Houlihan Lokey Investor Presentation Deck

Made public by

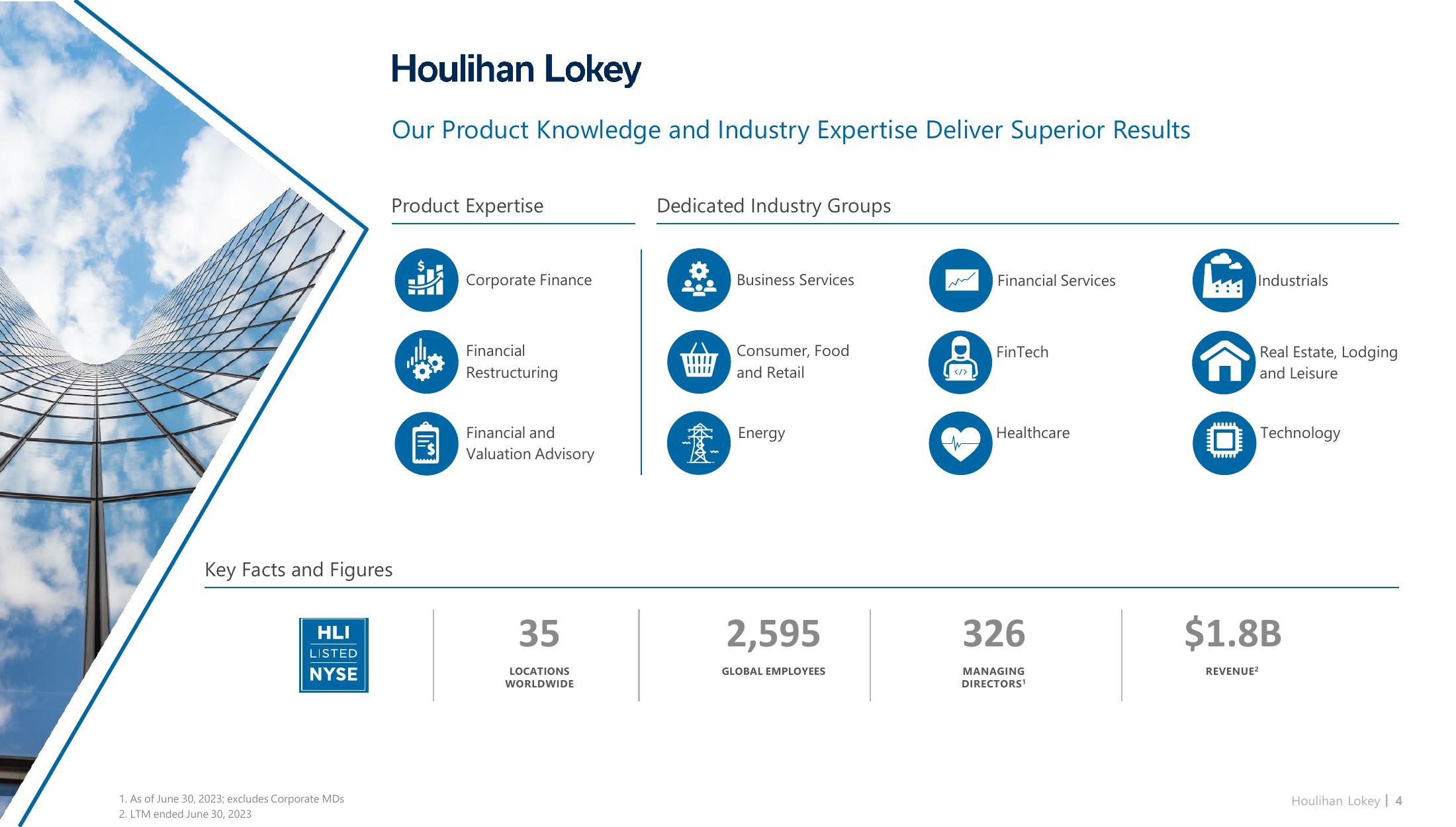

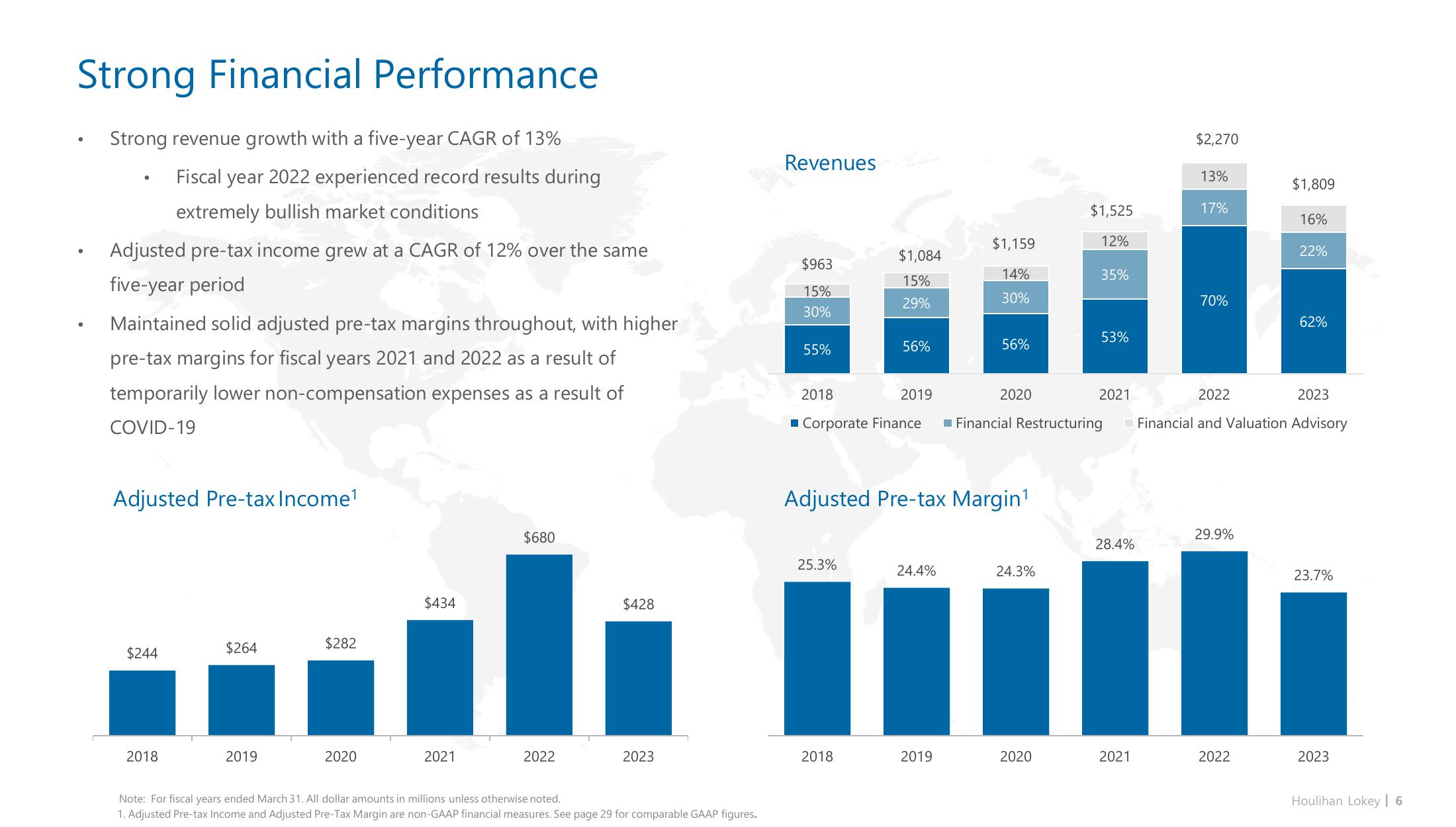

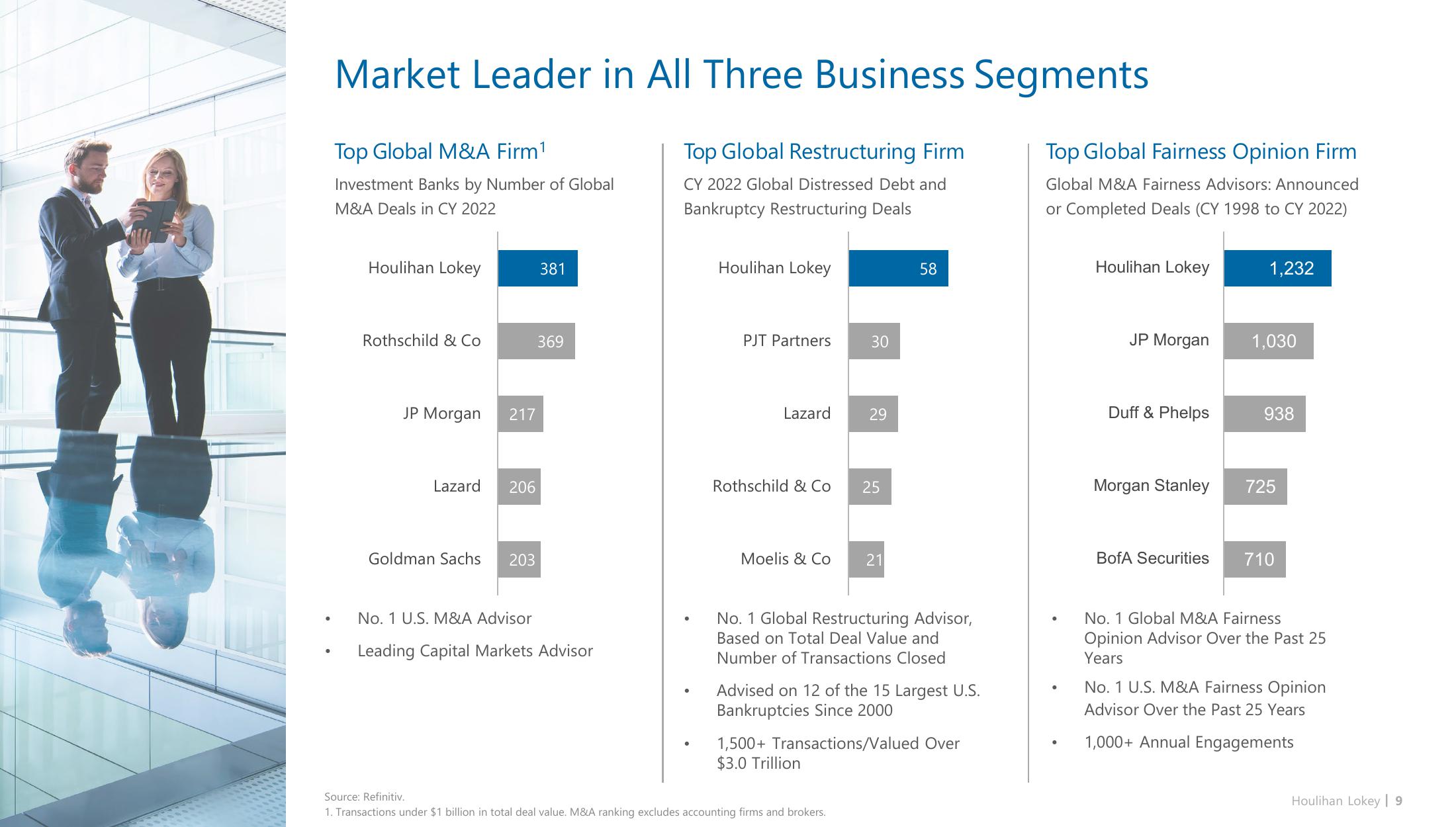

Houlihan Lokey

sourced by PitchSend

Creator

houlihan-lokey

Category

Financial

Published

July 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related