G Medical Innovations IPO Presentation Deck

Released by

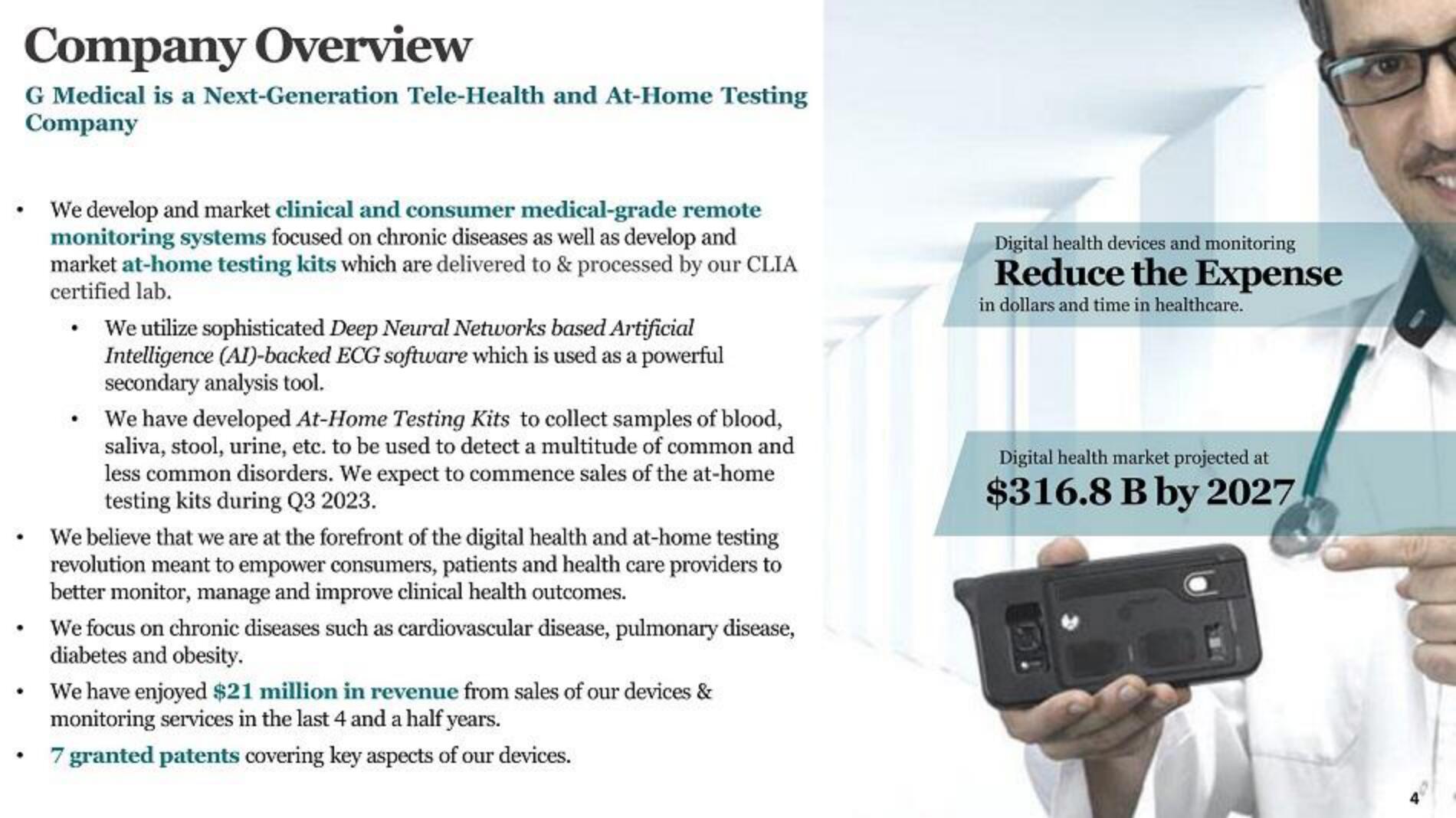

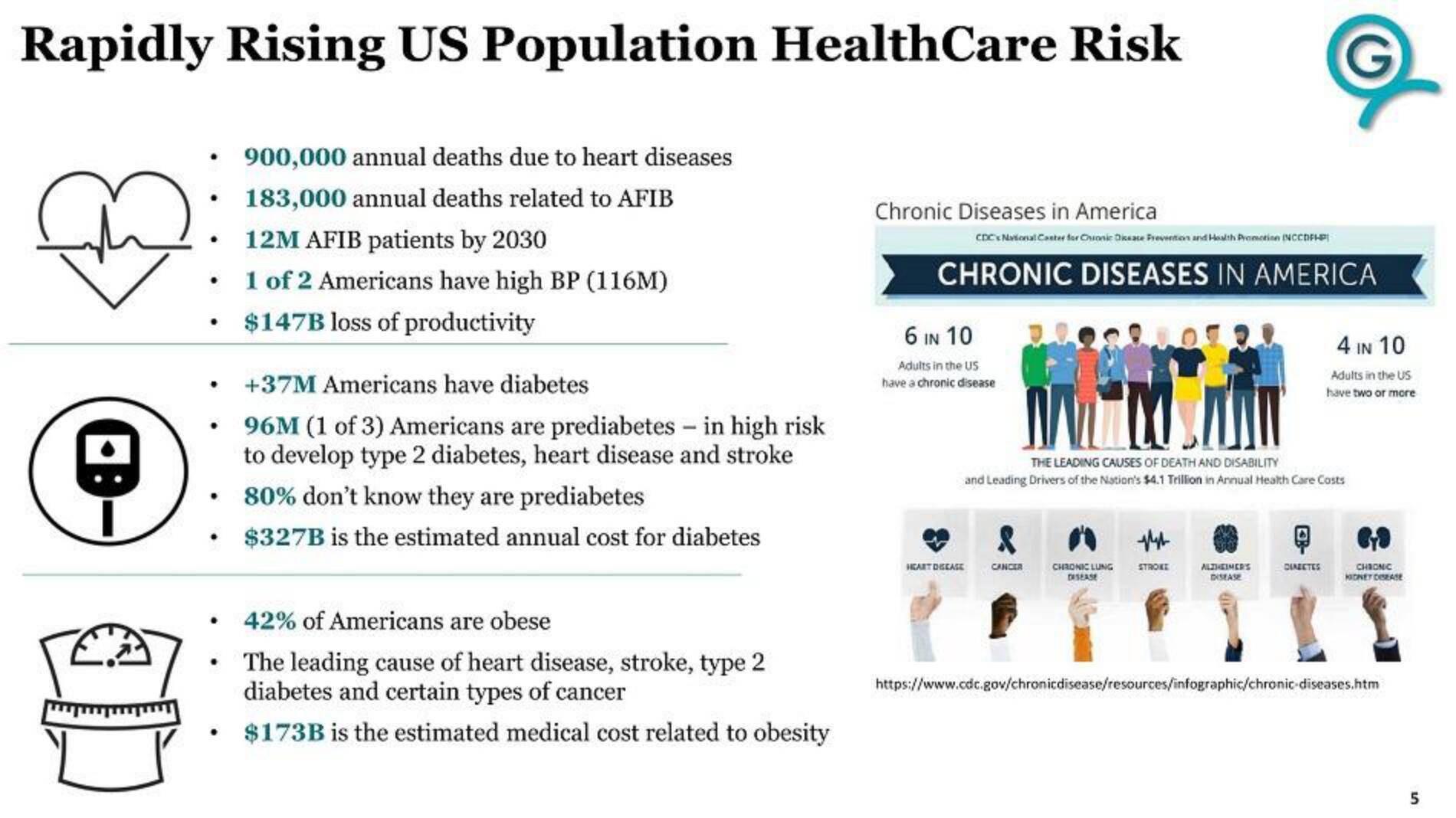

G Medical Innovations

Creator

g-medical-innovations

Category

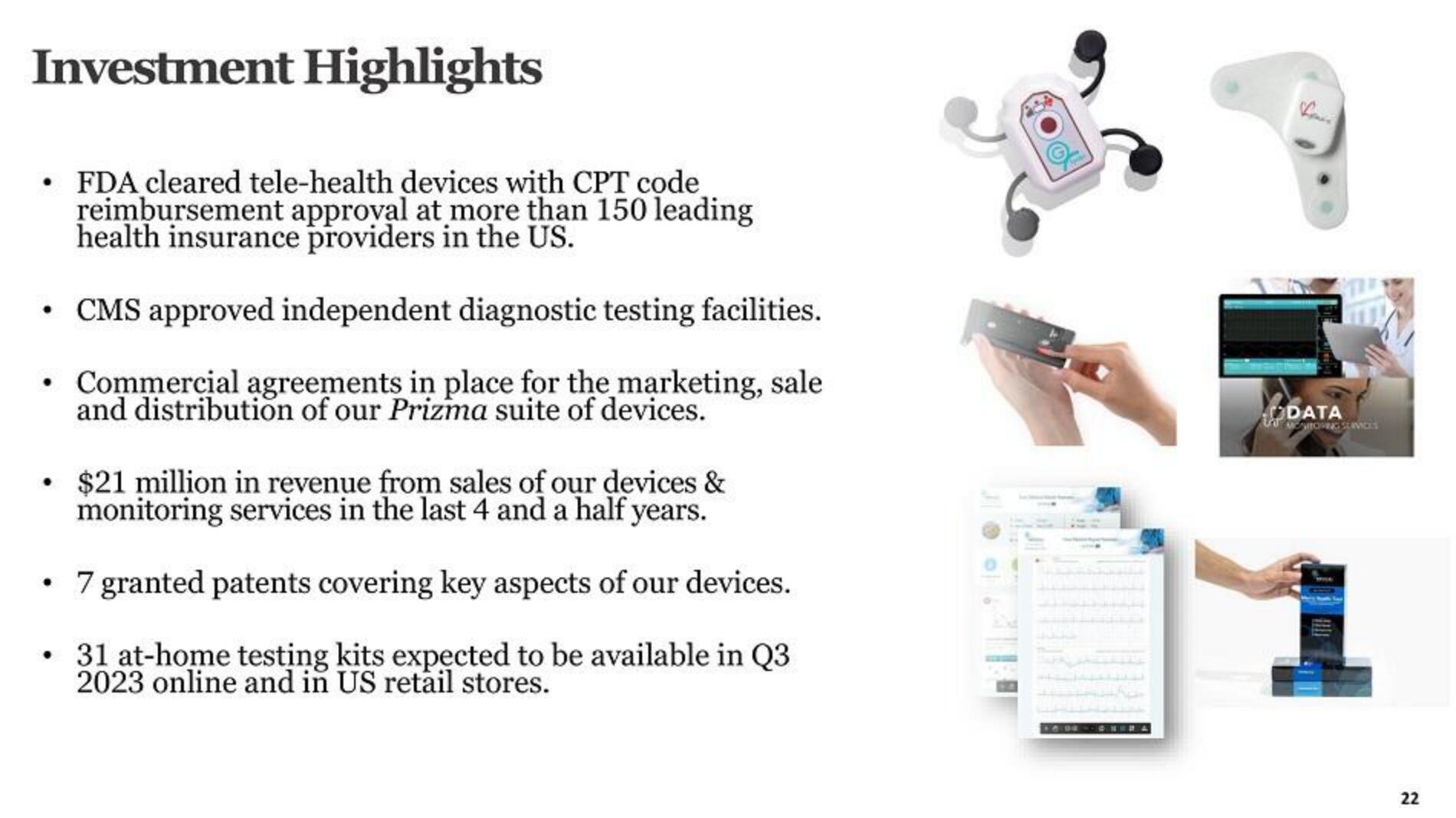

Healthcare

Published

February 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related