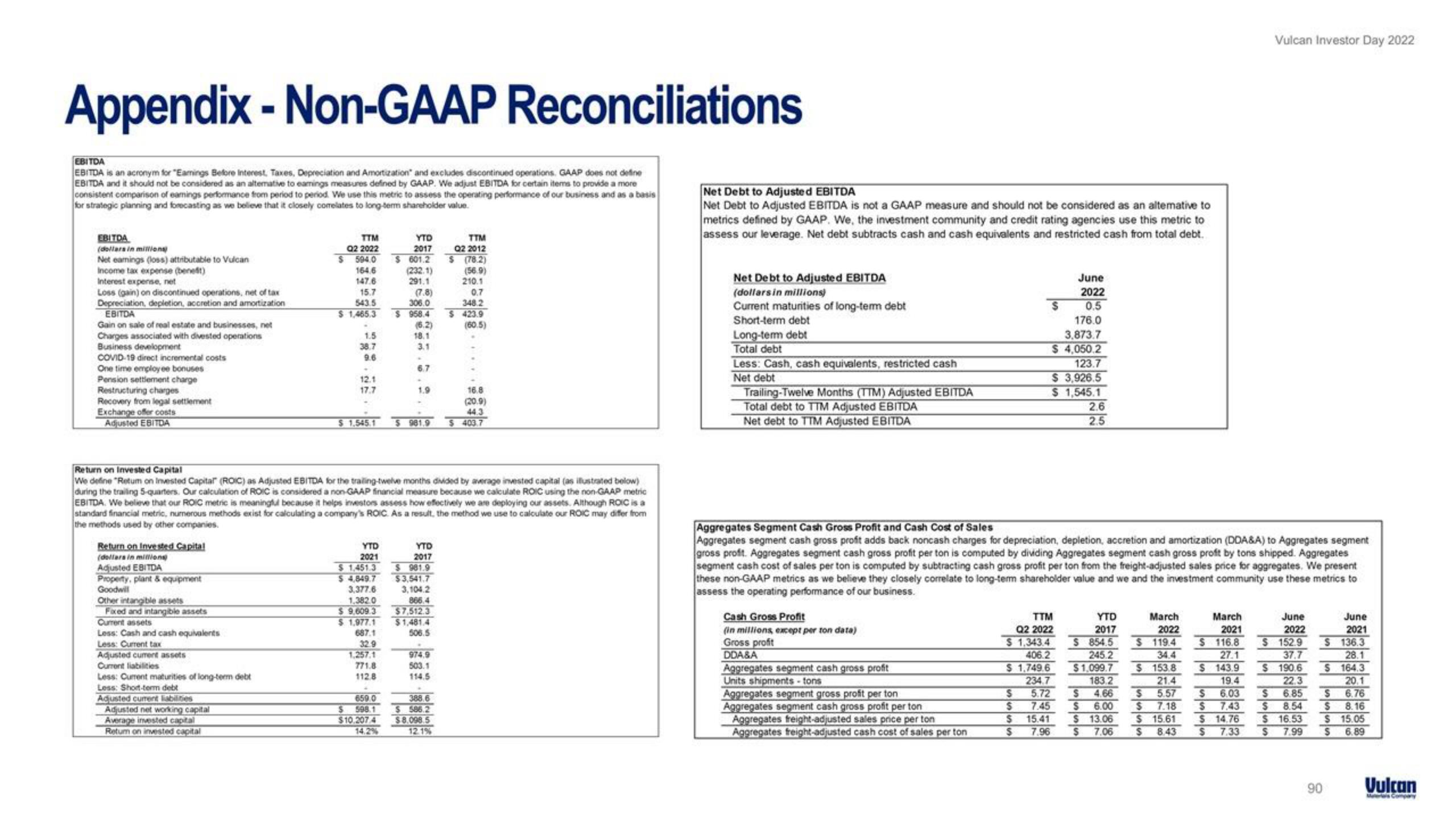

Vulcan Materials Investor Day Presentation Deck

Made public by

Vulcan Materials

sourced by PitchSend

Creator

vulcan-materials

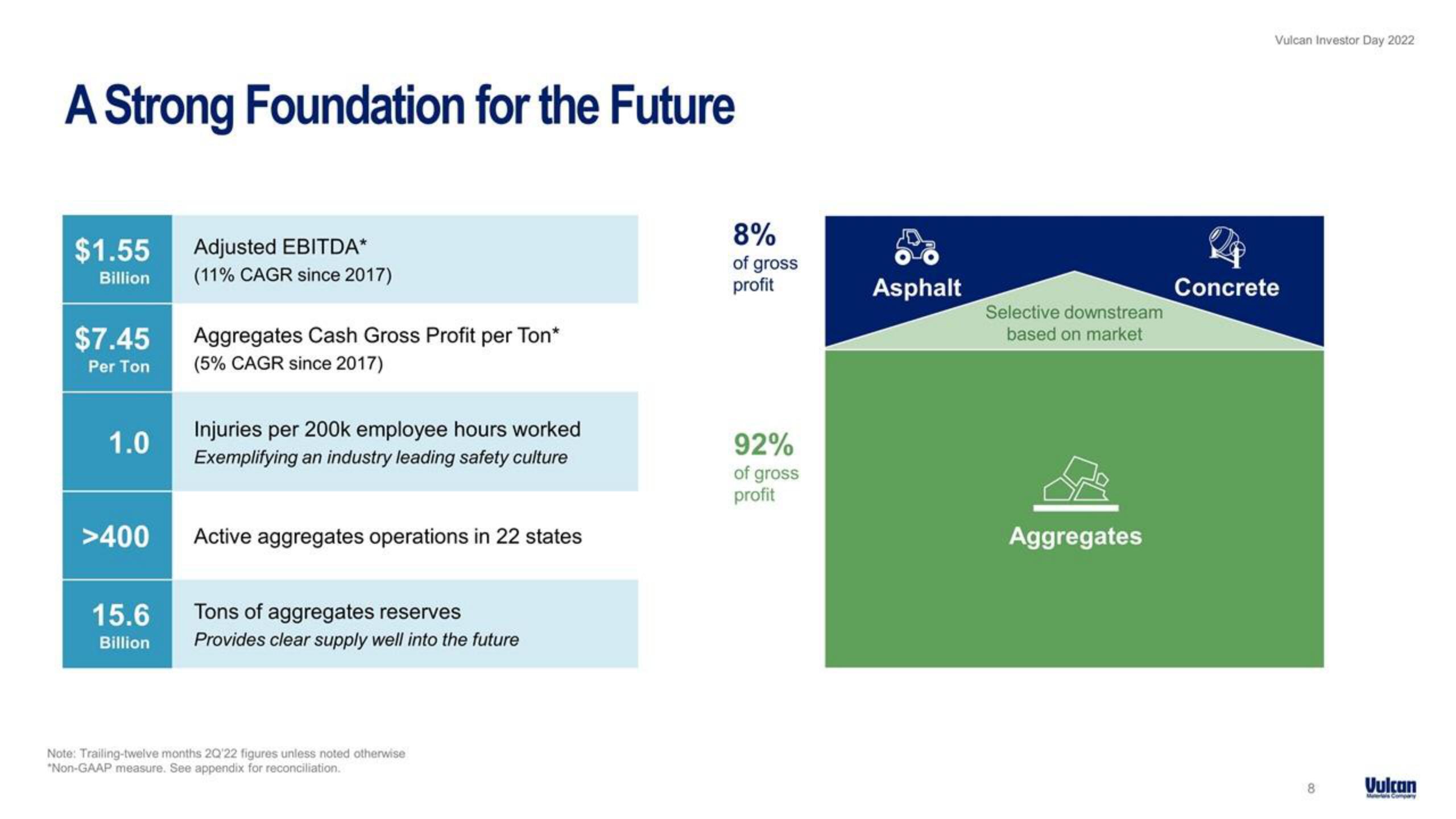

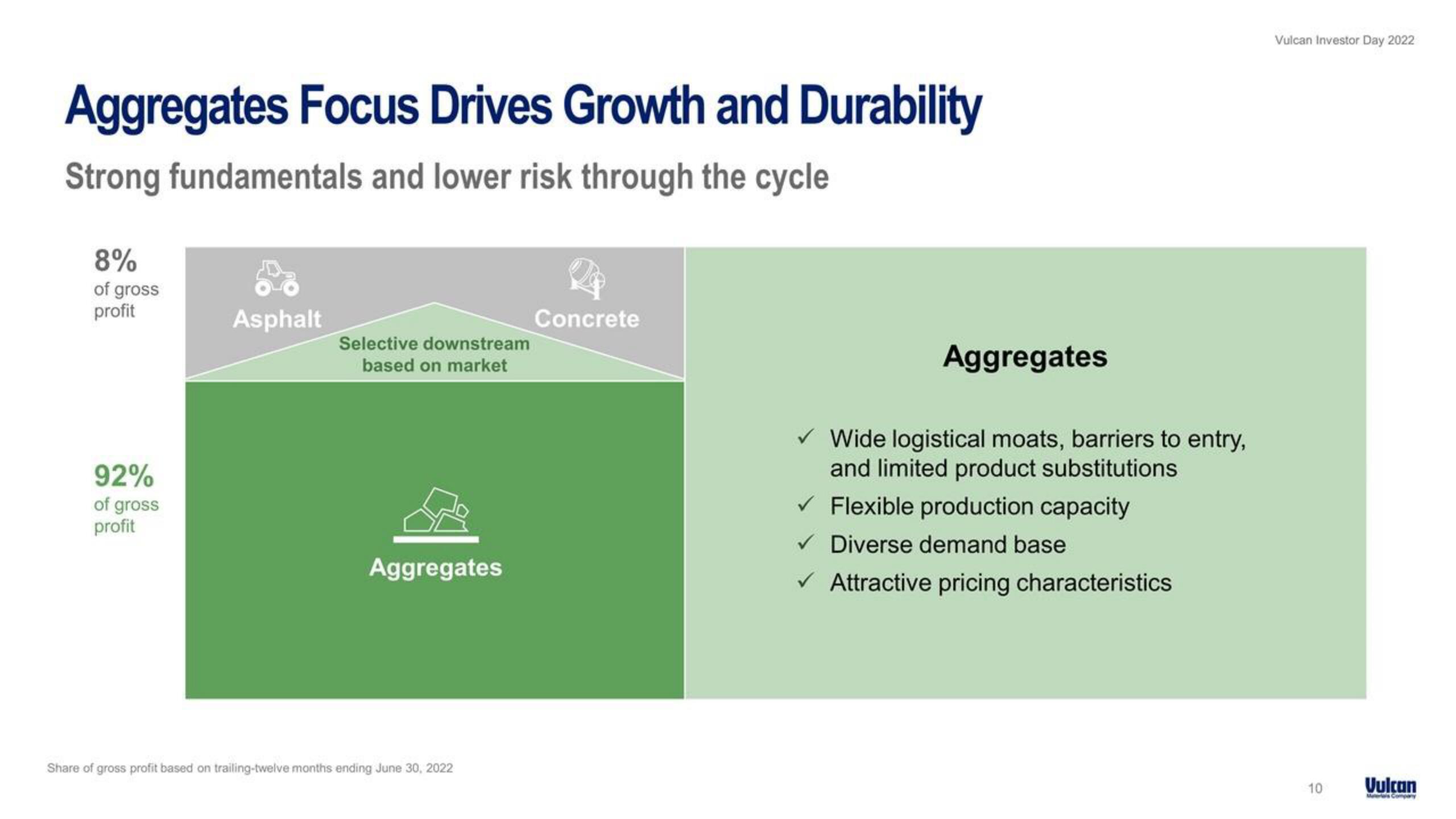

Category

Industrial

Published

September 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related