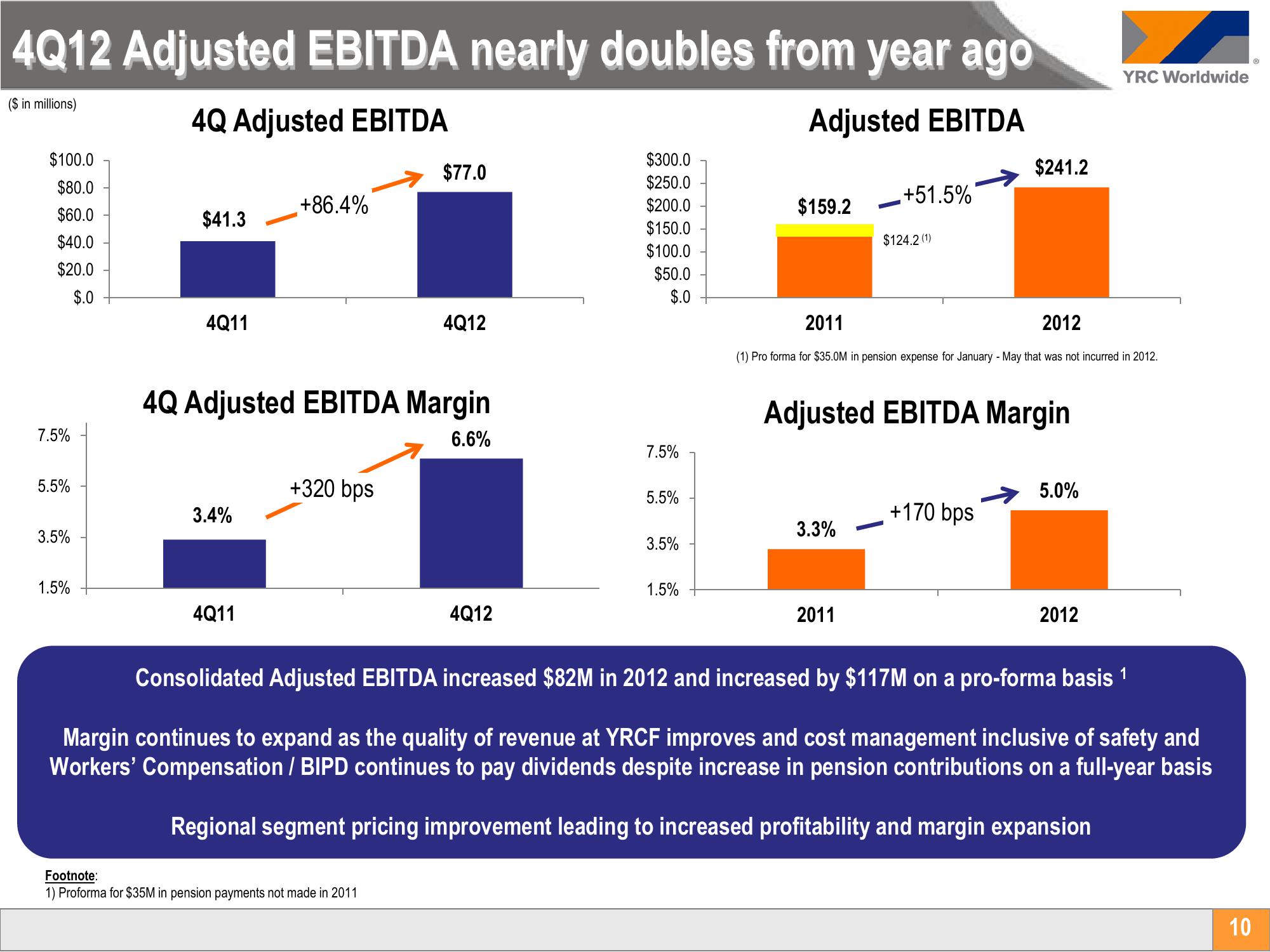

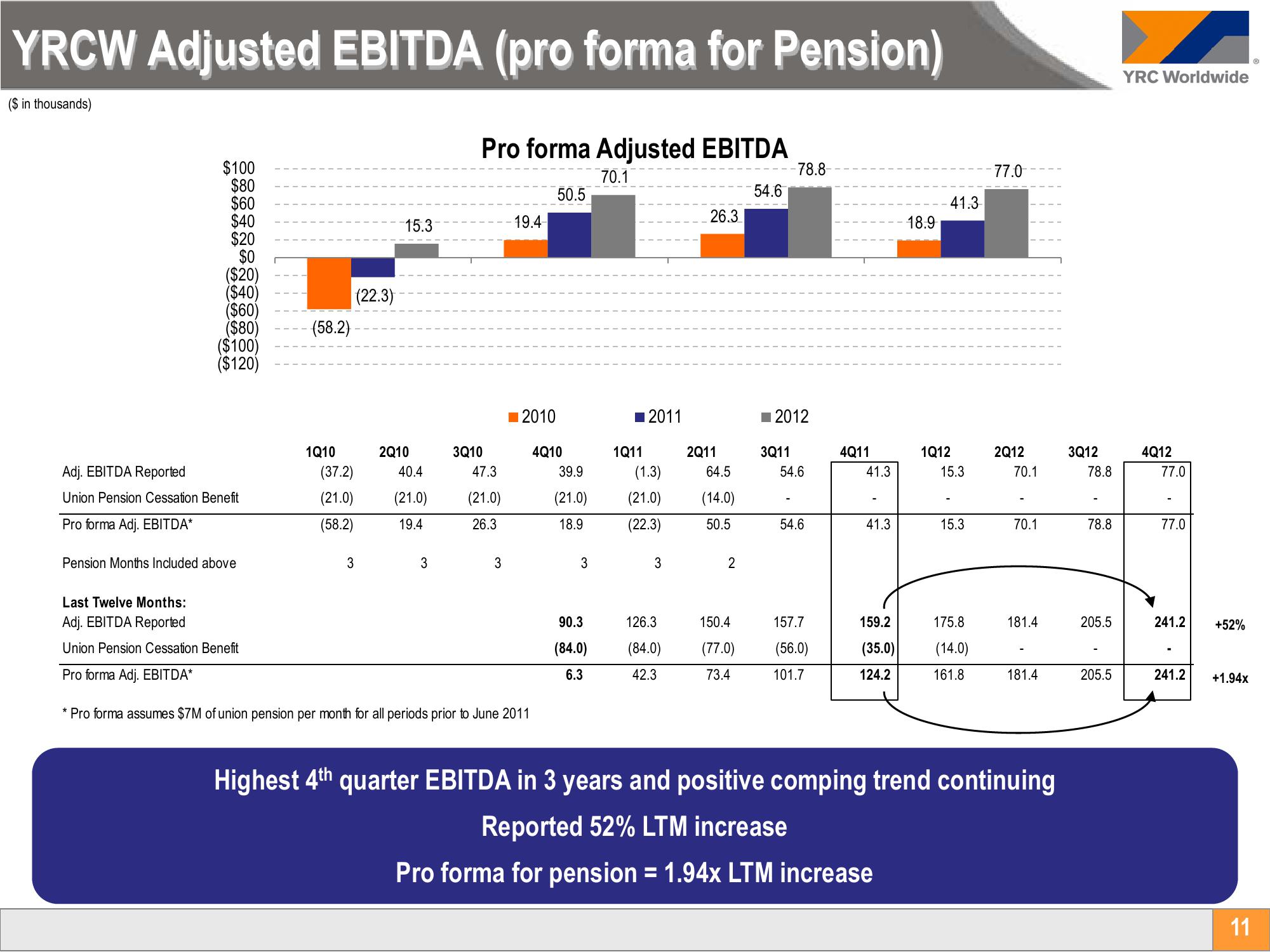

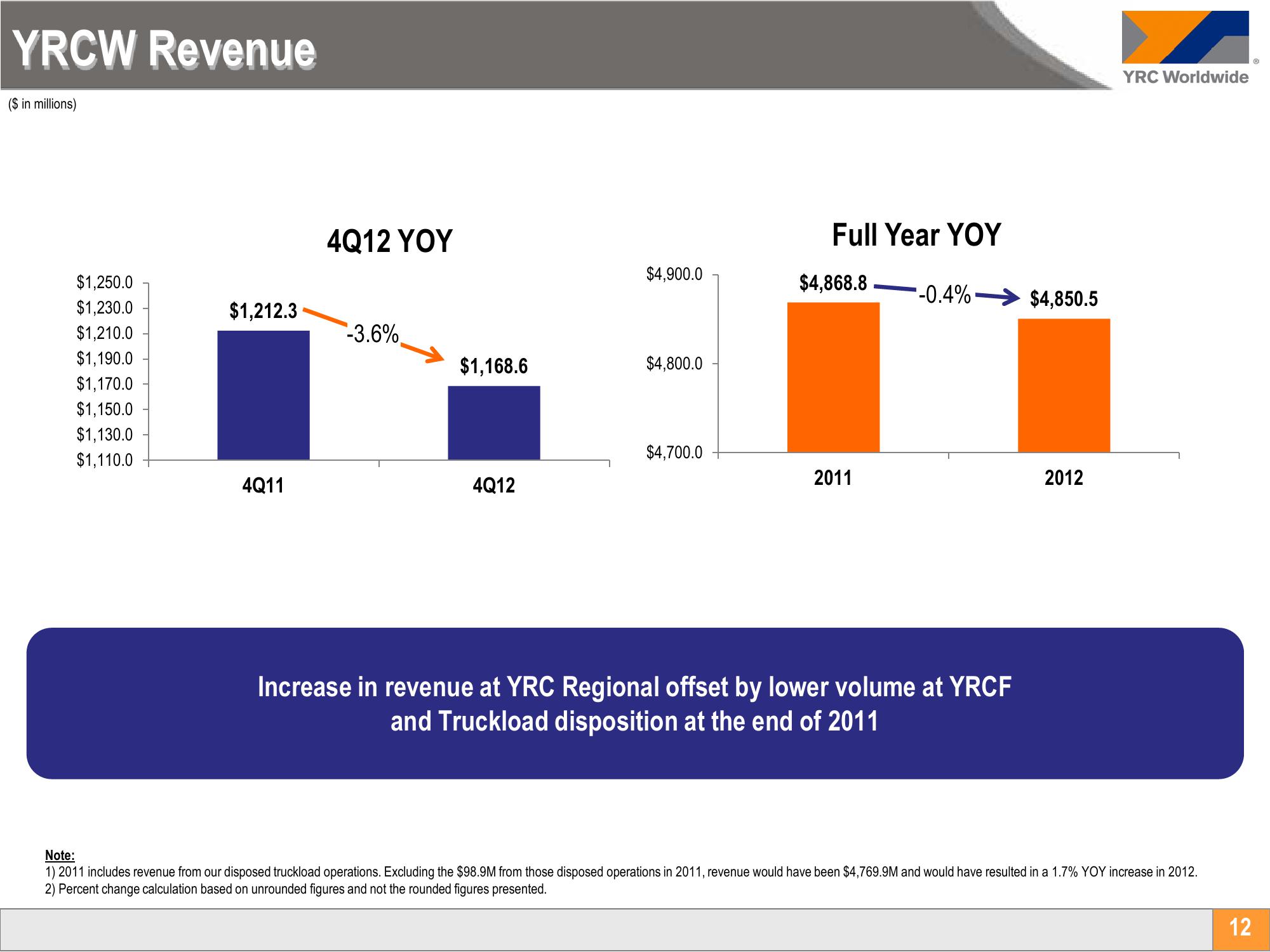

Yellow Corporation Investor Conference Presentation Deck

Released by

Yellow Corporation

Creator

yellow-corporation

Category

Industrial

Published

February 2013

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related