Central Pacific Financial Investor Presentation Deck

Made public by

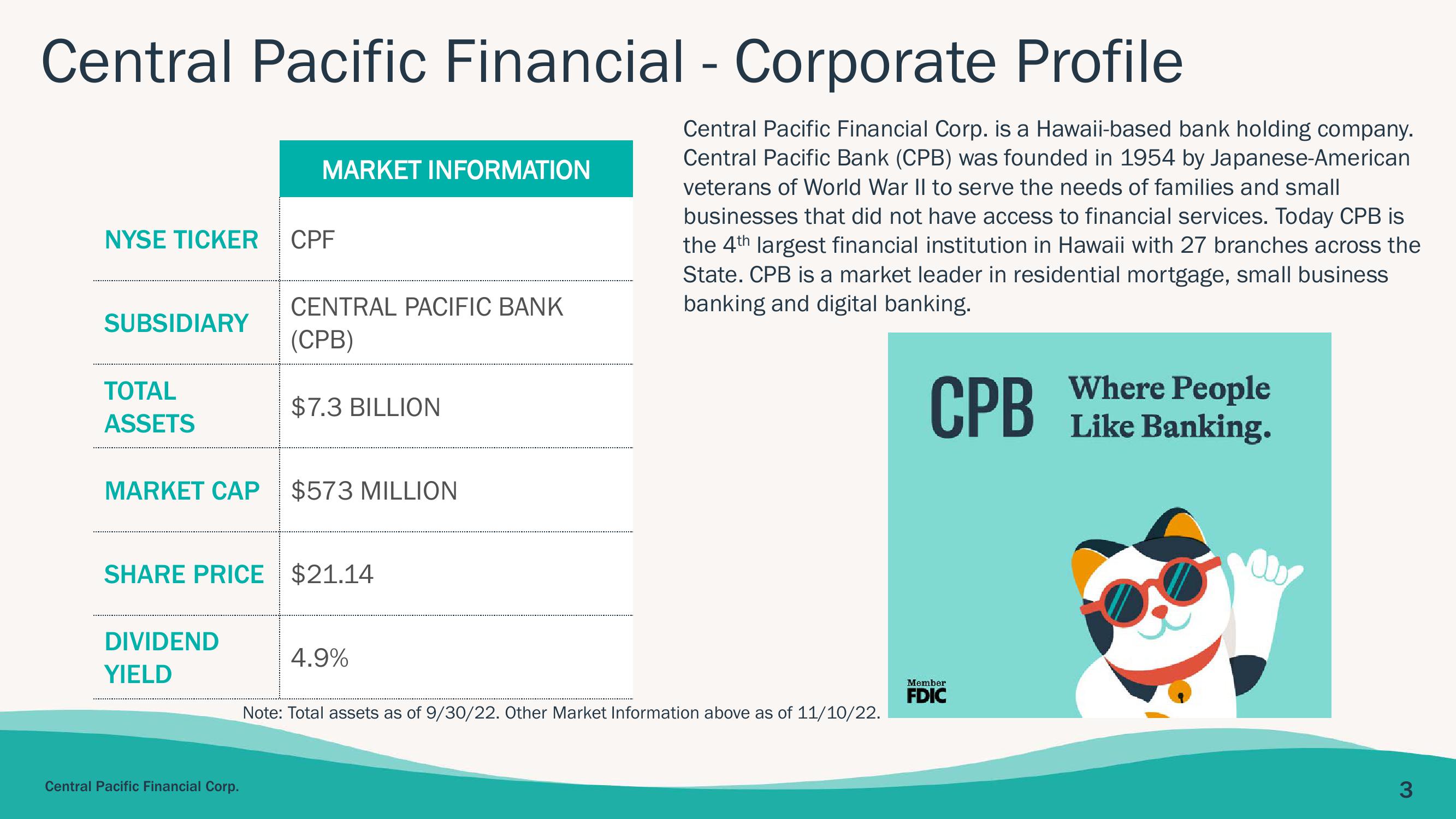

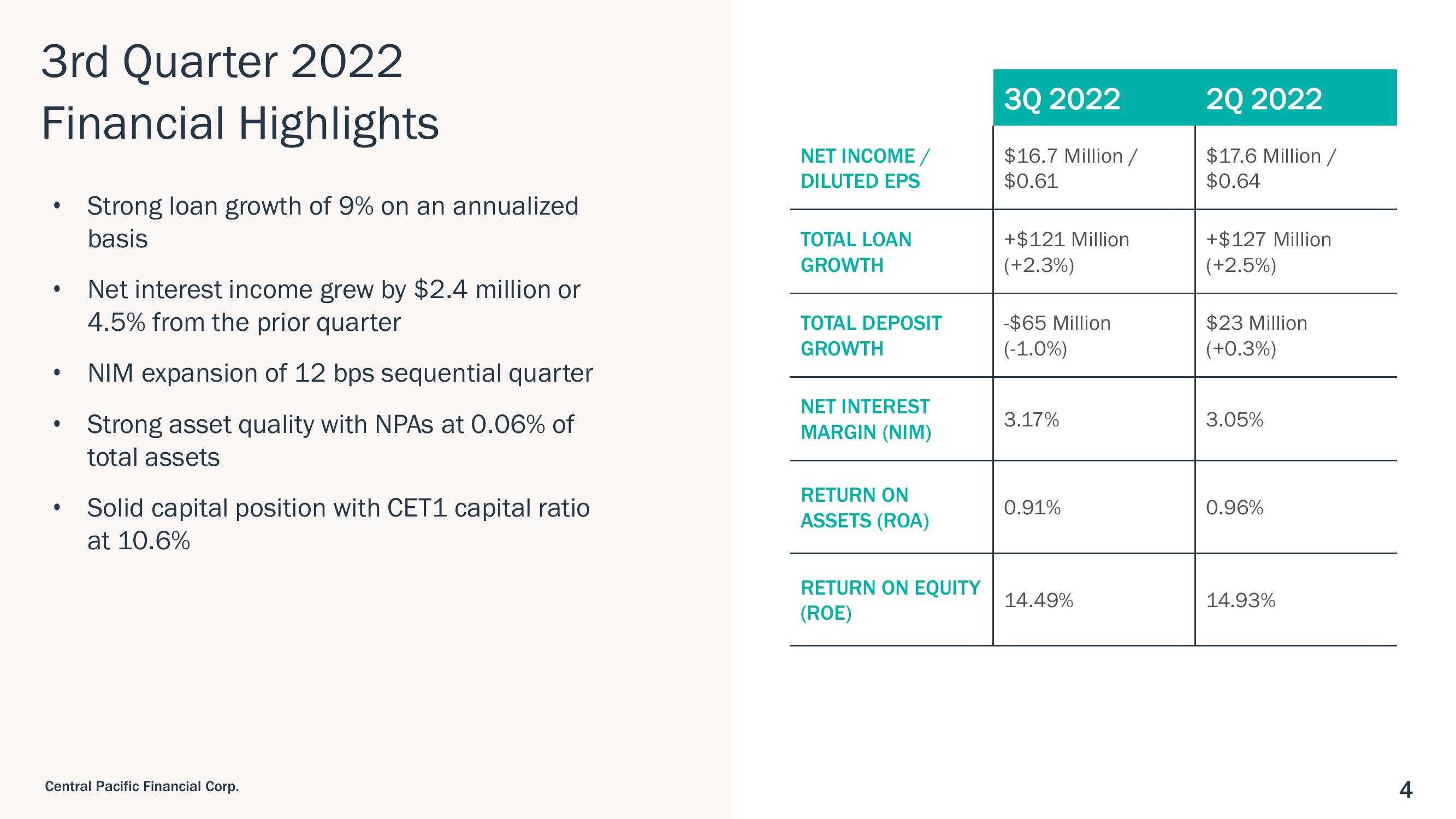

Central Pacific Financial

sourced by PitchSend

Creator

central-pacific-financial

Category

Financial

Published

November 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related