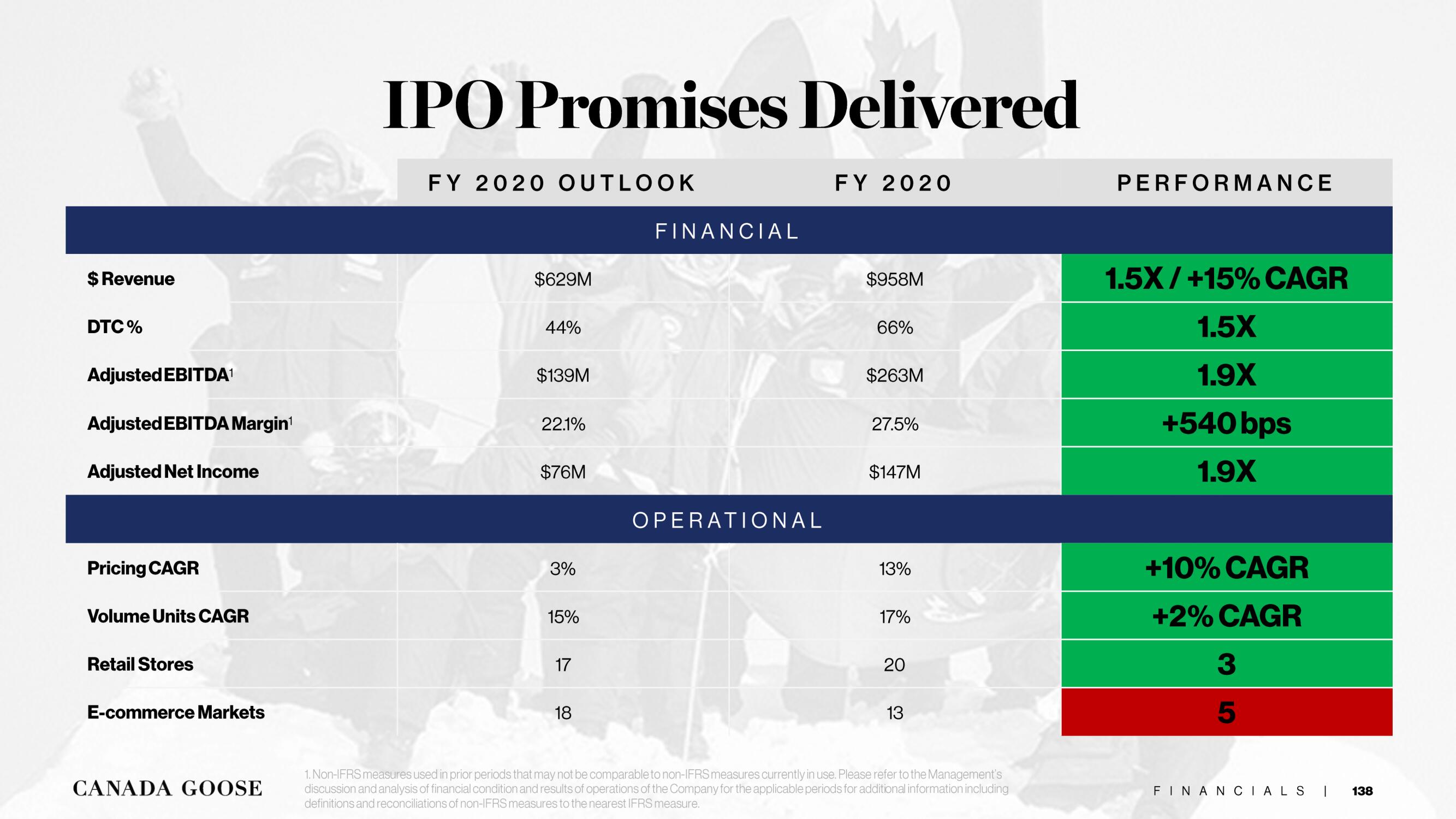

Canada Goose Investor Day Presentation Deck

Made public by

Canada Goose

sourced by PitchSend

Creator

canada-goose

Category

Consumer

Published

February 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related