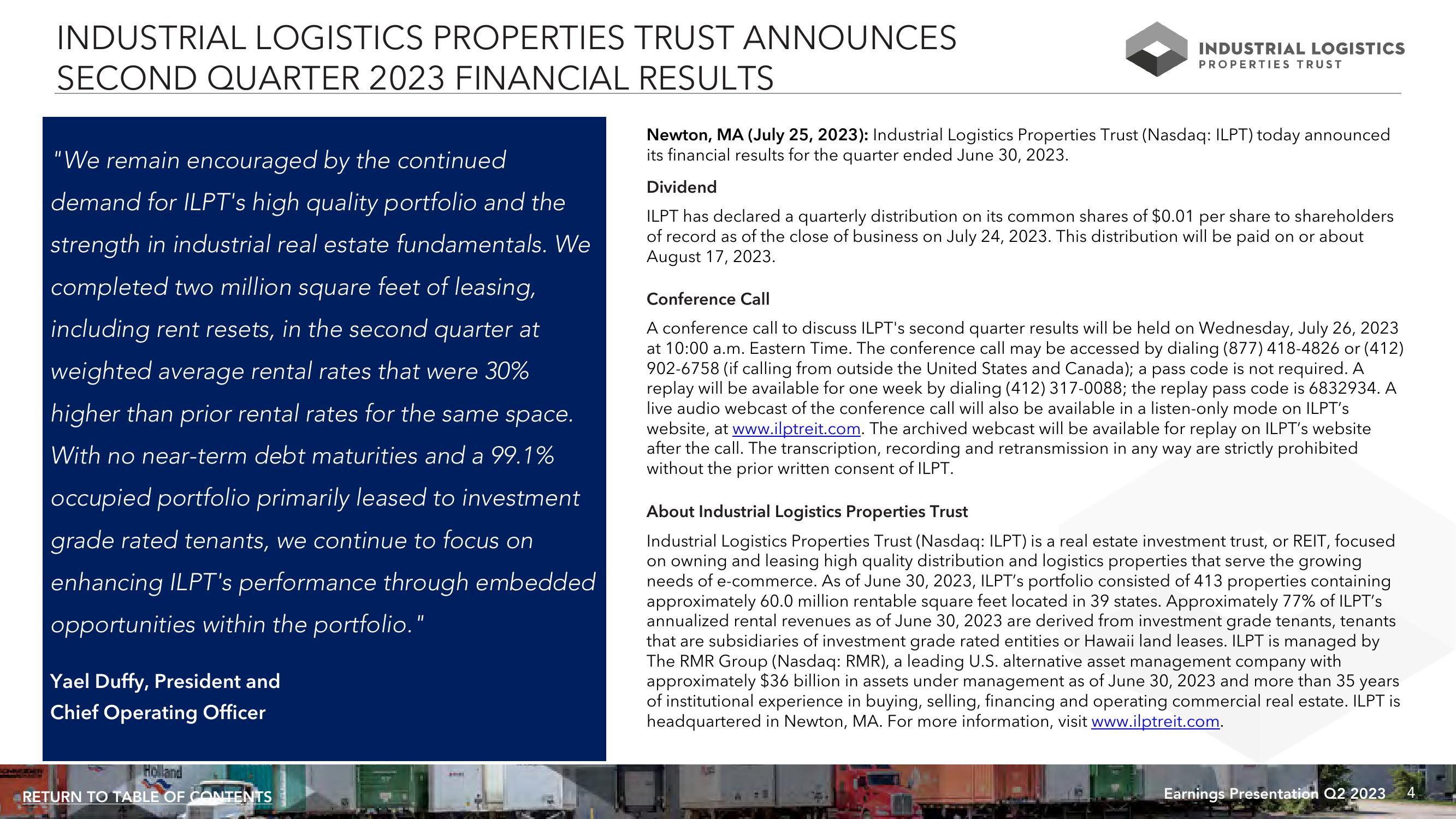

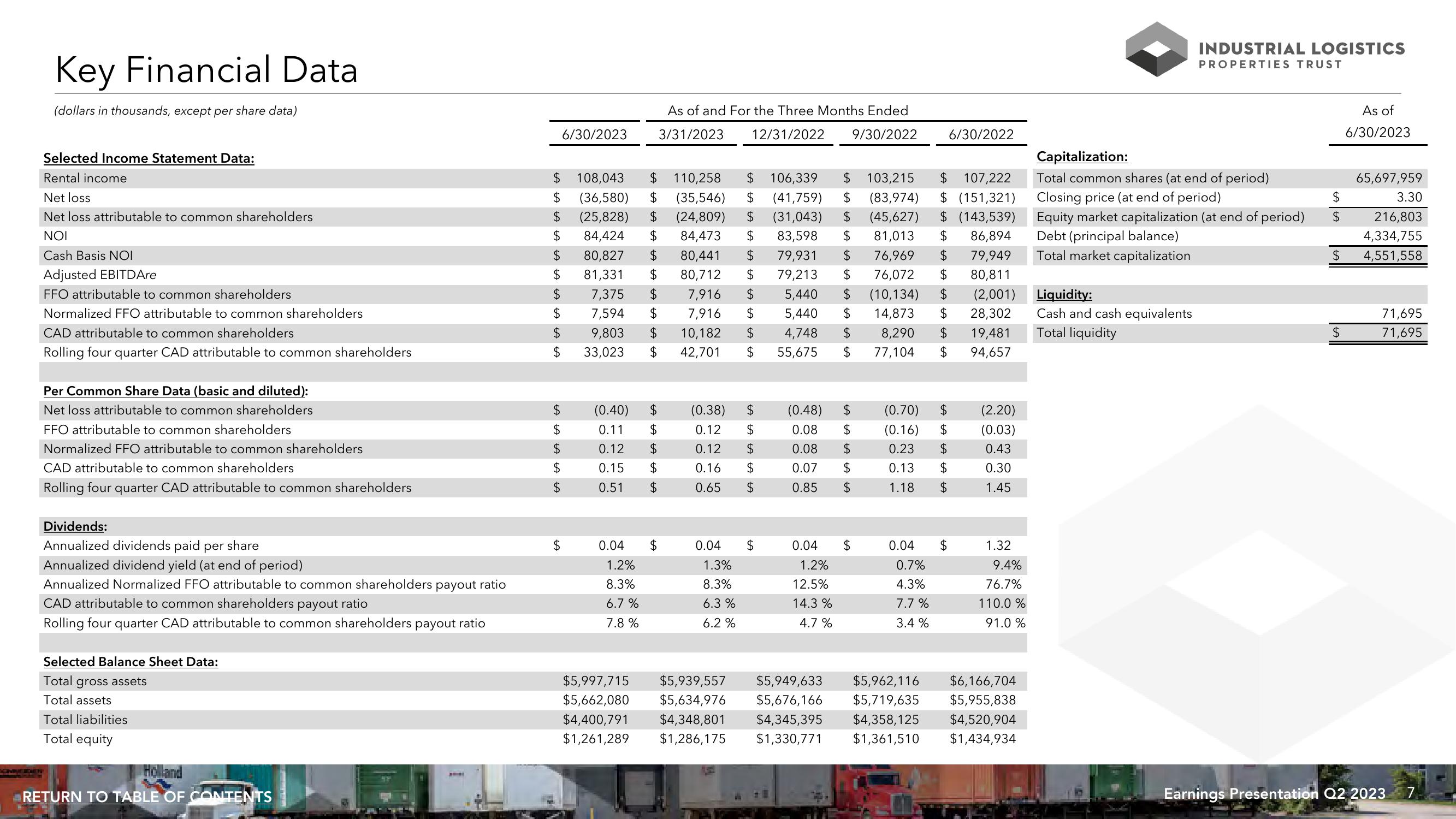

ILPT Q2 2023 Financial Results

Made public by

Industrial Logistics properties trust

sourced by PitchSend

Creator

industrial-logistics properties trust

Category

Industrial

Published

STAGING

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related