Benson Hill Investor Day Presentation Deck

Made public by

Benson Hill

sourced by PitchSend

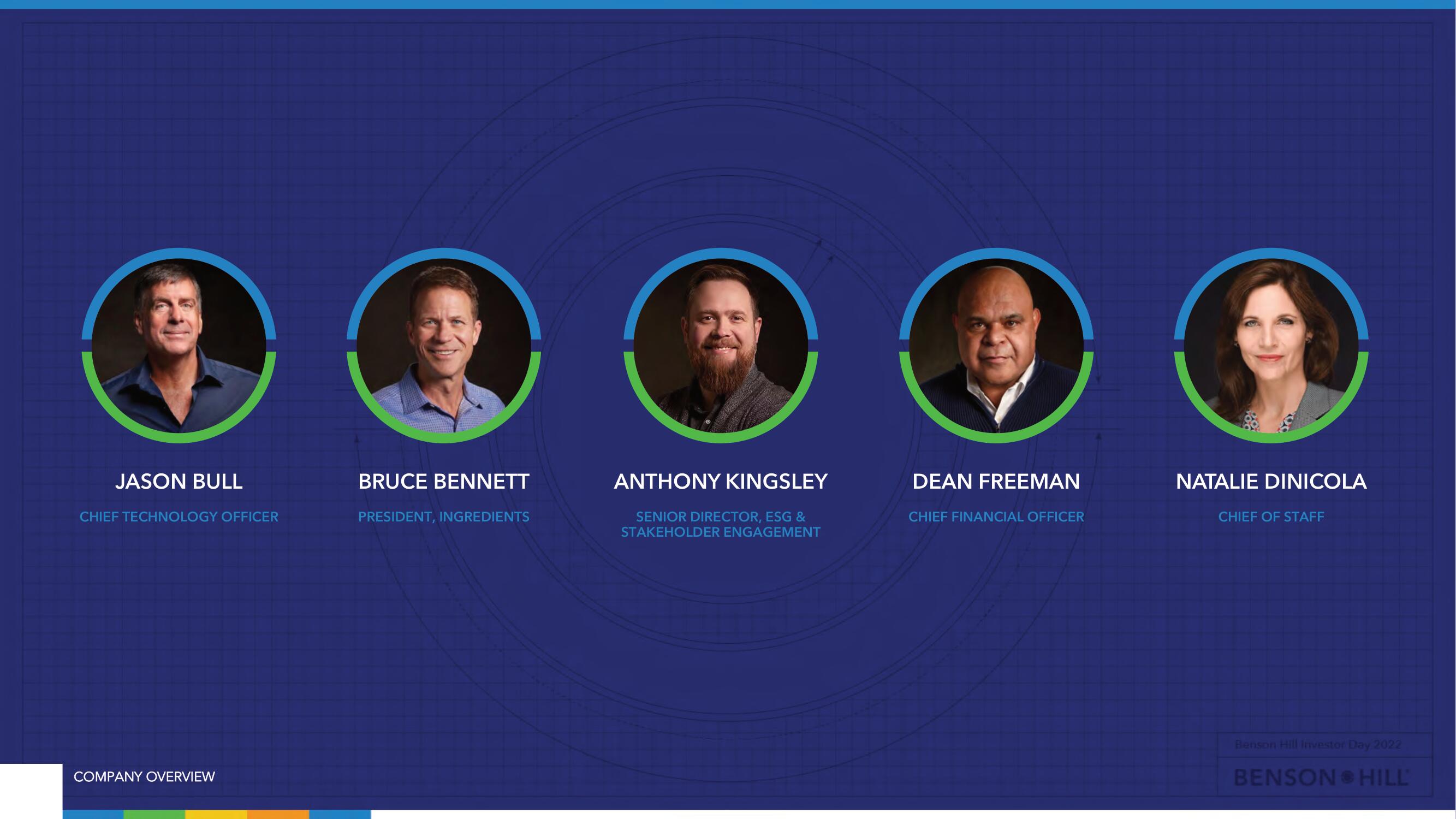

Creator

benson-hill

Category

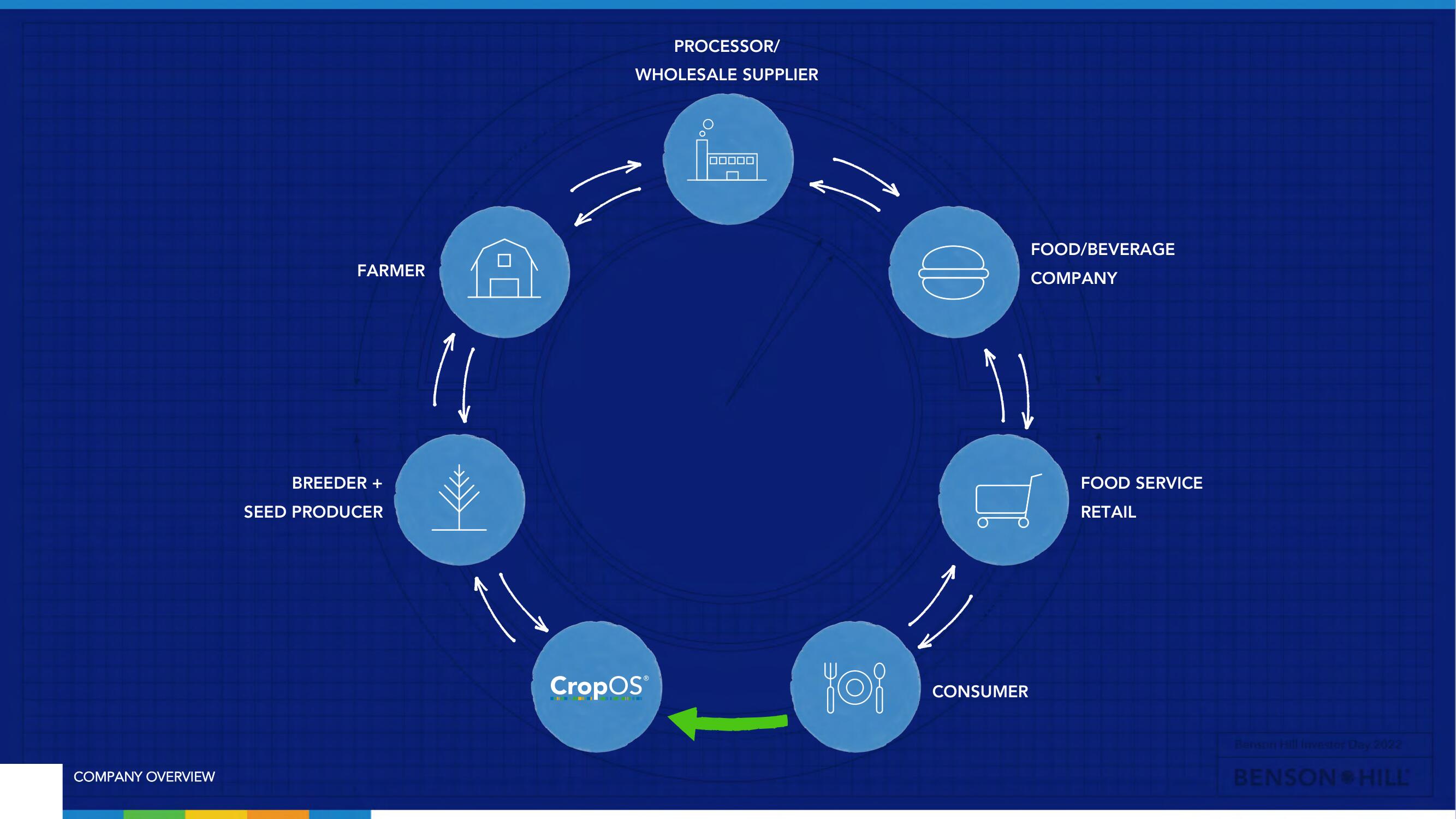

Industrial

Published

April 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related