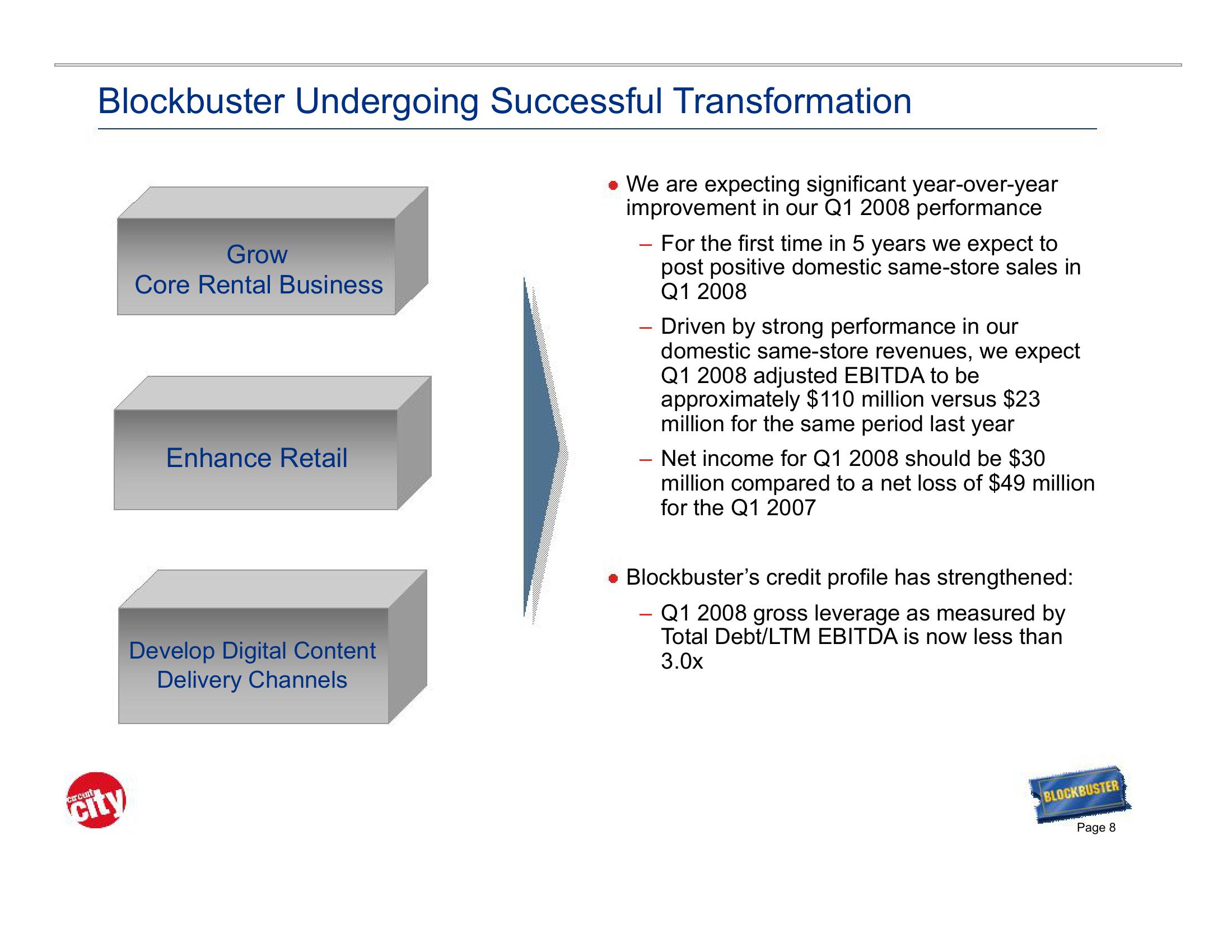

Blockbuster Video Investor Presentation Deck

Made public by

Blockbuster Video

sourced by PitchSend

Creator

blockbuster-video

Category

Consumer

Published

April 2008

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related