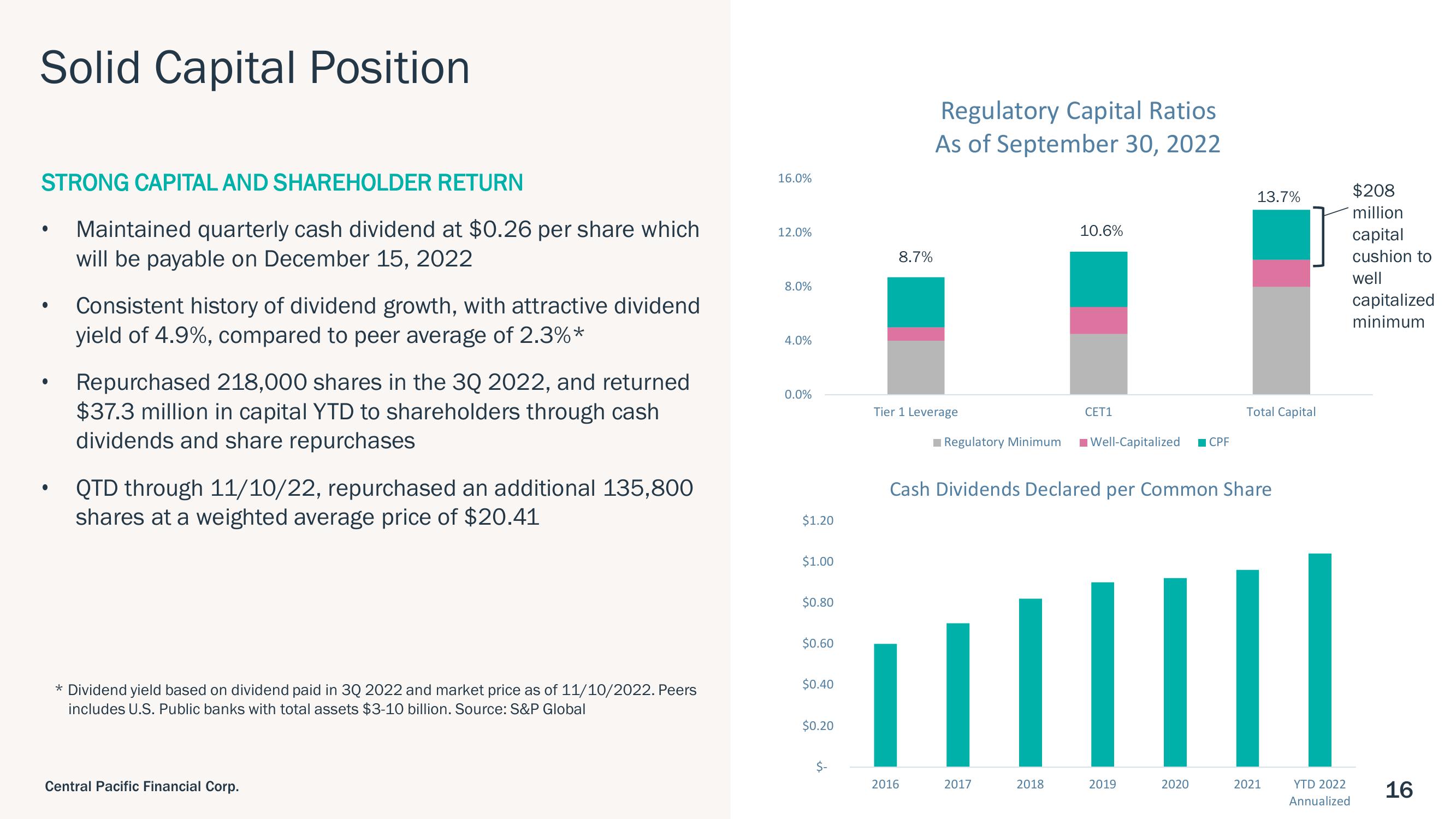

STRONG CAPITAL AND SHAREHOLDER RETURN

Maintained quarterly cash dividend at $0.26 per share which

will be payable on December 15, 2022

●

Consistent history of dividend growth, with attractive dividend

yield of 4.9%, compared to peer average of 2.3%*

Repurchased 218,000 shares in the 3Q 2022, and returned

$37.3 million in capital YTD to shareholders through cash

dividends and share repurchases

QTD through 11/10/22, repurchased an additional 135,800

shares at a weighted average price of $20.41

* Dividend yield based on dividend paid in 3Q 2022 and market price as of 11/10/2022. Peers

includes U.S. Public banks with total assets $3-10 billion. Source: S&P Global

Central Pacific Financial Corp.

16.0%

12.0%

8.0%

4.0%

0.0%

$1.20

$1.00

$0.80

$0.60

$0.40

$0.20

$-

8.7%

Regulatory Capital Ratios

As of September 30, 2022

Tier 1 Leverage

2016

10.6%

CET1

Regulatory Minimum Well-Capitalized CPF

|||||

2018

2017

Cash Dividends Declared per Common Share

2019

13.7%

2020

Total Capital

2021

YTD 2022

Annualized

$208

million

capital

cushion to

well

capitalized

minimum

16View entire presentation